XRP Price Surges 40% to $1.4 as Court Disallows SEC to Access Ripple’s Execs Personal Records

The blockchain-based payment processor has registered another win in its ongoing legal battle against the US Securities and Exchange Commission. The Judge ruled in favor of Ripple by dismissing SEC’s request to access Ripple executives’ personal bank records.

- CryptoPotato reported in early March when the SEC sent subpoenas to six banks requesting personal financial information for Ripple’s CEO Brad Garlinghouse and the co-founder Christian Larsen.

- The duo objected and filed a motion indicating that they had agreed to provide all necessary records relating to XRP transactions but asserted their personal finances had no relevance to the case. Furthermore, their lawyers called SEC’s move a “wholly inappropriate overreach.”

- Judge Sarah Netburn has agreed with Ripple’s executives and granted their motion on Friday. She announced that obtaining such personal bank information from the defendants was unnecessary:

-

“The SEC’s requests and third-party subpoenas make broader requests. However, that would result in the disclosure of an immense trove of private financial information with no relevance to whether the Individual Defendants offered or sold XRP into the public market or promoted its sale to potential investors.” reads the court document.

- Consequently, the ruling order the SEC to withdraw the sent subpoenas.

- This marks Ripple’s second court win in a week against the SEC. Earlier this week, the Judge allowed the firm to receive access to SEC’s internal discussions about Bitcoin (BTC) and Ethereum (ETH).

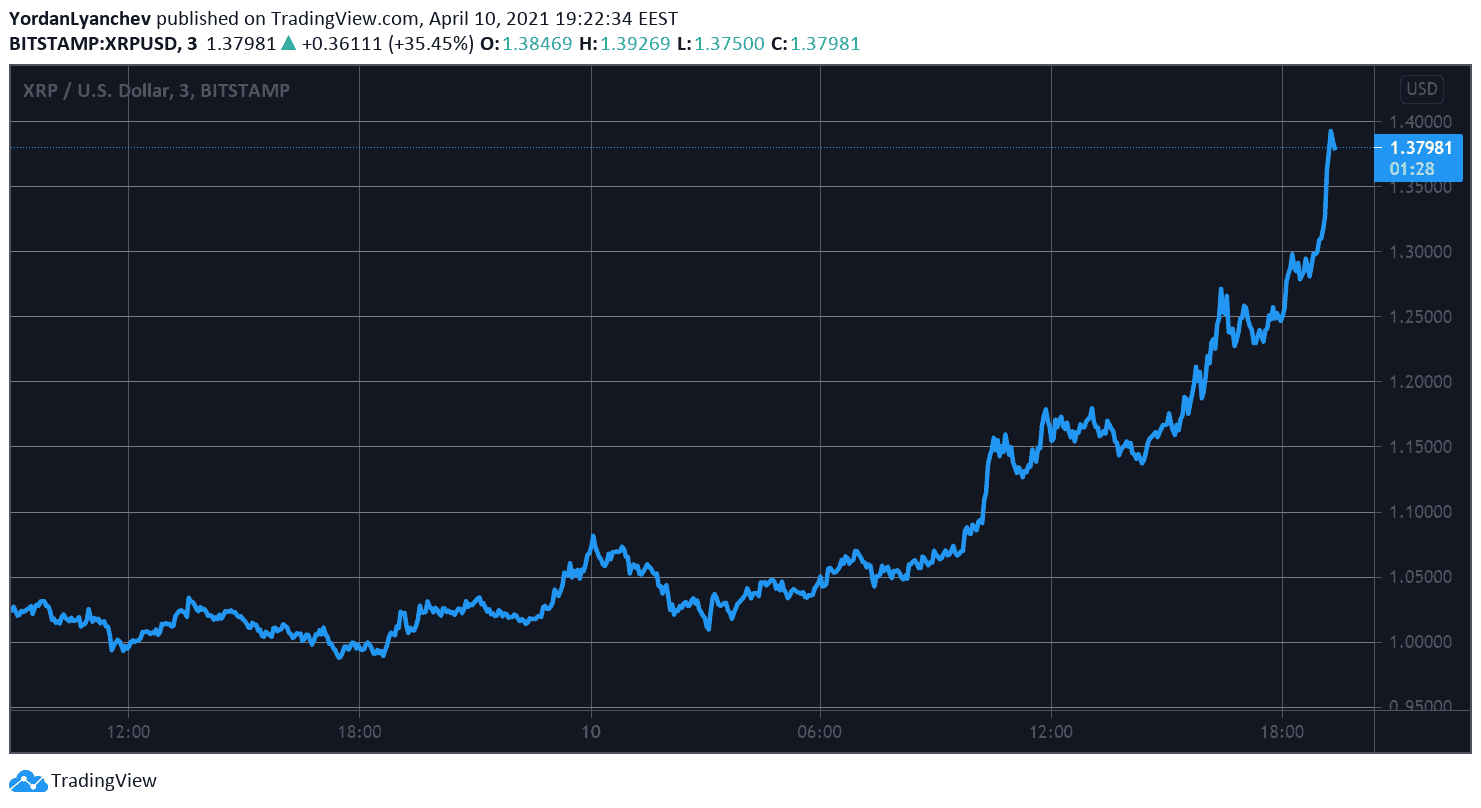

- It’s worth noting that the bull run of Ripple’s native digital token has only intensified after the latest court ruling. XRP traded around $1 yesterday but has skyrocketed by roughly 40% and reached a new 3-year high of $1.4 (on Bitstamp).