XRP Jumps 7% in Seven Days but Worrying Signs Start to Pop (Ripple Price Analysis)

The good news for Ripple is that we are finally seeing some bullish sentiment in the market. Although trading volume is progressively declining, the possibility of breaking out of the 5-month consolidation phase remains alive.

Technical Analysis

By Grizzly

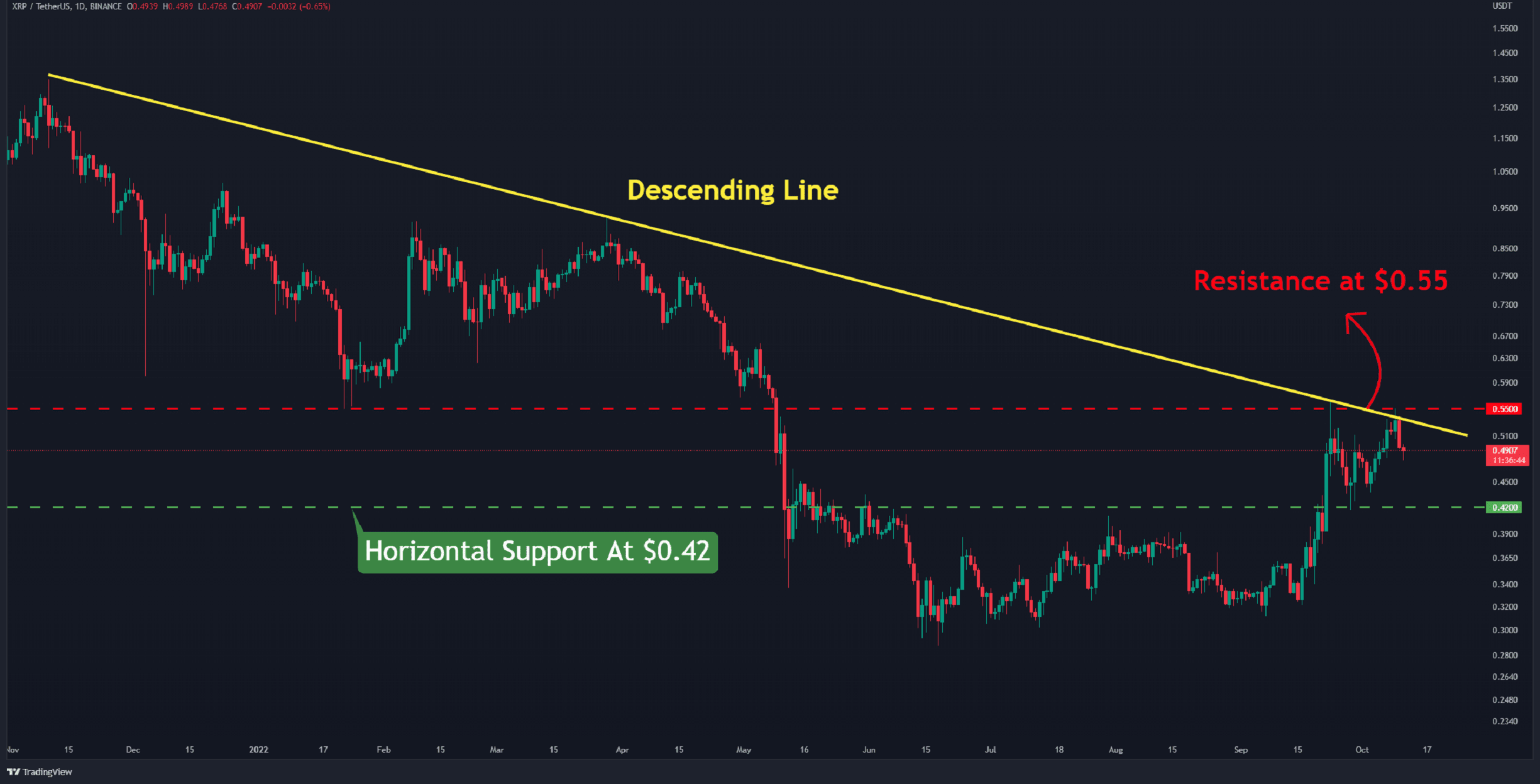

The Daily Chart

On the daily chart, the bulls have once again hit the horizontal resistance level at $0.55 (in red). It intersects with the descending line’s resistance (in yellow), which has been a hindrance to the price since November 2021.

Overall, the positive sentiment continues to rule the market. If the cryptocurrency can stay above the horizontal support at $0.42 (in green), this bullish could invoke a retest of $0.55. If the resistance is cleared, the next main target would be at $0.7.

It should also be noted that the trading volume is decreasing compared to the end of September. While prices remain below $0.55, this is not considered a favorable sign.

