YouTube’s Whac-a-Mole Approach to Crypto Scam Ads Still Remains a Problem

(YouTube screenshot/modified by CoinDesk)

YouTube’s Whac-a-Mole Approach to Crypto Scam Ads Remains a Problem

YouTube has long struggled with disinformation, misleading content and outright scams on its site. Despite lawsuits and Google’s own ad policies, cryptocurrency scam ads are still making it through the gates and circulating for days.

In April the CEO of Ripple, Brad Garlinghouse, filed a lawsuit against YouTube, alleging the company’s inaction against fraudulent content on its platform has damaged Ripple’s reputation by not curbing scam “giveaways” of XRP.

According to the complaint, in one instance a scammer stole $15,000 worth of XPR from a victim.

Garlinghouse is not alone. Apple co-founder Steve Wozniak is also suing YouTube and its parent Google for allegedly “allowing bitcoin giveaway scams that use his likeness to thrive on its platform,” CoinDesk reported when the lawsuit was filed this summer.

Despite these lawsuits, scam ads are still circulating. Scammy ads featuring Ethereum founder Vitalik Buterin offering an ether giveaway were showing up on authentic crypto channels like Ivan on Tech (250,000 subscribers) and Venture Coinist (20,000 subscribers) just a couple of weeks ago. One user (who asked to remain anonymous) said this ad was reported to YouTube, but there was no quick action by the platform.

Content is content when it comes to growth

In the early days of YouTube, there was a plethora of pirated content that drove its growth, said Adam Helfgott, CEO of the programmatic advertising firm MadHive.

“This is somewhat analogous to that situation,” said Helfgott in a phone call. “The more you start limiting a platform or content on a platform, when you don’t really know if something is good or bad but you have reason to suspect it’s one or the other, users will start to rebel and then you won’t have massive growth.”

In July, YouTube moved to dismiss the Ripple lawsuit, relying on Section 230 protections, which protect companies from content liability.

“YouTube’s motion to dismiss the allegations boils down to the idea that the video-sharing giant did not willingly or knowingly engage in any of the scams or copyright infringement, and cannot be held liable for any third-party content on its website,” CoinDesk reported at the time. “The firm’s motion also adds that it shut down such scams whenever it was alerted to them.”

The part that’s still an open question is how much money YouTube – and its parent company – makes from scam ads, even on the margins, and the effectiveness of the mechanisms in place for removing them.

“Protecting users from ad scams and fraud is a key priority,” said a Google spokesperson in response to CoinDesk’s query about the YouTube ad. “We have robust policies prohibiting ads that attempt to circumvent our enforcement by disguising the advertiser’s identity and impersonating other brands. In this case, we quickly removed the ad and suspended the advertiser account.”

The ad ecosystem

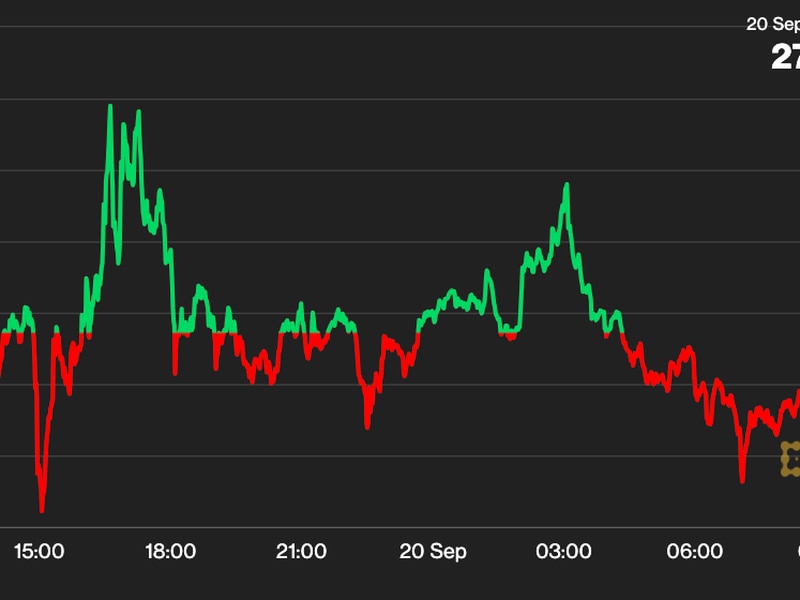

The ad, which has since been taken down, ran from Aug. 12 to Aug. 17, according to Google.

Google has policies that lay out what kind of ads can run on its platforms, including YouTube. Under these policies, advertisers are not allowed to run ads, content or destinations that attempt to trick or circumvent the ad review processes, according to Google. Due to the complex and evolving nature of cryptocurrencies and their related products and services, Google only allows a limited set of advertisements for regulated exchanges in the United States and Japan.

Yet, the scam ads persist.

Helfgott said there are challenges when it comes to reviewing ads, given there is so much content out there, and that it would be hard for anyone to manage this volume. In 2019, Google took down approximately 2.7 billion bad ads. That means it removed about 10 million ads per day.

At the same time, he said, companies could be doing a better job. However, companies that rely on advertising on a massive scale, like Youtube and Facebook, aren’t necessarily incentivized to do so.

Helfgott said because of the mass scale of YouTube, there is a large amount of ad inventory on the site and Google may be reluctant to cut that back. For every rule YouTube implements on advertising, the number of ads could drop, and that’s not in Google’s interest as a company relying heavily on ads to make a profit.

These complicated dynamics and incentives may mean scammy cryptocurrency ads are potentially here to stay on YouTube, even if only for a few days. It’s a complicated game of whac-a-mole, with no end in sight despite the pending lawsuits.

Responsibility: YouTube’s or the FTC’s?

“Scams and fake giveaways are pretty common over both YouTube and Instagram,” said Data & Society Researcher Robyn Caplan, who focuses on platform governance. “It’s something that falls under the jurisdiction of the FTC [U.S. Federal Trade Commission] – it would be reported to them, a state attorney general or the local consumer protection office.”

Caplan said YouTube’s Section 230 argument would likely work in its defense because it would be like someone suing the U.S. Postal Service over similar scams and giveaways through the mail.

That doesn’t mean YouTube can ignore these scams, however.

“Platforms should definitely be honoring their terms of service, which means they need to be taking down scams in a timely manner,” said Caplan.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.