You Don’t Have To Worry About Bitcoin’s Reliance On Utilities

Imagine what life would be like if there were no electricity or communications networks available.

How many days of food do you have at your house? How much cash do you have on hand? Can you go out to try to buy up what’s left at the stores that still have their doors open? What else would you be worried about? What would you prioritize? What would you want to make sure you had on hand to survive indefinitely in a world without electricity and communications networks? What would you do if the world were suddenly knocked back hundreds of years?

Fortunately, this scenario that I have laid out is nearly impossible. It would require some suspension of disbelief — how could all electricity and communications networks be knocked offline at the same time without hope of rebooting them? The chances of such an event happening approach zero, but if such a world were to come to fruition, it would represent an indescribably massive step for the entire world’s way of life in the worst direction. So much of our lives is existentially tied to the internet and other communications networks. Bricking them would send the world into chaos.

Try to think of a business or organization that isn’t immensely dependent on access to electricity and the internet. You probably can’t. But is that a bad thing?

Progress Can’t Be Destroyed

I would argue that it is not. Our standards of living have been massively improved by the development and continued increasing consumption of energy, all while the actual work exerted by the collection of human bodies on the physical world remains the same (holding aside population growth). We can manipulate nature around us to make our lives considerably easier and more enjoyable without changing anything in our physical forms. We can only claim to be just a little healthier and stronger than our ancestors because we have exploited our environments in such a way that we can use tools to save our backs and improve our health with better foods and medicine.

Primitive man kicked off this process by developing simple machines like ramps, wheels, levers, pulleys, etc. and putting energy sources like wood and waterways to work. Clever people with knacks for mechanics, who were willing to defer some consumption today in order to reap the benefits of future consumption, started to build more complicated systems with these simple tools and ideas. Suddenly, Mr. Caveman could kiss his wife goodbye in the morning and expect to be more productive in his workday by orders of magnitude, despite putting in the same number of hours and the same physical effort.

Imagine that you are Mr. Caveman and your caveman neighbor, Grum, observes your use of your grand complicated machinery made of pulleys, levers and wheels that you use to do whatever cavemen needed to do back then. One day, Grum says, “Your thingamajig seems great and all, but what happens when one of the ropes on your pulleys breaks? Or one of your wheels cracks? That whole setup is going to be a useless pile of junk.”

Would that convince you to stop what you’re doing and be more like Grum? Or would you say, “I’ve thought about what happens when stuff breaks, so I’ve stocked up on spare parts. In the worst-case scenario, if something serious goes wrong, I’ve been so productive with this machine, I could get by for a bit without it running while I do what I need to repair it.” And as you walk away from the conversation, you’ll probably mumble, “You’re such an idiot, Grum.”

When things go wrong, the capital and the fruits of its production that already exist in the world do not disappear. They can be repaired or broken down and repurposed. If some catastrophe like a tornado completely obliterates them, the knowledge to produce what has been destroyed still remains and what was lost can be rebuilt with all of the lessons learned from the previous iterations. In the many thousands of years of human existence, no event has been so bad that humanity was unable to recover and continue to build off what was previously built. The proof of this should be obvious.

The Bitcoin Network’s Resilience

Let’s return to today. Bitcoin continues to grow and pull more of the world’s wealth into its network, challenging the hegemony of government’s Cantillonism-powered fiat. It’s on a crash course for global monetization, returning the world to a hard money standard like it has never seen before.

More and more people are becoming aware of it — this includes the Grums of the world.

One of the criticisms you’ll hear a lot is the idea that Bitcoin has a critical flaw because it relies on the internet and electricity to be useful. Obviously, it is true that if you lose electricity or the ability to access the network, you would be unable to use Bitcoin (assuming physical manifestations of UTXOs wouldn’t exist). Once your utilities get back online, your node will ping the other nodes in the network to figure out how far behind it is and start catching back up. Given that an average internet connection and simple hardware like a Raspberry Pi and SSD hard drive can sync the entire blockchain in a few days, even being offline for a week wouldn’t require much time to catch back up (not to mention that there are ways to still use Bitcoin without the fully-synced, fully-validating node).

