Work As Hard As You Possibly Can On Bitcoin

Every single Bitcoiner benefits from contributing to the growth, prosperity and strength of the network.

Rule VII: Work As Hard As You Possibly Can On Bitcoin And See What Happens

A reimagination of “Beyond Order” by Jordan Peterson through the lens of Bitcoin.

- Part 1

- Part 2

- Part 3

- Part 4

- Part 5

- Part 6

Preface

These essays mirror the exact chronological structure of “Beyond Order” by Jordan Peterson, offering a reflection through a Bitcoin lens. This is chapter six of a 12-part series. If you read the book, it adds a second dimension. All quotes credited to Jordan Peterson. All reflections inspired by Satoshi Nakamoto.

The Value Of Heat And Pressure

“Heat and pressure transform the base matter of common coal into the crystalline perfection and rare value of the diamond. The same can be said of a person.”

Bitcoin is the transmutation of the base matter of gold into digital perfection and rare value. Fiat currency is fragile and must be enforced via threat of punishment. Bitcoin is antifragile and becomes stronger with errors, stress, and time. How antifragile is your money?

“A house divided against itself, proverbially, cannot stand. Likewise, a poorly integrated person cannot hold himself together when challenged.”

Cash rules everything around me and permeates all segments of society. Wealth inequality has become a singular point of contention across conversations touching gender pay gap, racial pay disparity, reparations, universal basic income, increasing taxation and defunding the police. Governments have weaponized money to centrally manage the economy for so long that we are now paying the price for decades of misallocated capital. Our country has become a house divided against itself. The conversation is couched around social issues but the common thread connecting them all is the conversation is largely over money.

Economies are too complex to be centrally planned. It’s a game of whack-a-mole that fails to address the fact that the money itself is in large part responsible for the chaos in the economy. Printing more money is like calling in the arsonist to fight the fire with gasoline. America has rested on her laurels for too long and has slipped from a high-quality nation into a poorly integrated one. It has caused generational atrophy.

This is why we are fighting on every corner. What we need is something that benefits all Americans equally, but a thing we all individually must earn, defend and protect. That is what unites and that is what is American. Bitcoin moves America closer to a high-quality, well-integrated indivisible house.

“If you aim at nothing, you become plagued by everything.”

The internet has shined a light on an unlimited number of social and global problems. It’s too many things to aim at. And I personally have fallen prey to this analysis paralysis. As we shed our naiveté and awaken to the many plagues facing humanity, it is easy to slip into cynicism and nihilism. None of us is able to solve all of humanity’s ails, but choose one. Money is one of those plagues and Bitcoin is aimed squarely at solving at least this one thing.

The Worst Decision Of All

“I typically encouraged my clients to choose the best path currently available to them, even if it was far from their ideal.”

You may not like Bitcoin but it’s becoming irresponsible to own none. Those who understand it find it to be a blessing while others will be dragged, kicking and screaming, because time waits for no one. There are many use cases for Bitcoin adoption: tyrannical governments, failing currencies, inflation protection and avoiding confiscation.

“Cynicism about such things, or mere indecision or doubt, finds an easy but truly adversarial ally in the mindless nihilistic rationality that undermines everything: Why bother?”

We live in times of cynicism. Conspiracy theories, fake news, insecurity, invisible threats, imminent threats; it’s enough to make anyone feel powerless. So why bother when we’ve already lost the fight? True solutions to large complex problems are no easy task. Inflation currency promotes high-time-preference thinking, making focusing on good long-term solutions more challenging. Money alters behaviors and inflationary dollars promote short-term thinking when what we need most to turn these macro plagues around is solid long-term ideas that can be generated via low-time-preference thinking.

“…the worst decision of all is none.”

These problems won’t solve themselves. You don’t need to save the world. Tackle a small problem that is unserved: how about converting your savings account currently yielding 0.5% to a bitcoin savings account yielding 200%? Even small changes require a pound of flesh; steel your reserve, study up and put a little skin in the game. And if you don’t, walk away with three damn good reasons why you’re convinced bitcoin is not for you. But either way, hold your ground. Doing nothing is the worst decision of all. Pick a side and be open minded. It is lazy to pick sides based on glossy ideology. Coming to your own conclusions requires an understanding of both sides. You don’t have to believe in Bitcoin, but know exactly why or why not and be willing to defend that hill.

Discipline And Unity

“But the story of integration and socialization does not end here. Initially the apprentice must become a servant of tradition, of structure, and of dogma, just as the child who wants to play must follow the rules of the game.”

