World Famous Hotel Chain, Pavilions Hotels & Resorts, To Accept Bitcoin Payments

Dreaming of taking time off work to vacation in a beautiful resort after a wild bitcoin pump? Well starting tomorrow, you can.

Starting tomorrow, July 7, the world famous Pavilions Hotels & Resorts will begin accepting payments in bitcoin, managing director Scot Toon reported.

The announcement also stated that they have partnered with Coindirect in Britain to allow guests to pay in BTC while booking their stays across Europe and Asia. Customers will also have the option to purchase properties on the Thai resort island of Phuket in Japan using bitcoin.

Accepting payment in bitcoin has become increasingly popular over the past few years, and as we move further into this digital age, mass adoption seems imminent.

Toon agrees and even stated, “Cryptocurrency is something that [Pavilions] saw is going to be around forever. It’s not going away anytime soon, and people are adopting it more and more over the last couple of years. People are taking it on in the retail sector, so it made sense for us in the travel sphere to take it on.

“It’s exciting times to be able to see more and more people adopting cryptocurrency for business,” Toon added. “You’re going to see more and more in the travel sphere adopting cryptocurrencies as a form of payment.”

Toon also addressed the volatility of Bitcoin by sharing his thoughts on how fiat currencies also experience price fluctuations, and that it is just a part of international business.

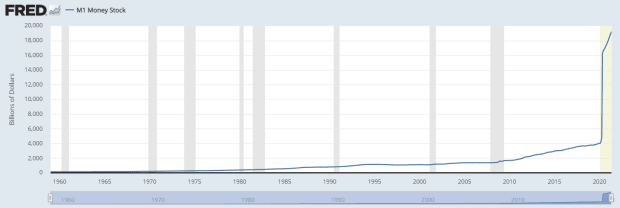

Pavilions will either hold or sell the bitcoin they receive as payment, depending on what they see fit at the time. One could only assume they may hold nearly all the bitcoin they receive, and sell only when necessary to cover costs. Over the past year, central banks have been printing money like crazy. Expanding the monetary supply, especially like this, is going to result in currency devaluation and inflation.

This world famous hotel chain is choosing to get paid and store some wealth in the hardest money humanity has ever had – one where the supply is 21 million BTC and not a single coin more. They do not have to worry about a central bank printing away their earnings anymore.