XRP Explodes 50% to Head the Altseason While Bitcoin Price Rests (Market Watch)

While Bitcoin struggles beneath $18,500, most altcoins have been exploding in value. Ripple has led the charge with massive double-digit gains to new highs. Ultimately, BTC’s dominance has shrunk in the past few days by 8%.

Smells Like An Altseason

The alternative coin market has been exploding lately. The situation has only intensified in the past 24 hours, and Ripple is once again stealing the show.

XRP has gained another 50% of value since yesterday and even neared $0,80 before retracing slightly to $0.70. On a weekly scale, XRP has skyrocketed by 135% and returned to the top three spot in terms of market cap. This is XRP’s highest price tag since mid-2018.

Ethereum also reached new yearly highs of $620 (on Binance). Although ETH has retraced slightly, the second-largest digital asset still hovers above $600.

Bitcoin Cash has also gained a double-digit percentage – 17%. As a result, BCH has jumped to $345.

Cardano (9%), Binance Coin (8%), Chainlink (4%), Polkadot (4%), and Litecoin (2%) are also in the green.

Stellar has followed Ripple’s performance and has added 50% of value. XLM is almost 100% up in the past week and trades north of $0.16.

Horizen (40%), Verge (35%), Orchid (32%), Status (27%), Nano (26%), Bitcoin Gold (25%), TRON (22%), Dogecoin (21%), and NEM (20%) are just a few other coins with double-digit price increases.

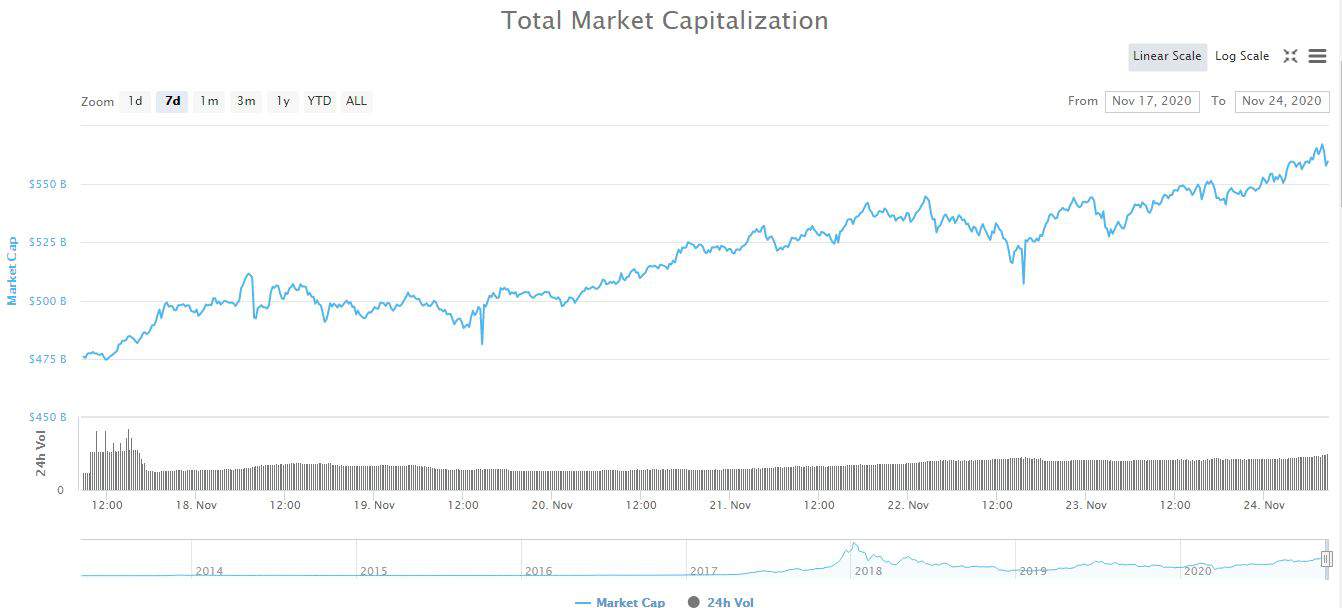

In total, the cryptocurrency market cap has surged to $560 billion. Just a few days ago, the metric had dipped beneath $500 billion.

Bitcoin’s Dominance Falls

The primary cryptocurrency has also been on a roll lately, resulting in the latest yearly high of about $19,000 marked on Saturday. However, the asset has stalled since then and even dipped to $17,400 a day later.

Bitcoin reclaimed the $18,000 price level and even attempted another leg up towards $18,800, but it was stopped. The retracement that drove BTC beneath $18,500 means that it is slightly in the red on a 24-hour scale.

Consequently, the altcoins have managed to reduce Bitcoin’s dominance over the market. The metric comparing BTC’s market cap with all alternative coins has fallen to 60.5%, whereas it peaked at 68% last week.