Yearn Finance (YFI) Surged to $35,000 Following Coinbase Pro Listing Announcement

YFI took the crypto world by storm last month when it did the unthinkable and surged higher than Bitcoin’s price at the time.

Since its launch in mid-August, the DeFi token pumped monumentally to top out at around $39,000. It is a prime example of demand through scarcity as the big draw for this asset is the fact that there are only 30,000 in existence.

Since that giddy height, YFI retreated back to around $18,500 on September 5th. The news that Coinbase Pro will be listing the token has given it a new lease of life and the bulls are running again.

Coinbase Pro Pumps are Back

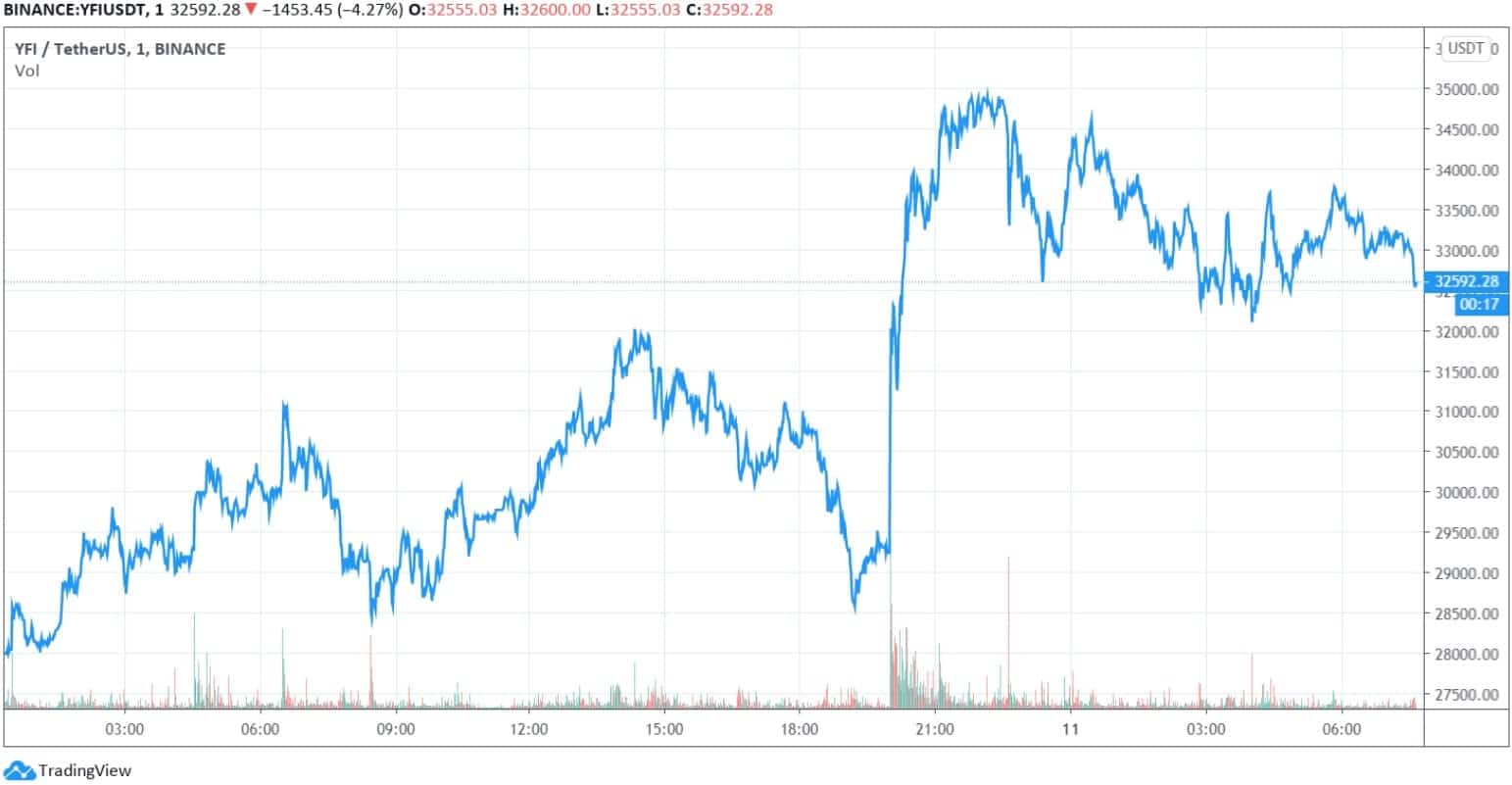

In a move remnant of the crypto exchange induced altcoin pumps back in 2017, YFI has surged over 63% since late trading on Wednesday. From a low of around $22,000, the DeFi token skyrocketed to top out at $35,000 on Binance.

Over the past few hours, it has pulled back slightly to trade at $32,700 at the time of writing which is still a gain of almost 20% in less than 24 hours.

Coinbase announced that it would open the doors of its Pro platform for YFI deposits on Monday, September 14, and allow trading to commence the following day providing there is enough liquidity.

On Monday September 14, our YFI-USD order book will enter transfer-only mode, accepting inbound transfers in supported regions. Orders cannot be placed or filled. Trading will begin on or after 9AM (PT) Tuesday Sept 15, if liquidity conditions are met. https://t.co/6UTHK3Htpf

— Coinbase Pro (@CoinbasePro) September 10, 2020

It added that YFI was not available on the regular Coinbase exchange, or to residents of New York State.

UMA Listed on Coinbase

The company has been busy listing DeFi tokens in order to keep pace with rivals Binance and Huobi Global which have been doing the same.

In a separate announcement, the regular Coinbase exchange stated that it would be listing Universal Market Access, UMA. The DeFi platform touts itself as ‘an open-source protocol that allows developers to design and create their own financial contracts and synthetic assets.’

Unlike YFI, UMA prices did not get a pump from the news and have actually retreated almost 7% today. From an intraday high of just above $17 a couple of hours ago, UMA prices have tanked to $16 at the time of writing.

Over the past 30 days, however, it has been on fire with a surge of 440% from $5 to reach an all-time high of $27 on September 2nd. Most of the DeFi related tokens have pulled back over the past week following their epic rallies.

The post Yearn Finance (YFI) Surged to $35,000 Following Coinbase Pro Listing Announcement appeared first on CryptoPotato.