You Are Not Too Late To Become Wildly Wealthy With Bitcoin

Despite what appearances suggest, the best of Bitcoin is yet to come.

When I discovered bitcoin some years ago, I thought I was woefully late to the party. In retrospect it’s obvious how hilariously wrong I was. Like Jon Snow, I knew nothing. Most of the price action, technological development, geopolitical consequences —all this was still ahead of me. And as years go by, I believe this to be even more true today. If you’re reading this, you are not too late. This is still the beginning.

“I’m sure that in 20 years there will either be very large transaction volume or no volume.” -Satoshi Nakamoto

One thing becomes clear after years of researching Bitcoin and its effect on the world: Bitcoin cannot succeed just partially. It won’t play second fiddle. Like Satoshi foresaw, it’s all or nothing. Global monetary evolution or irrelevance.

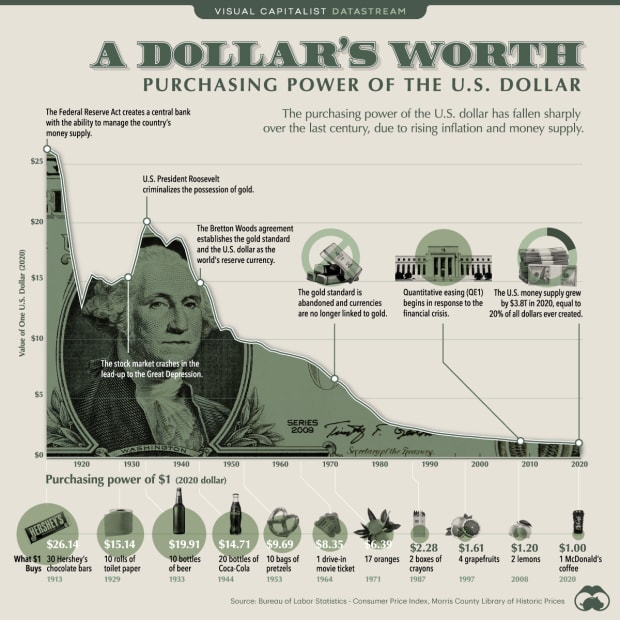

Why is this the case? Bitcoin is money, emerging in a bottom-up fashion, competing with top-down fiat money. Society needs money to smoothly exchange goods & services and to preserve the value generated for future use. In economic terms, money serves the role of being a medium of exchange and a store of value. Now fiat money works quite fine as a medium of exchange (especially in the Western world), but it’s been getting increasingly worse as a store of value over the decades.

To compensate for this failure of fiat money, people look to other instruments to use as a store of value, such as securities or real estate. Bitcoin thus competes with such instruments as well. Compared to other stores of value, bitcoin doesn’t fall under a particular jurisdiction (such as stocks, bonds, derivatives or real estate) and doesn’t require a third party for safekeeping (such as gold, diamonds or expensive art). These two qualities are sometimes overlooked even though they are as important (if not more) as the reliable monetary policy resulting in the 21 million final supply.

The case for storing value in the jurisdictional walled gardens with third-party risks will be harder to sustain as bitcoin becomes perceived as a mature asset with diminishing risks over time.

The instruments currently used as a provisionary store of value won’t disappear, they will just lose their “monetary premium” —which, as the term implies, should accrue to functioning money. When the problem of money is fixed via broad bitcoin adoption, the provisionary instruments will be repriced to a pure market value and utilized where it makes most sense: houses for living, bonds for predictable cash flow, stocks for capital allocation. These instruments are useful for society, but they have no place serving as a store of value. This is a role for sound money.

The Bitcoin Generation

Let’s consider things in the long term. I’m not talking about a Bitcoin Astronomy kind of timeframe now, more of a “grandpa, what did you do in the 20s?” kind of thing. If bitcoin succeeds and becomes the global sound money that the world so direly needs, we are going to be known as the first bitcoin generation. And it won’t matter whether you gambled on Mt. Gox, witnessed the blocksize wars or lived through the great Chinese hashrate migration. You will be considered an OG just because you were there before bitcoin fixed the world.