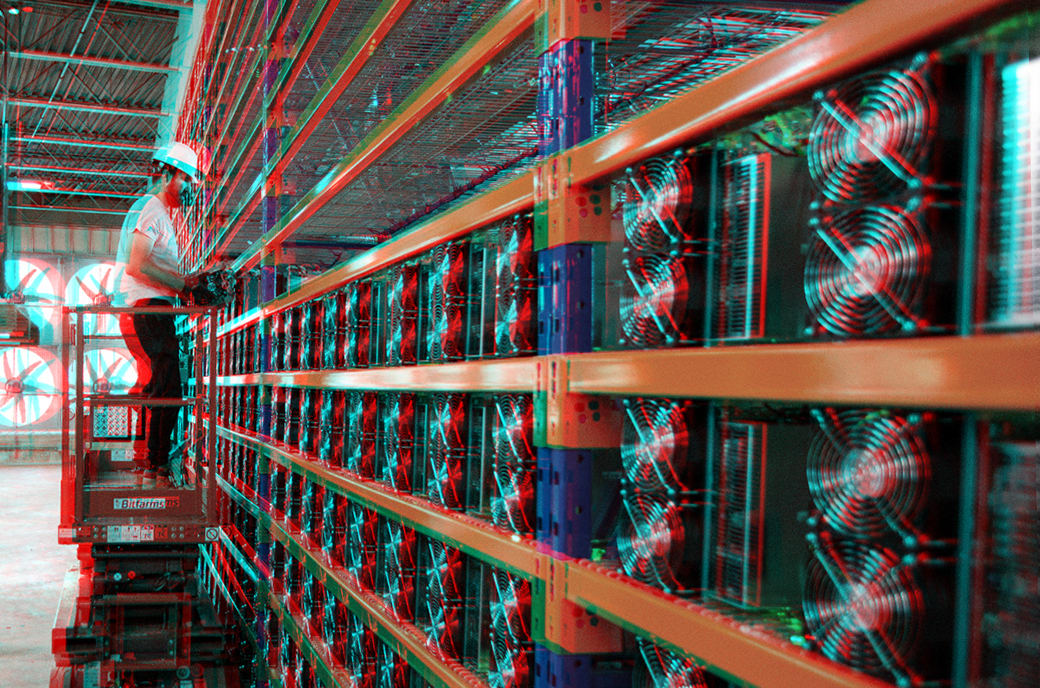

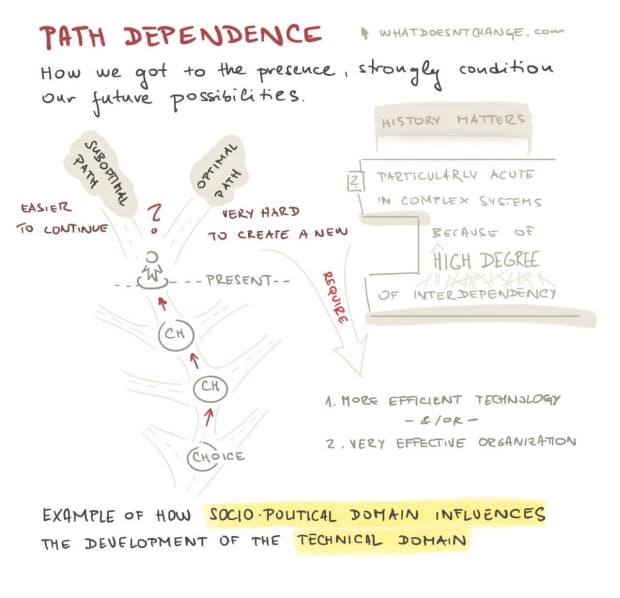

Bitcoin is purchased through exchanges requiring Know Your Customer (KYC) compliance. Bitcoin plays the role of the apprentice as a servant of tradition, structure and dogma. But history teaches us the path of infrastructure inversion: the horse to the car, natural gas to electricity and landlines (telephony) to fiber optics (internet). In all three of these examples the new technology initially appears inferior because it rides on the old infrastructure. Then an inflection point is met where the users find enough value in the new infrastructure to justify the switching costs. Finally, the old technology is easily accommodated on the new infrastructure. Most people recognize bitcoin the asset — the coin. Fewer understand the power of Bitcoin the network — the new infrastructure.

