XRP Led November’s Crypto Bull Run With 169% Gain

XRP Led November’s Crypto Bull Run With 169% Gain

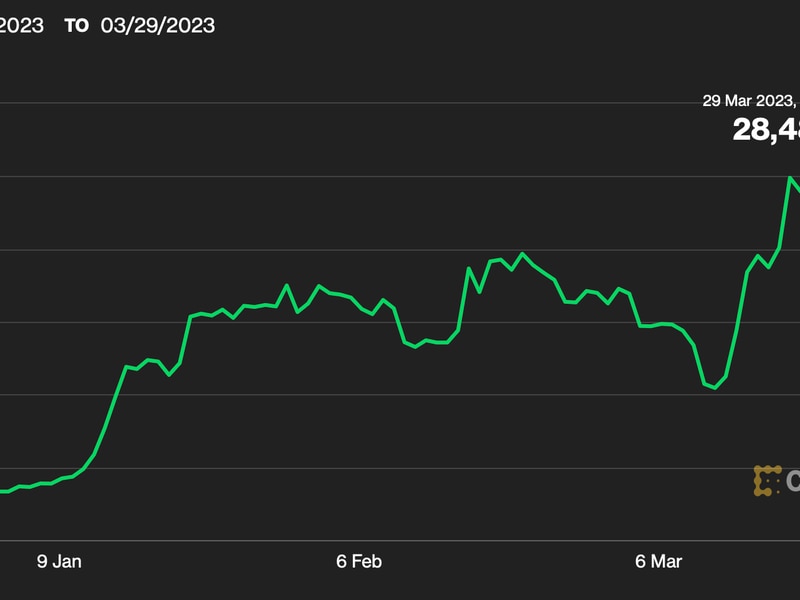

As bitcoin dominated headlines in November with its rally toward an all-time high, one of the most prominent alternative cryptocurrencies, XRP, quietly jumped 169% during the month to top the performance rankings among digital assets in the CoinDesk 20.

The move left XRP, the payments token used in Ripple’s global payments network, up 225% in 2020, versus the older and larger bitcoin’s 165% gain. XRP has a market capitalization of $21.4 billion, a fraction of bitcoin’s roughly $350 billion.

The frenzy in XRP may be driven by a looming airdrop of free “spark” tokens to anyone who holds XRP, some digital-markets analysts told CoinDesk last month.

There’s also the possibility that some first-time cryptocurrency buyers are unaware that it’s possible to buy a fraction of a bitcoin – divisible up to the eighth decimal, instead of a whole token. For the novice investor, XRP, currently changing hands at 62.3 cents, looks a lot cheaper on a price table than bitcoin’s $19,087.

“As the digital asset space has seen renewed interest in the second half of 2020, a new wave of investors are looking for ways to get exposure,” said Brian Mosoff, CEO of the publicly traded Canadian investment fund Ether Capital. “Ripple appears to offer exposure in their portfolio, and a quick Google search may result in some users believing XRP is cheap and likely to become a product banks utilize for cross-border settlement.”

Stellar, another payments token founded by Ripple co-founder Jed McCaleb, was the second-best performer in November among the CoinDesk 20, gaining 153%. It’s up 313% on the year.

For comparison, bitcoin rallied 40% in November while ether, the native cryptocurrency of the Ethereum blockchain, rose 56%.

Ether Capital’s Mosoff, for what it’s worth, says he’s skeptical of XRP’s gains.

“Ripple has struggled to gain wide-spread institutional adoption despite years of effort,” Mosoff said.