Key Support Levels: $0.42 & $0.33

Key Resistance Levels: $0.55 & $0.68

Daily Moving Averages:

MA20: $0.48

MA50: $0.40

MA100: $0.37

MA200: $0.45

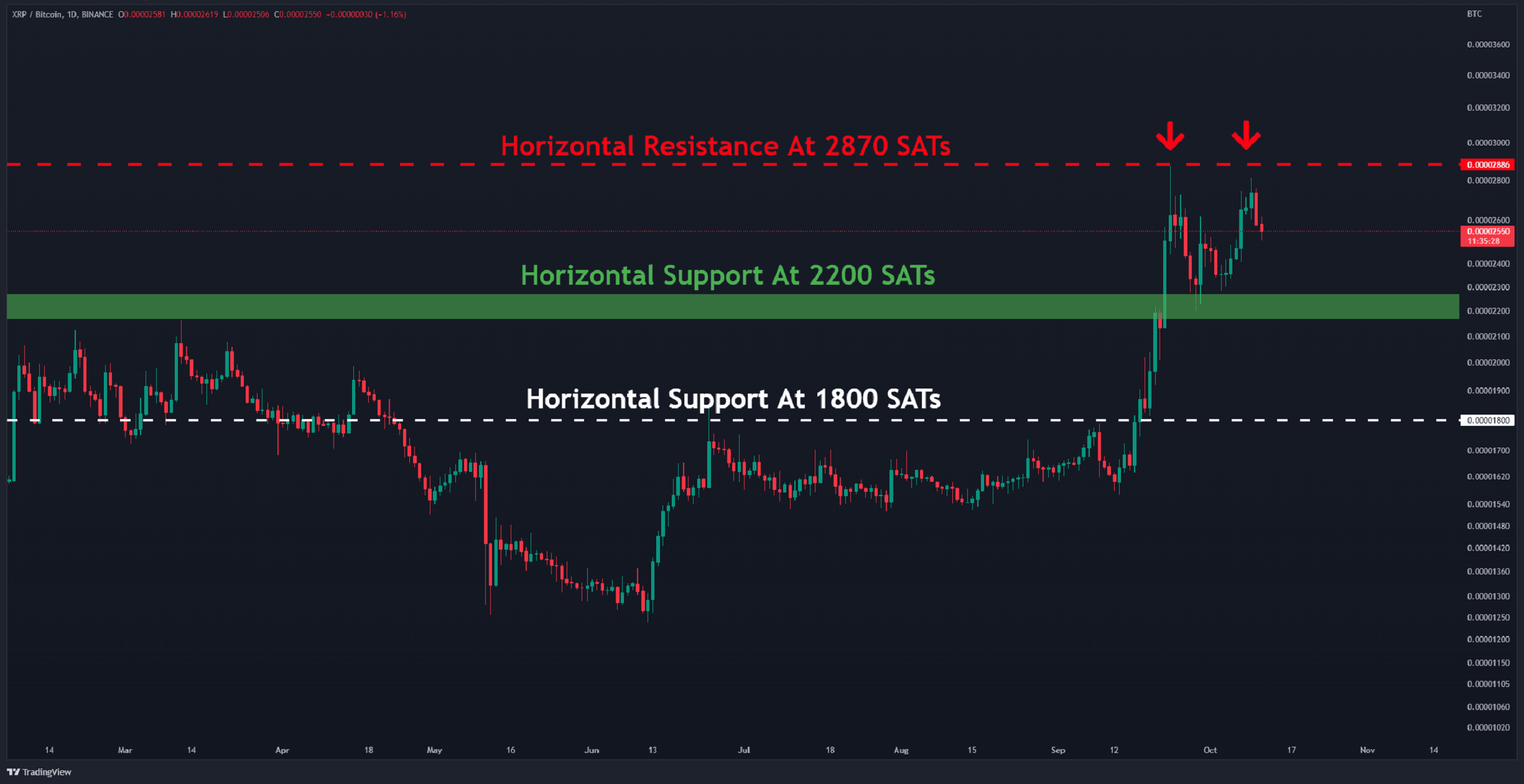

The XRP/BTC Chart

The situation against Bitcoin is similar to the above. The cryptocurrency retested the overhead resistance (in red) but was met with a selling barrier.

An uptrend could result in a breach of 2870 SATs if the price can stay over 2200 SATs (in green). If the green zone is broken, the next level of support will be found at 1800 SATs (in white).

Key Support Levels: 2200 SATs & 1800 SATs

Key Resistance Levels: 2870 SATs & 3900 SATs

The post XRP Jumps 7% in Seven Days but Worrying Signs Start to Pop (Ripple Price Analysis) appeared first on CryptoPotato.