Xena Exchange Beginner’s Guide – How to Trade Video Tutorial

Xena Exchange is a new crypto trading platform with a beautiful design and plenty of advanced features. Xena claims that it is one of the fastest crypto exchanges, with a latency of 1 millisecond.

Before we start, please note that while margin trading can result in higher rewards, it comes with higher risks as you can quickly lose a significant amount of your balance if you are not thoroughly familiar with the platform and the margin trading risk.

How to register a new account on Xena?

To register an account, navigate to the Xena homepage and then click on the green “Sign Up” button in the top right corner. Fill out your email, confirm and after completing your name, country and selecting password – you’re done.

While you don’t necessarily need to verify your account, Xena recommends that you do so. The main reason is that verified Xena users have much higher withdrawal limits. The verification process is fully automated, and it takes only a few minutes to complete, while it requires two documents: proof of ID and proof of residence.

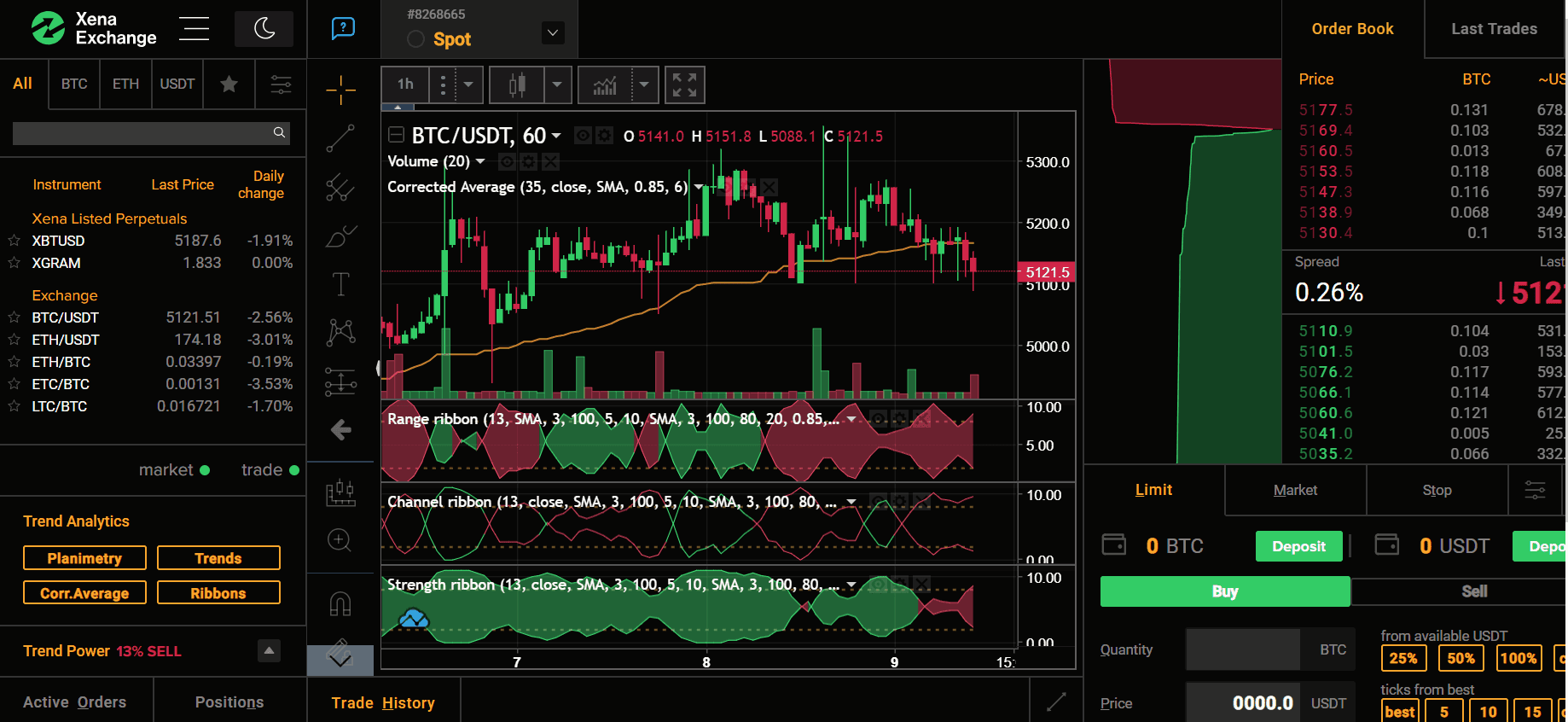

Xena’s main display overview

On the left-hand side, you can see the variety of trading pairs available on the exchange, as of writing this:

Spot trading is available for the following trading pairs:

● BTC/USDT

● ETH/USDT

● ETH/BTC

● ETC/BTC

● LTC/BTC

Margin Trading: Xena offers margin trading with a maximum leverage of 1:100 for the Bitcoin/USDT market as of writing this; however, the maximum leverage is available only for high-limit orders. Xena also offers XGRAM/USDT trading pair with no leverage, for now, XGRAM is a future on Telegram’s token called Gram.

Margin Trading: Meet The LOT unit

Xena’s Bitcoin margin contracts are traded and measured in Lots. The current lot size is equivalent to 100,000 contracts or 100K USDT. The minimum order is 0.01 lots, which is equal to 1,000 USD. This includes your leverage.

Another thing to note is that for orders with a volume of less than 1 million USDT, the margin rate is up to 20x, and it depends on your account collateral. The margin is calculated automatically and rises as the size of your position increases.

Trend Analytics & Trend Power Indicators

On the left pane, just in the middle, there is the Trend Analytics section.

Those are four buttons, which are unique trend signals and indicators, so users have a better grasp on market growth and potential. Let’s meet them closely:

- Planimetry adds multiple simple moving average lines: from 2 days to 1200 days.

- Corrected average helps to identify market sentiment trends – a buy signal is when the corrected average crosses under the price. A sell signal is just the opposite.

- Trends (or Trend Power) indicator is an oscillator similar to the classic relative strength index or RSI, but using an additional Laguerre filter to enhance the responsiveness of the indicator to the last price.

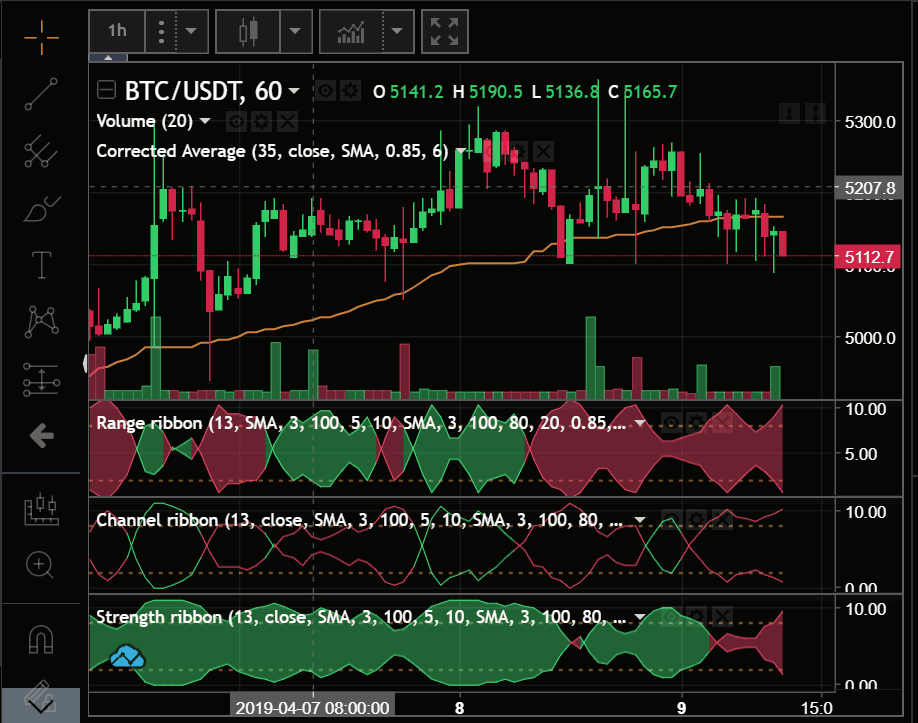

- Ribbon, which is a combination of known oscillators such as range, channels, and strength. The ribbon calculates and aggregates to get smoother results.