As second-layer application development expands Bitcoin’s utility, user adoption increases in tandem, bringing the free market closer to this infrastructure inversion. As Bitcoin offers more to more people, its network effect grows. Once Bitcoin breaks the inflection point, it becomes undeniably attractive: switching cost drops, value increases and the new infrastructure consumes its predecessor. This is not a best-guess; this is a likelihood based on path dependence.

The achilles heel of digital money is precisely that it rides on old infrastructure: the original internet. That internet of communication is inherently an insecure network. This is why the cybersecurity industry is described as layers of an onion. It can be attacked at every imaginable angle because, at its core, the internet is not built for security. Therefore, cybersecurity on the internet of communication will never be solved because it is an infinite problem. Bitcoin, the internet of money, is an inherently secure network at birth by design. As traditional banks figure this out, their hefty security budgets will shrink considerably.

“The goal of this heat and pressure is subordination of an undeveloped personality… to a single path, for the purposes of transformation from undisciplined beginner to accomplished master.”

In an ADHD society that loves the newest, shiniest object, Bitcoin is singularly focused on one thing: being a store of value. This makes it appear boring to the untrained eye, but for those in the trenches, we witness a network tested by immense pressure for the purpose of transformation from new money on the block to a Bitcoin standard.

Dogma And Spirit

“… the Gospel of Mark, which is a commentary on what are among the most influential Rules of the Game ever formulated — the Mosaic Ten Commandments…”

The Ten Commandments gave mankind a protocol for coexistence. Bitcoin gave mankind a protocol for trust. The Bitcoin protocol includes code that is well known, such as a 21 million hard cap supply and four-year halving cycles, as well as less known, such as difficulty adjustments, amongst many other topics. Each Bitcoin full node enforces these protocol rules and serves as your private access point to Bitcoin’s open global pseudonymous blockchain.

“It is worthwhile thinking of these Commandments as a minimum set of rules for a stable society — an iterable social game.”

The Ten Commandments are bedrock foundations in nearly every Western society. They enabled order, allowing civilizations to rise. Fiat currency is a fluid set of rules that change as needs arise. This leads to misuse because changes dictated by the few impact the majority. When monetary policy is unpredictable, the majority live high-anxiety, stress-filled existences.

At its highest level, Bitcoin is a simple set of fixed rules. The rules are determined by the nodes. The idea is that the protocol can change, with node consent, but calcifies over time. This is in stark contrast to fiat currencies. New additions like Lightning Network or Rootstock are built on top of Bitcoin’s foundations, leaving the underlying protocol unchanged, but serve to augment new functionality such as scale or speed. Just as sand is a suboptimal anchor for a home because it constantly shifts beneath you, fiat is a suboptimal anchor for money. Bitcoin is the strongest foundation for money ever invented by mankind. Just like a home anchored to granite, Bitcoin offers a highly predictable unwavering protocol. Bitcoin is money you can build thousand-year civilizations around.

“The core idea is this: subjugate yourself voluntarily to a set of socially determined rules — those with some tradition in their formulation — and a unity that transcends the rules will emerge.”

Choose a game that presents the best opportunity for success and consider how fairly the game treats you. This is why football (aka “soccer”) is a worldwide phenomenon — it’s egalitarian. Football is the most popular sport on earth played by 250 million and watched by four billion. Anyone can kick a ball, making it incredibly inclusive. Bitcoin and football share much in common. Opening a bank account is not possible for billions around the world due to the barriers to entry. But anyone with an internet connection can open a bitcoin account. And no one can confiscate, censor or inflate away your bitcoin. The game of Bitcoin is a major upgrade for the average human being. And its openness allows it to transcend the rules enforced by closed systems. Unity is beginning to emerge around Bitcoin as humanity awakens to the most egalitarian game we’ve ever played. Bitcoin is to money what football is to sport — the beautiful game.

“It is for this reason that an apprenticeship ends with a masterpiece, the creation of which signifies not only the acquisition of the requisite skill, but the acquisition of the ability to create new skills.”

And if you’re daring, bold and wise enough, you can submit a Bitcoin improvement proposal (BIPs). Bitcoin continues its development with contributions from unsung heroes like Adam Back, Pieter Wuille, Peter Todd, Nicholas Doirier, Luke Dashjr and many more. They are moving us closer toward a masterpiece. Most mere mortals can contribute by simply running a full node. That gives you the freedom to choose which version of the game serves the best spirit. Bitcoin is free to join, free to leave. That’s real freedom. Join the beautiful game.

Work as hard as you possibly can on Bitcoin and see what happens.

This is a guest post by Nelson Chen. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.