Now this may sound like I just smoked a huge bowl of hopium, but stay with me for a minute. Bitcoin today is nowhere near its potential. Remember: it’s an all or nothing kind of thing.

The current tally goes like this:

- Bitcoin stands at 7% of gold’s market cap. While gold has a strong Lindy effect going for it, you definitely can’t teleport it to the other side of the planet in the blink of an eye like you can do with sats over the Lightning Network. Gold needs trusted intermediaries to function properly. Bitcoin wins over gold in the long run.

- Only one country so far has adopted bitcoin as its legal tender. The game theory here is clear: the 20th century was the age of dollarization; the 21st will be the age of bitcoinization.

- All the geopolitical games involving bitcoin are still ahead of us. In the words of the legendary Jack Mallers: “There’s no fucking way you are ready” for what we’ll see in the coming years. Grab your beef jerky and stash your sats in the coldest of storage. History is upon us.

- Most people aren’t aware of the Lightning Network. How often do you hear the “Bitcoin can’t scale beyond four transactions per second” FUD? Lightning is working, here and now.

- Many still aren’t aware of bitcoin’s divisibility into 100,000,000 units, aka satoshis or sats. The unit bias lures many into shitcoins, naively believing they found affordable alternatives to bitcoin. You can still get thousands of sats for one dollar — that is hilariously cheap.

- Smaller central banks aren’t even accumulating bitcoin so far, even though bitcoin on the balance sheet offers a high chance of saving minor national currencies (in the interim at least, before they become obsolete as hyperbitcoinization occurs).

- Large investors are only slowly waking up to the fact that there is something terribly wrong with bonds, equities and even money itself. But waking up they are.

- Only one corporation is conducting a speculative attack on the US dollar, so far. When others realize how to leverage fiat’s monetary policy against itself, this will become a crowded trade.

The trends above, while not all measurable, tell us more about bitcoin than the short-term price performance (short-term being less than yearly candles). Short-term price action may be seductive to gamblers, but it’s quite irrelevant in the grand scheme of things. It really doesn’t matter whether the price is $3,000, $30,000 or $300,000. No fiat price tag actually matters because fiat money itself will not matter in the long run. As long as we denominate bitcoin in fiat terms it still is too early because that means that bitcoin hasn’t become the universal unit of account yet.

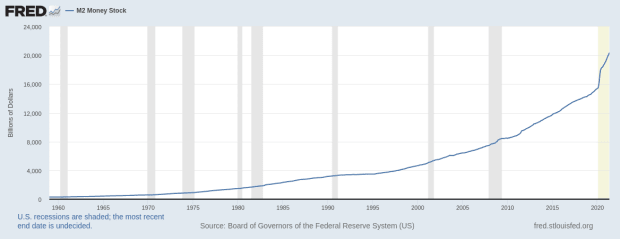

Fiat is becoming ever more worthless with each passing year. That’s just how the current debt-based system works. Ever more monetary units need to be created to prevent the whole thing from collapsing:

Every fiat currency in existence is undergoing hyperinflation. The only difference among them is the time scale on which it happens.

Using bitcoin for stacking more fiat is a sign of fundamentally misunderstanding what is happening in the world today. Fiat is not a sustainable form of money, as many have pointed out. Stacking fiat is a fool’s game. There is an unlimited amount of fiat. No matter how much you acquire, you are going to get diluted to zero, given sufficient time.

Number Go Up Turns Into Number Go Down

Pricing bitcoin in fiat doesn’t make sense in the long run, so then what does?

Pricing everything else in bitcoin.

Admittedly this feels a bit absurd for now, when most of us still have fiat-denominated wages, expenses and debts. Yes, we are still on the fiat standard. But as bitcoin gradually takes over, making mental calculations in bitcoin will become habitual.

Nowadays, we don’t think about the “price” of the dollar, but rather what the dollar buys. And it will be the same with bitcoin as the world gradually adopts it as money. People will mentally shift from bitcoin’s price to bitcoin’s purchasing power.