Below the Trend Analytics, we can find the Trend Power: This signal shows a BUY or SELL, for bullish or bearish trends. Trend Analytics utilizes three technical indicators: Commodity Channel Index, Exponential Moving Average, and Relative Strength Index. All indicators are calculated in 5 different timeframes: 5 & 15 minutes, 1 & 2 hours, and 1 day.

Xena’s Price Chart

Now, let’s move on to the price chart: the chart is provided by the leading charting service TradingView and includes all necessary options and indicators for traders.

On the top left side of the chart, you can set the time interval: from one minute up to a weekly chart timeframe.

Next is the price display option: select between bars, candles, hollow candles, Heikin Ashi, line, area, or baseline.

Next, you can add common indicators such as RSI, Moving averages and more.

On the menu to the left of the price chart, you can select from drawing and editing tools, such as support and resistance trend-lines.

The order book is located on the right side of the screen. It shows the available orders for buying (demand, which is marked in green) or selling (supply, which is marked in red). You can use the Order Book to assess the impact of your orders on liquidity.

If you click on the Last Trades tab, you can see the latest orders executed on Xena, showing the coin’s price and volume, as well as the time of the trade.

Account Types: Spot and Margin

Any new account comes with a Spot account. However, if you need a margin account too, you can open one using the button under the account list or using the account page. Xena allows to open up to five different margin accounts.

Deposit and Withdrawal of Funds

In the main menu, click the green “Deposit / Withdraw” button in the top right corner of the page. On the top left, select the account you want to deposit into, and then click “Deposit” next to your desired cryptocurrency. Then, you will receive your new deposit address, which you should use to fund your account.

After depositing, you can always use the Transfer option, to move funds between your Xena accounts.

Xena accepts deposits from the following currencies: Bitcoin Cash – BAB and BSV, Bitcoin (BTC), Ethereum Classic (ETC), Ether (ETH) Litecoin (LTC), Tether USDT, and Ripple (XRP).

Please note that deposits and withdrawals at Xena are crypto-based only – as in many others crypto exchanges. Hence, no FIAT deposits are accepted, at least as of now.

Your deposit is expected to arrive after six confirmations.

How To Start a New Position on Xena’s Margin

To start a new position, navigate to the trading platform section. On the top of the page, choose the account you want to use for trading and the type – margin or spot.

A little comment about margin trading: As any cryptocurrency exchange, Xena can’t afford to lose the funds they loan you via margin trading, they automatically close positions when they reach their liquidation price. Therefore, do your homework before trading on margin.

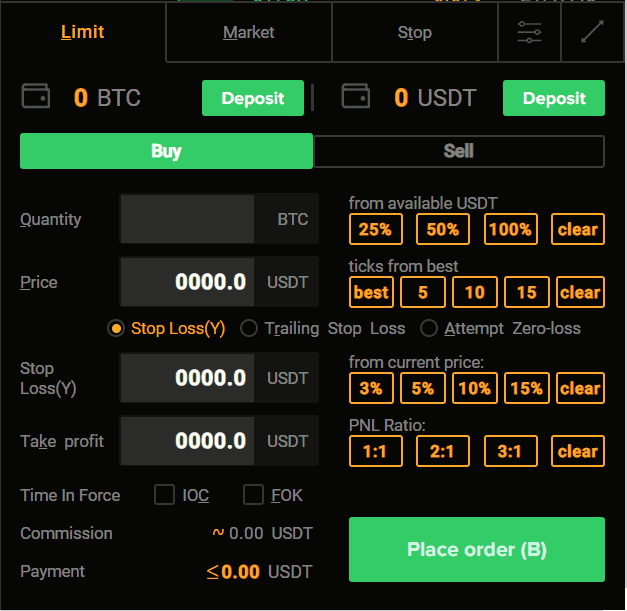

You open your position from the bottom right section of the trading screen. Let’s go through the different order types which are the three tabs here:

- Limit: With this option, you can set the order price manually.

- Market: Your order will be executed automatically at the best available rate on the market.

- Stop: The Stop order fires only when the Stop price is triggered.

For this guide, we are going to open a short position of 1000 USD. Short means that we believe the Bitcoin price will decrease.

