Yam Finance Replants and Rebases But Tokens Still Slide

The DeFi food farming frenzy gained momentum in mid-August when Yam was one of the first to launch high yielding liquidity pools with a highly experimental elastic supply token to be distributed as rewards.

A code bug and subsequent bailout by DeFi whales put the project on hold until its relaunch to Yam v3, which occurred late last week. Now the team is looking towards the future.

Replanting the Yams

In a recent medium post, the Yam Finance team has outlined its vision for the future of the project. Without posting a specific roadmap, Yam has focused on four primary areas in need of development.

Protocol optimizations are the first one since the relaunched version is essentially the same as Yam v1, but with audited smart contracts. A function that would allow users to burn Yams for a proportional share of the treasury was suggested along with the treasury purchasing more stablecoins or ETH to increase liquidity.

Increasing the rebase frequency, which is currently set to 12 hours, could lessen the impact of treasury purchases, while changes in allowing liquidity providers to participate in governance voting were also considered.

Treasury management will get an overhaul, and there needs to be an improvement to interface and usability, the post added. The Yam Finance team also wants to incentivize technical contributors, community moderators, and creators of platforms that support the overall Yam ecosystem.

“As you can see, there is a lot of work that can be done to improve Yam. Despite the last month of progress, the relaunch of Yam is truly a starting point.”

YAM Rebased But DeFi Tokens Tanking

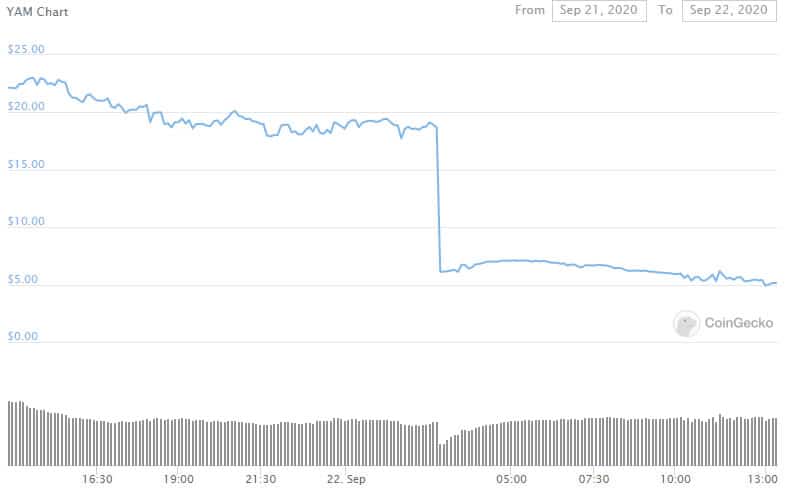

The relaunch has not improved token prices, which have been dumping along with the rest of the DeFi and crypto-asset market today.

Uniswap has a number of fake Yam tokens listed, making it difficult for the uninitiated to ascertain which is which. However, since the rebase a few hours ago, YAM v3 tokens were trading just around $4.5, following a 28% fall from around $7, according to Coingecko. Of course, it’s worth noting that this happened after the rebase, which increased users’ total holdings by a factor of 2.49x.

YAM is not the only DeFi token in pain today as double-digit losses are being felt across the board with tokens from Aave, Yearn, Synthetix, Curve, Uniswap, and SushiSwap all dumping hard.

The post Yam Finance Replants and Rebases But Tokens Still Slide appeared first on CryptoPotato.