Bitcoin’s reliance on electricity creates an incentive for people to secure their access to electricity. It’s no different than any other tool or technology that relies on electricity. What grocery store manager, for example, would want to risk losing tens of thousands of dollars-worth of inventory due to a power outage? He would want to purchase insurance coverage for his store to protect himself against such loss. If he hadn’t already done so, the insurance company offering him a policy would inform him that he could get lower rates by installing emergency backup generators. This would lower the risk of spoilage and the benefits of doing so are shared by both the grocery store and the insurance company (not to mention the manufacturer of the generators).

Likewise, businesses and other entities that use Bitcoin would make sure that in the event of the disruption of their services, they would have the ability to continue operations. Gasoline or diesel-powered generators would be obvious choices, as many are designed to switch on as soon as an outage is detected. Coupled with an uninterruptible power supply (UPS), these backup systems are currently readily available at relatively low cost for anyone who wants to keep their node running and phones and other hardware with connected wallets charged during disruptions.

In the event that the USP is also down during the power outage, connectivity would still be available via cellular communications networks. WiFi hotspots would be useful for keeping local nodes connected.

Let’s consider the purpose of a full node. It keeps a copy of the ledger as it gets updated to check that the person claiming to send you Bitcoin actually sends it to you. If you do not run your own node, your wallet software is pinging someone else’s node, which may or may not be sending you truthful information. A well-coordinated attack against you could feature the sender working with the node operator that your wallet relies on to trick you into thinking you’ve received bitcoin and completing your side of a trade. The risk is only on the receiver of bitcoin, not the sender, so the loss of access to your node would not pose any risk if you’re just sending bitcoin. However, it is unlikely that anyone in a Bitcoin economy would only be spending, so there is a need to have access to a node without requiring trust.

It is important to remember that the wallet on your full node is not necessarily the wallet from which you’re going to be sending and receiving transactions. The node may only be checking the validity of transactions and updates to the ledger. Therefore, those with concerns about keeping their use of Bitcoin trustless can run multiple nodes in different locations to spread out their risk in the case of outages. As long as there is a way to connect to one of them, a person can easily create redundancy. Maybe they run a node at the place of his business and another in his home. Additional layers of protection can be added with a little bit of security tradeoff by adding more nodes from trusted business associates, friends or family (like Uncle Jim) and the use of cloud computing platforms to leverage their near-100 percent uptime. The more geographically distributed these nodes are, the more unlikely you’ll be left on an island having to trust a stranger’s node.

In the case of a wider outage of typical internet and cellular networks, Bitcoin’s low bandwidth requirements make it feasible to run via satellite, mesh networks and short wave radio. These services would also presumably be useful for any secondary layers built on top of the on-chain layer. Once again, the ability to create redundant systems and layers of protection against predictable problems helps to build a robust system for everyone.

The Importance Of Securing Electricity

So far we’ve only discussed issues related to the individual who is sending and receiving block and transaction data. These people typically are not responsible for updating the ledger, which falls on the miners who have their own set of challenges. Fortunately, the connectivity solutions already identified for individual users would be very similar for miners since they are sending and receiving the same types and amounts of data. The big difference for miners, however, is securing electricity.

They do a massive amount of computing and that computing requires a massive amount of electricity. A large chunk of miners’ ability to be profitable is access to cheap electricity, especially as ASICs continue to commoditize. As miners set up their facilities and soak up the available electricity supply, new miners entering the market can’t simply set up right next to an existing miner if doing so drives up the cost of electricity to make mining unprofitable. Miners must get creative in the ways they capture their competitive advantage.