Since bitcoin is mostly used as a store of value first, it makes sense that we adopt a habit of thinking about our bitcoin stash in terms of sats instead of dollars. The dollar value of our bitcoin holdings may change over time, but most people eventually arrive at the conclusion that the only thing that matters in the end is to accumulate more sats. Many find out the hard way: selling at a fiat price they deem high enough, only to witness another steep rise in price later. Most speculators find themselves having less and less bitcoin over time. When they realize this, they shift their mental model from dollars to sats. Been there, done that.

The next step is when people start to accept a part of their wage in bitcoin. This is a natural progression for long-term bitcoiners, looking for jobs where they can fully focus on their passion. Beside the passionate bitcoiners, the option to earn a part of their wage in sats is coming to workers from other paths of life soon. While the wage itself will be denominated in fiat, workers will inevitably notice how many sats they receive each month. As bitcoin rises in terms of fiat price, workers will also notice that they earn fewer and fewer sats, although these smaller amounts will be worth more in fiat terms as time goes by. Incidentally, this is how the deflationary aspect of bitcoin may become viewed as a natural way things are.

A further step will then be to mentally reprice large purchases in sats. “Three million sats for an iPhone?! Fifty million sats for a car?!!” Any long-term hodler knows that these prices will go down over time. Bitcoin has a strong effect on lowering your time preferences, i.e. valuing future wellbeing over short-term gratification. Mentally denominating things in sats will become second nature.

This is how “Number go up” gradually turns into “Number go down.” Bitcoin’s price may go up to infinity in fiat terms in the future, but few will pay attention because fiat will become irrelevant at that point. Nobody cares today how much bitcoin is worth in Zimbabwean dollars, and nobody will care in a few decades how much it is in U.S. dollars. People on the sats standard will instead witness constantly falling prices.

But what about the volatility? Once bitcoin becomes the universally accepted unit of account, the volatility and the rate of appreciation will diminish greatly. This is due to multiple factors: there won’t be any speculators aiming for fiat gains, everyone will auto-DCA (though it will be called simply “saving”) and the market capitalization will be so huge that it will be virtually impossible for any single entity to move the purchasing power of bitcoin. There won’t be any dumps, nor will there be pumps. Instead, the rate of purchasing power appreciation after hyperbitcoinization will simply correspond to the rate of productivity growth. This bitcoin standard is in harmony with technology-induced growth deflation.

Technology is deflationary. That is not conjecture. It is the nature of technology. And because technology underpins more and more of the world around us, it means that we are entering into an age of deflation unlike any the world has ever seen. -Jeff Booth, The Price of Tomorrow: Why Deflation is the Key to an Abundant Future

Now you may say “all this is nice and all, but it’s decades away.” Well, that’s kind of the point of the whole article, isn’t it? You are not too late today because the major socio-economic consequences are still ahead of us. Appreciation of the possible — and in my opinion, quite probable future developments — has a strong effect on today’s behaviour. Knowing where it all leads motivates us to act in a virtuous manner today: adopting a low time-preference outlook, patiently stacking while accounting your savings in sats instead of fiat, ignoring the fiat maximalists and shitcoiners (as if there’s a difference).

Nobody Is Late, But Not Everyone Is Early

Nobody can ever be late to bitcoin. When bitcoin becomes global money and its rate of purchasing power appreciation reflects mankind’s productivity growth, it will always make sense to store value in bitcoin. It will simply be the best savings instrument there is, constantly appreciating without third-party or venture-failure risks.

The future isn’t written, though. There are risks to stacking and holding bitcoin before hyperbitcoinization occurs. Some of these risks are technical in nature; we still don’t have the safekeeping truly sorted out for good, though tools are improving at a rapid pace and are becoming more intuitive. Other risks are political in nature; the state still has a legal monopoly on money and will protect it. Current bitcoin holders face the risk of unfair tax treatment, confiscations or other forms of harassment.

That is why it is possible to be early, even though nobody will be ever late to adopting bitcoin. Early simply means being there before hyperbitcoinization occurs.

And that will be something to tell our grandchildren about.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.