YouHodler – Get loan in cash with your crypto as collateral

Featured – Cryptocurrencies are beginning to show their promise as a unique store of value and efficient means of transfer, yet the case for lending still hasn’t been fully proven. YouHodler aims to bring a lending solution to the market by offering cryptocurrency-backed loans that give borrowers access to fiat.

Borrowers are able to get access to USD or EUR, and their loans are secured in BTC, ETH, XRP, and other popular cryptocurrencies.

Cryptocurrencies are unique because they function as both a currency for everyday spending, as well as an investment that accrues value over time. However, for people who hold lots of cryptocurrencies but are also in need of funds to spend on everyday expenses, this can be a real dilemma. If they sell their crypto to spend on everyday expenses, they could potentially lose out on the value it accrues over time.

YouHodler solves this problem by allowing a user with a cryptocurrency holding to borrow up to $10,000 in fiat while using some of their crypto as collateral for the loan. This solution seems to be especially useful in a bear market, where Bitcoin has hit its lowest price of the year, and most Altcoins are at or below their ICO price. This would be an ideal time for users to take out crypto backed loans and hopefully see their crypto accrue in value during the period of the loan.

YouHodler offers 3 types of loans: 15-day, 30-day, and 6-month. Interest rates can be anywhere from 3% to 26%, and the loan to value ratio (the value of the cryptocurrencies held as collateral compared to the fiat loan delivered) varies from 40% to 70%. The most common reason for the 40-70% discrepancy is to mitigate the risk of a borrower’s crypto collateral losing value during the loan period. If the borrower uses 1BTC (worth $4,000) as collateral to borrow $2,000, and the price of BTC drops by 40%, it would still equal enough fiat to function as collateral for the $2,000 loan.

In the event that the crypto collateral falls below 70%, YouHodler would simply request that the borrower provide more crypto as collateral.

On the flipside, if the value of the cryptocurrencies goes up during the loan period, the borrower gets to keep those extra gains, which means they could end up with the same, or even more money after the loan has been repaid with interest.

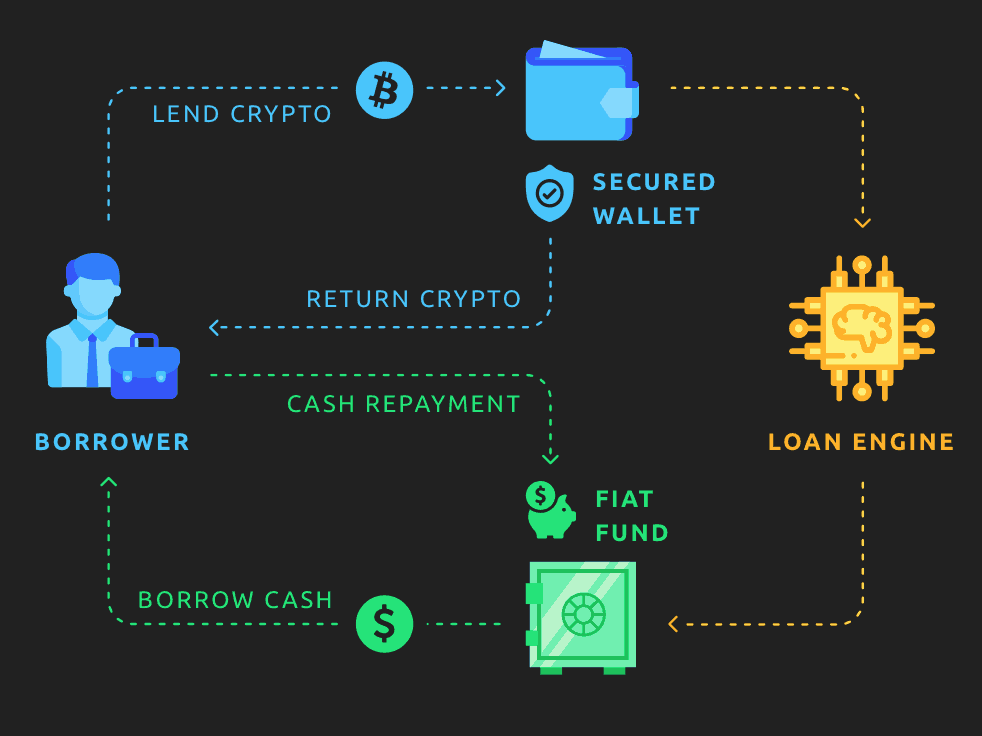

How it Works

The process is very simple. First, the user has to verify their identity; this is done by submitting a scan of the required personal documents, a selfie, and other relevant personal information. After your identity has been confirmed, you can deposit cryptocurrencies to your account. YouHodler currently accepts Bitcoin, Litecoin, Ethereum, Ripple, and Bitcoin Cash as collateral. Lastly, the user can borrow cash, which can be received through bank wire or credit card payments.

Benefits

YouHodler has developed its own fund, meaning there is no need to find a lender as in a traditional P2P model. Automated KYC/AML checks allow loans to be approved in seconds and funds are released almost immediately.

- Accepting Multiple cryptocurrencies YouHodler accepts BTC, ETH, LTC, BCH, XRP, and other popular cryptocurrencies as collateral

- Loan-to-value ratioYouHodler uses industry expertise and an advanced risk management system to assess the best Loan-to-Value and Margin Call levels.

- Easy Fiat Transfer YouHodler accepts all major Cards (Visa, MasterCard, Maestro, American Express, etc.).

YouHodler also has bank accounts set up in Switzerland because the country is very crypto friendly. All fiat money transfers are done in accordance with all the required security protocols including PCI DSS. The company is also partnered with trusted fiat payment providers, owns its own secure wallet (crypto assets are stored in cold wallets for added security) and is integrated with leading crypto exchanges (like CEX.io and Kraken). The groups of customers who would benefit most from this service are crypto holders, traders, investors, miners, and blockchain companies.

YouHodler was founded in 2018 and has its headquarters in Melford Tower, Limassol (Cyprus).

The post YouHodler – Get loan in cash with your crypto as collateral appeared first on CryptoPotato.