We often take for granted that we can find a hole in the wall of our home and plug into it to get some electricity. But how did the electricity get there? There’s no electricity delivery man who drops off a box of electricity at your doorstep every week. The electricity needs to be produced from a power plant where it takes some energy source (such as stored energy in coal or the kinetic energy of a river), converts it to mechanical energy and then converts the mechanical energy into electrical energy.

That electrical energy is sent through a maze of cables and wires and other equipment to make its way to each of the customers serviced by that power plant. This network, or grid, often has a number of power plants feeding it, which provide varying amounts of inputs to produce a steady and reliable output based on demand.

That demand isn’t static — it can change drastically depending on the time of year and time of day. As businesses and residents move in and out of a geographical area, the electricity demands will change as well. But as a general rule, human progress is strongly correlated to energy consumption, so as we move forward in time, our energy consumption tends to increase. Power plants can and have improved efficiencies in electricity production to improve their outputs, but higher demand often means expansions of existing plants and the construction of new ones.

Yet, for a variety of reasons (some good and some bad) such as economic, political, social, environmental, legal, etc., projects to add supply aren’t always feasible. The real estate in proximity to the power market might just not be available and the best site available might be too far to make it economical when the costs of transmission are added in. Or maybe fluctuating demand would cause the plant to have to idle for extended periods of time.

Regardless of the reasons, all else being equal, fewer power plants (i.e., less electricity supply) means higher electricity costs. Likewise, high demand means higher prices. For this reason, you shouldn’t expect to see miners operating facilities on Main Street during normal business hours.

What you will see, however, is miners taking advantage of quirks in the supply and demand cycles. Since power plants don’t want to idle their equipment and prefer to keep things steadily humming along, but don’t have a convenient, easy way to silo excess electricity, miners can bid low prices during periods of low demand. Suddenly, the power plants have an additional revenue stream that fills the valleys when their regular customers aren’t consuming much. The incentives might line up so well that power plants can even install their own mining facilities like Greenidge Generation in upstate New York did recently.

Bitcoin Will Always Find Power

As mentioned, miners tend to go where electricity is cheap and that includes places like hydroelectric power plants that by their nature often produce electricity above the capacity needed for the market they serve. But there is something even more interesting that happens with mining and electricity. Not only does Bitcoin mining add revenue to existing locations of energy production, but it also makes other previously unprofitable energy sources profitable. Transmission and distribution costs of electricity can be significant and great sources of energy are often in remote locations far enough away from existing infrastructure to make them unprofitable to tap. Bitcoin, on the other hand, doesn’t need all that infrastructure because it exists as digital information. Therefore, anyone can submit blocks to be added to Bitcoin’s ledger as long as they have connectivity to the network.

