YAM Finance Crashes Over 90%, Founder Admits His Failure

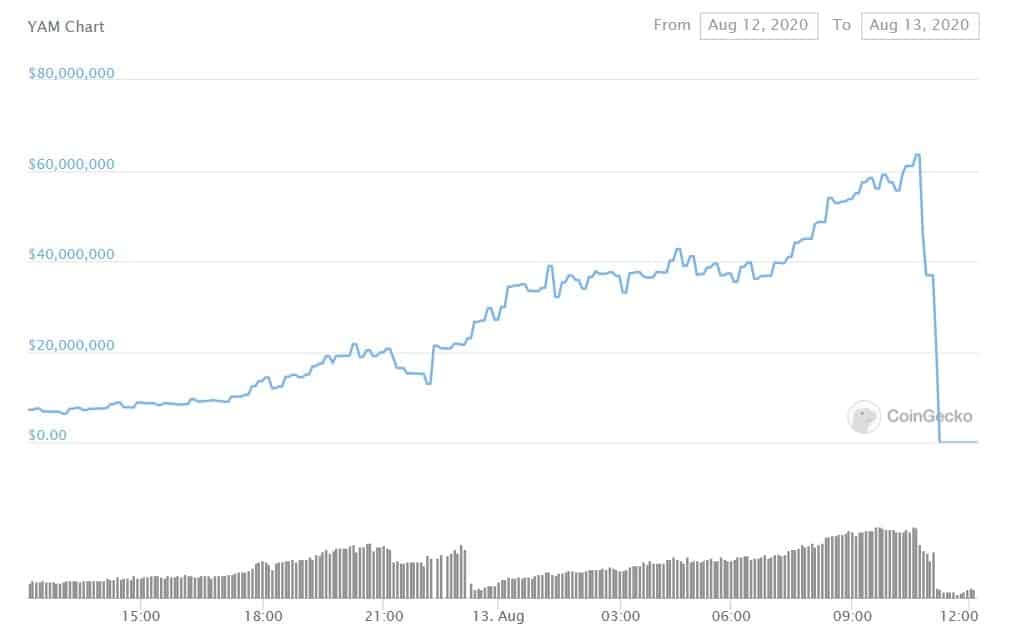

YAM – the financial experiment that started less than 48 hours ago crashed following an error in its rebasing mechanism that wasn’t fixed in time.

This event highlights the importance of proper due diligence in the field. Even though the development team made everything they can to disclose the dangers and the risks of the protocol, and they put warning signs wherever they can, people lost money as YAM’s value was virtually obliterated.

What Happened With YAM?

Yesterday, CryptoPotato reported that DeFi coins were getting propped up by a new financial experiment that allowed users to stake tokens of various protocols and earn yield in the form of YAM.

At the time, this created a massive hype around the new cryptocurrency, which drove its price to upwards of $200 from essentially zero, causing many to believe that this is the next big thing in DeFi.

The protocol was unique in that it had a fair distribution with no pre-mine, while also combining the elastic supply principles that were brought into light by another project – Ampleforth (AMPL).

In essence, the yield that farmers earned – YAM, was an elastic-supply token, meant to have a stable dollar value of $1. Whenever the market price is different than that, the protocol would expand or contract the supply to bring the price closer to the target.

Last night at 8 PM UTC, the community saw the first rebase, which was nothing short of impressive as holders received upwards of 800% more tokens in their wallets, as the price dropped from around $100 to $10.

Here Comes The Issue

Not a lot before the first rebase, however, the developers of the project announced that they’ve revealed a bug in the rebasing mechanism.

In essence, what the code error caused was explained by Yam Finance in a few tweets.

“… if governance is unable to submit a bug-fix proposal prior to the second rebase, no further governance actions will be possible.

There will be so much YAM printed that quorum will be impossible. If this happens, the YAM treasury will become ungovernable and these funds will be lost. This will happen on the next rebase at 8 AM UTC, unless a proposal is submitted prior.”

Even though farmers turned up and provided the votes necessary to submit the proposal, shortly before said rebase, the team warned of another issue:

“We are urgently investigating a potential flaw that would prevent proposal execution.”

The rebase took place, and it appears that the efforts were for not. One of the founding members of the protocol, Brock Elmore, took the blame for what happened.

i’m sorry everyone. i’ve failed. thank you for the insane support today. i’m sick with grief

— belmore🍠 (@brockjelmore) August 13, 2020

In all fairness, however, the team had done what they can to disclaim that the entire project was unaudited and prompted people to approach it with extreme caution. This is what a lot of industry proponents expressed, including the Founder of Ampleforth, Evan Kuo.

According to CoinGecko, YAM’s total market capitalization is currently $0 – a drop from $65 million hours ago.

The price for YAM is currently around $0.5, which is a decrease of more than 95% in the last hours.

This brings an important conclusion: the market is currently in a state of serious hype. That’s especially true for the DeFi space. It’s absolutely paramount to conduct serious research before investing in any project. Always exercise caution and never invest more than what you can afford to lose.

While the project is now essentially reduced to being another AMPL-clone, the last couple of days will likely be remembered for a long time coming.

The post YAM Finance Crashes Over 90%, Founder Admits His Failure appeared first on CryptoPotato.