Reminder: LOT is the base unit Xena uses. Hence, we will choose “limit” and set the size to be 0.01, which is the minimum order size for Xena. After setting the LOT size, the margin size will be calculated immediately. The margin, which appears in BTC, is equivalent to 1:20 the size of our position, which in this example is $50.

We can set prices both for Stoploss, which is used to control and minimize loss and for take profit, which is pretty much the opposite – to lock profits at some points.

Three Stop-Loss Options

Xena offers three types of stop-loss options:

- Stop Loss: which is the common one. If you choose this option, your position will be closed if the last market price touches the Stop Loss level you have set for your order.

- Trailing Stop Loss: This kind of Stop Loss moves automatically if the price goes in the position’s direction (goes up if you long, down if you short) and stays at the given percentage distance from the market’s last traded price.

- Attempt Zero Loss: This option is similar to Trailing Stop Loss, but the price will not go beyond, or lower, than the position’s opening price.

If you like you can set or edit the stop loss and take profit levels after initiating the position.

IOC and FOK

IOC means Immediate or Cancel: This cancels the part of your order that has not been executed immediately in full.

And about FOK, which means Fill or Kill, either execute your order in whole or doesn’t execute it at all.

Placing the order and position data & history

We execute the order using the “place order” button. One confirmation and the position is on.

We will then find our new opened position in the bottom part of the middle of the Trading display: in active orders if undone yet, or under Positions, if opened. Besides the position details and data, there is the current price and total and floating PL which stands for Profit and Loss.

Floating PL, also sometimes called unrealized PL, is calculated using the current best bid and best ask price. It shows you how much you’ll approximately get if you close your position now. There is a similar field called Unsettled Variation Margin that is calculated using the current value of the underlying index.

There are regular clearings (once an hour) when the UVM is settled to your account. For example, if you have opened a long position at the price of $5300, and by the moment of the clearing, the index price was $5400, $100 (in Bitcoins) will get deposited to your account.

At the same time, both floating PL and UVM will become zero (as you already ‘realized’ the PL at the clearing). The total PL shows how much you earned or lost on your position since the moment you opened it.

Two more tabs in this section are trades and positions history.

Closing a position

On the main trading display, press on the X button on the right side of your position in order to terminate it, and confirm. From now the position will be a part of the history tab.

Additional features provided on Xena’s main menu

If we click on the Main Menu icon – here we can find the Perpetuals page, which is the margin traded coins (which is currently Bitcoin and GRAM), here we can see here real-time info about our positions along with up-to-date market data.

Next on the main menu is The Portfolio page, which is pretty much the same but for the coins traded on Spot.