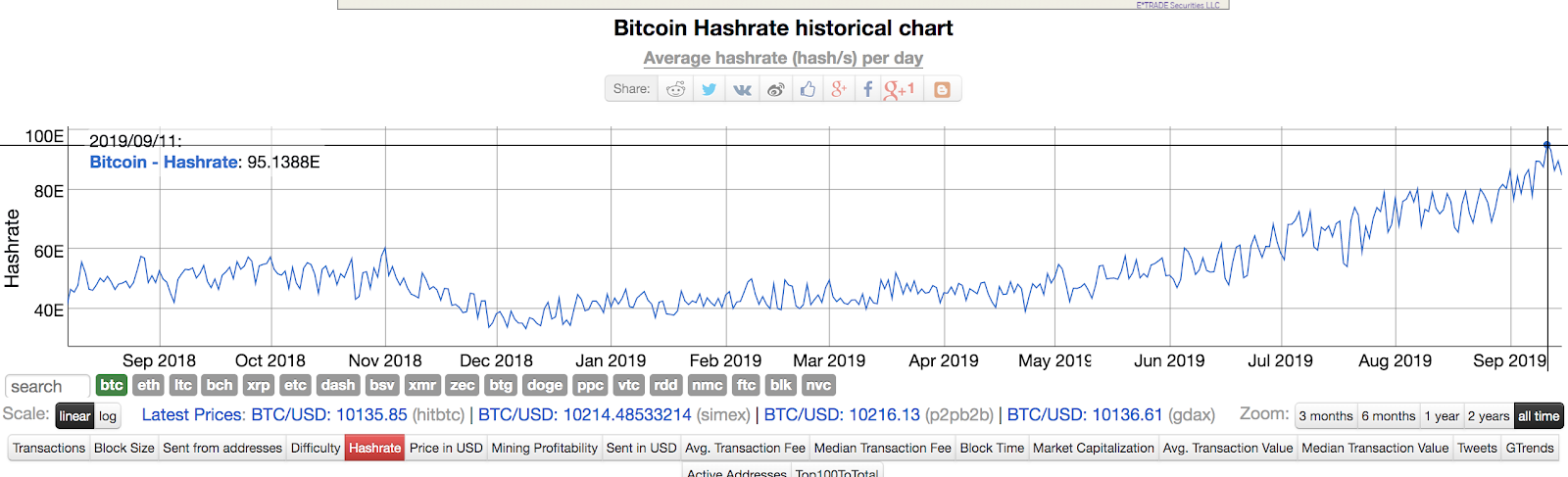

This is one of the reasons why keeping block sizes small is so critical. If miners not only had to submit blocks tens or hundreds of megabytes in size, but also had to receive new blocks every ten minutes, then it might be too much for the bandwidth of a satellite internet connection to handle. Or with all the competition for solving blocks, latency caused by their weak connection would result in them losing the race to saturate the network with their block first. Fortunately, the actual arrangement results in more energy being used to solve blocks, which increases Bitcoin’s hash rate, which makes the network more secure.

And for the purposes of this article, having mining facilities spread across the far reaches of the Earth makes the network more robust against electrical and communications outages. Mining operations are popping up in places like Iceland, where the plentiful geothermal heat is used to power mining rigs. Methane gas that was previously wasted by burning it with flares at remote oilfields because it was unprofitable to capture and sell is powering generators that create electricity to mine bitcoin, turning trash into treasure.

So, even an EMP blast taking out an entire region’s electrical equipment wouldn’t come close to spelling doom for Bitcoin. It would mean there would be a loss of hashing power until those affected could get their equipment back online. Maybe it means that difficulty gets adjusted downward for a time period or maybe other miners can switch on their rigs to fill some of the gap caused by less competition.

As more wealth is engulfed by the Bitcoin market, incentives to ensure that the output of capital is maximized are created. Better infrastructure would be built around the massive investments to make sure that profitability continues into the future to the benefit of everyone who touches Bitcoin. With deep pockets and clear vision, the industry leaders will take the reins away from governments and their crony corporate friends to build and maintain better electrical grids and communications networks since the inadequacies of the latter will be unceremoniously revealed by a wealth transfer this time driven by market forces.

The fiat world with its instant gratification will be no match for the hard money, low time-preference world ushered in by Bitcoin.

If there is one more “but what if…” to cover, let’s consider an incredible solar flare that engulfs the entire Earth and destroys all of the electrical infrastructure like we discussed in the beginning. Would that cause a failure of Bitcoin?

Maybe it would (unless someone was keeping paper copies of each block and then digitized them again). So you’ve got me — Bitcoin might get destroyed in a cataclysmic event that would end the world as we know it. But that sounds like an argument for Bitcoin, not against it. We can sit here and think up wondrous scenarios that would destroy any system or institution regardless of how fantastic and unlikely they may be. If that’s what it takes to defeat Bitcoin, then I’ll take it every single time.

What’s more robust than a form of money that will survive unless the Earth itself is destroyed along with it?

This is a guest post by Rollo McFloogle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post You Don’t Have To Worry About Bitcoin’s Reliance On Utilities appeared first on Bitcoin Magazine.