World Largest Asset Manager BlackRock Reveals $360K Bitcoin Gains Through CME Futures

A recent filing with the US Securities and Exchange Commission indicated that the world’s largest asset manager has indeed “started to dabble” with the primary cryptocurrency by purchasing a portion of CME’s March 2021 BTC futures that expired on March 26th.

- The Wall Street behemoth has expressed a pro-cryptocurrency approach for the past several months after its CIO, Rick Rieder said that BTC is here to stay and could even replace gold.

- Later, Rieder took it a step further by claiming that BlackRock has already “started to dabble a bit into it.” However, he failed to specify the precise nature of their bitcoin-related endeavor.

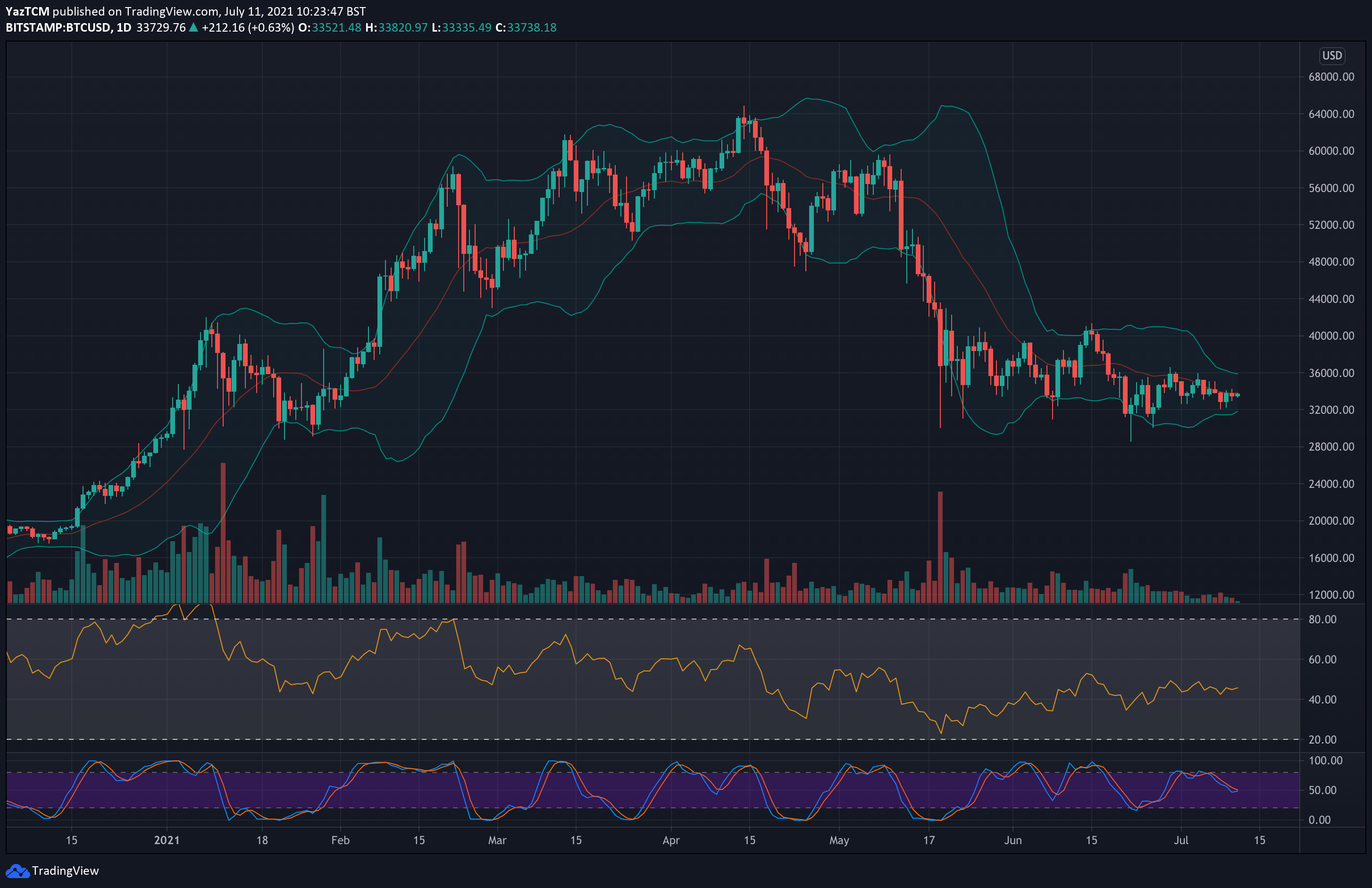

- That became known yesterday after the SEC released a filing reading that the BlackRock Global Allocation fund held 37 units of CME’s March 2021 BTC futures, which expired on March 26th.

- The filing further revealed that the notional amount of the contracts was roughly $6.1 million on the date of expiration, which suggests that their value has appreciated by just over $360,000.

- It’s worth noting that the SEC filings only provide financial data until January 31st, meaning that the documents don’t reveal if BlackRock still holds any CME Bitcoin futures contracts.

- Prior to the information that emerged now, BlackRock had filed two Prospectus documents with the SEC on behalf of the BlackRock Funds V and BlackRock Global Allocation Fund Inc. Both papers suggested that the organization could engage in trading cash-settled BTC futures contracts.