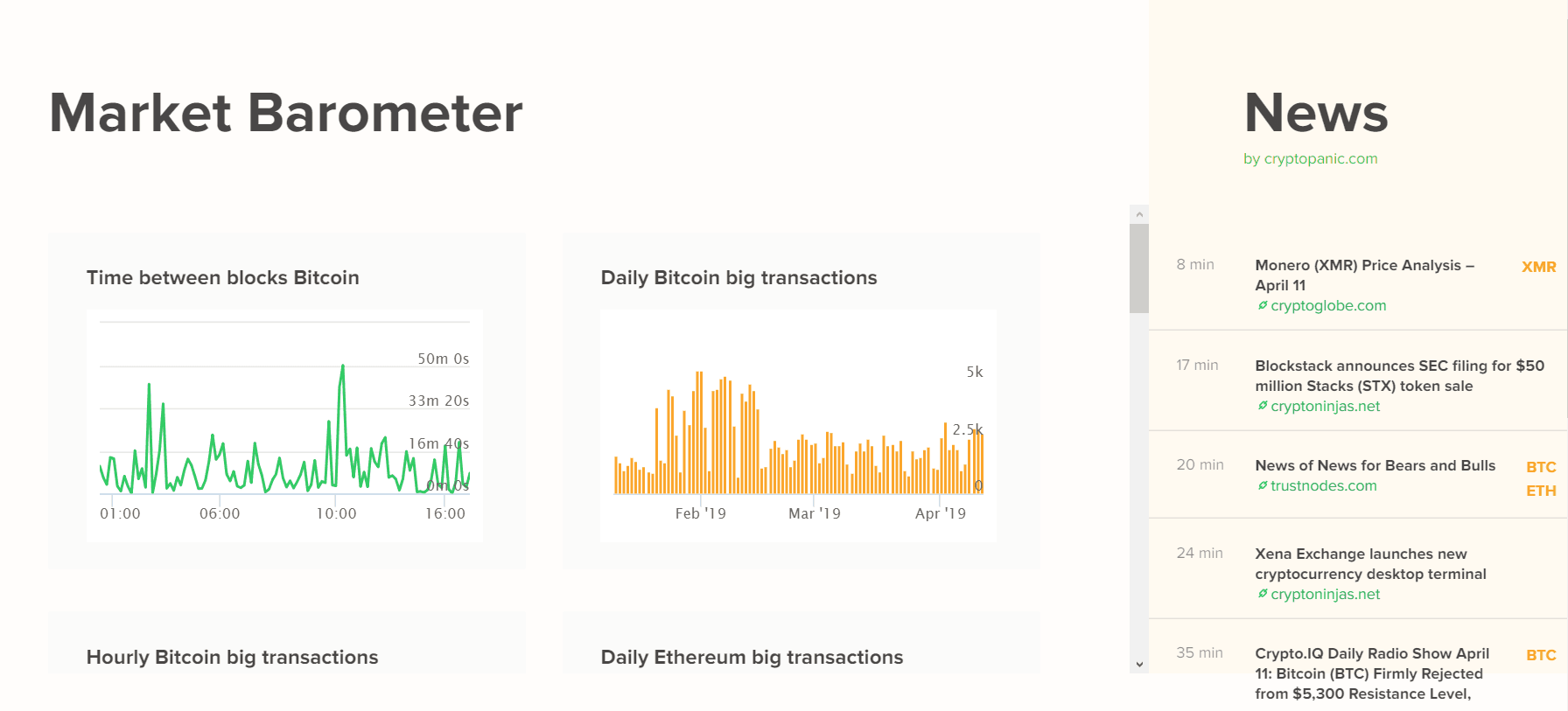

In the Market Barometer you can find a wide variety of charts with real-time data, such as big daily transactions for Bitcoin & Ethereum, as well as Twitter’s hype indicator. On the right side of the Market Barometer page, Xena displays a crypto news feed for your convenience.

Xena’s fees explained

For spot trading, Xena charges 0.10% if you are the taker and 0.05% if you are the maker. Remember, Taker buys from the order book, while the maker puts up the position and adds to the order book.

For margin trading — taker pays 0.075% while maker gets 0.025% rebate. The fees are reduced for traders with high trading volumes.

While there are no deposit fees, Xena takes a small cut from withdrawals with the fee varying by the cryptocurrency used for the transaction. For example, the crypto exchange takes 0.001 BTC from Bitcoin, 0.005 ETH from Ether, and 5 USDT from Tether withdrawals.

What about Xena’s exchange security?

Because there have been many attacks that target exchanges, one of the most important factors when considering trading on an exchange is security.

In this field, Xena exchange has some various security features, including DDoS protection, 2FA – which is second layer authentication, as well as regular penetration tests, real-time audits for all assets and transactions, and multi-sig cold storage with keys stored in geographically distributed secured locations.

Xena also has automatic fraud monitoring and anti-market manipulation policies.

Summary & Score

Xena is an excellent platform for traders who look for advanced features. While we can’t confirm that Xena is the fastest cryptocurrency exchange on the market as they claim to be, we can say it has a decent trading platform that has the potential to become one of the leading margin exchanges.

XENA

7.1

Pros

- Low latency that allows fast order placement and response time.

- Advanced unique trading indicators like Trend Analytics, Power and Market Barometer

- High focus on security and transparency

- Decent variety of order types and options

- Competitive fees

Cons

- Low variety of available trading pairs

- As of now, not enough liquidity which results in high order-book spreads between supply and demand.

- Leverage level can’t be set manually and limited only to 20x and above.

- Exchange’s regulation status is a question mark; however, this is a common issue with crypto margin exchanges

- The trading platform is not beginners’ friendly

The post Xena Exchange Beginner’s Guide – How to Trade Video Tutorial appeared first on CryptoPotato.