With the CBAC, East Meets West in Search of Adoption and Innovation

The noise that surrounds economic relations between the United States and China is amping up exponentially. You can thank the latest trade wars for that, as fresh tensions boil over between the two nations who are currently trading new tariffs on imports, with no shortage of ill will underpinning the moves.

But the Chinese government’s ire is not just outward-facing. As a country where ICOs are currently not allowed, exchanges have had their bank accounts frozen, and internet and mobile access to cryptocurrency trading information has been banned, China is taking an equally hard line on a wide range of crypto-centric activities within its own borders. All this despite a stark dichotomy, wherein over 50 percent of the worldwide mining population resided within its borders in 2017, and cryptocurrency adoption is outpacing most other countries.

While trade war bullets may be flying thick and fast between these two mega-economies, the key to a better Chinese blockchain sector just may be unlocked by deploying cooperative forces in the United States, as seen by the recent launch of a New York City office for the China Blockchain Application Center (CBAC). The CBAC NY was founded with the hope of paving the way for rapid blockchain adoption in China, in part by picking up regulatory best practices from the United States, all while fostering blockchain and crypto collaboration between the two nations.

An early-stage, non-governmental organization (NGO) established in 2015, the CBAC collaborates with regulatory bodies to develop comprehensive regulations, encourage the application of blockchain technology in traditional industries, and connect Chinese practitioners with peers around the world. By helping to develop increased regulations, blockchain industry applications and international connections, members of the CBAC are hoping to elevate blockchain’s role in China’s $12 trillion economy.

Crypto Challenges in China

One of the speakers at a well-attended August launch party in NYC’s financial district was Stewie Zhu, founder and CEO of the distributed banking public blockchain Distributed Credit Chain (DCC), and a standing committee member of the CBAC. While ICO scams and other bad actors have significantly hindered progress in his home country, Zhu sees plenty of near-term potential for crypto and blockchain technology there.

“While China has prohibited the sale of new cryptocurrencies through ICOs since early last September, there is still a big appetite for the application of blockchain technology,” Zhu told Bitcoin Magazine. “In fact, a [recent] Chinese Supreme Court ruling has stated that blockchain technology can be used to authenticate evidence in legal contexts. The trading of cryptocurrencies is possible, but the government is trying to create financial stability to minimize any illegal activity. The Chinese government is eager to make considerable strides on the technology front, and while stringent, they are trying to ensure that cryptocurrency trading is done responsibly.

“There are challenges behind blockchain technology as it relates to banking,” Zhu continued, “because it requires a reconstruction of long-standing relationships in the current market, as well as time for citizens to understand the mechanisms behind using blockchain. Companies may need to make significant changes to their daily operations to incorporate blockchain, not to mention the time and resources needed for pre-application research.”

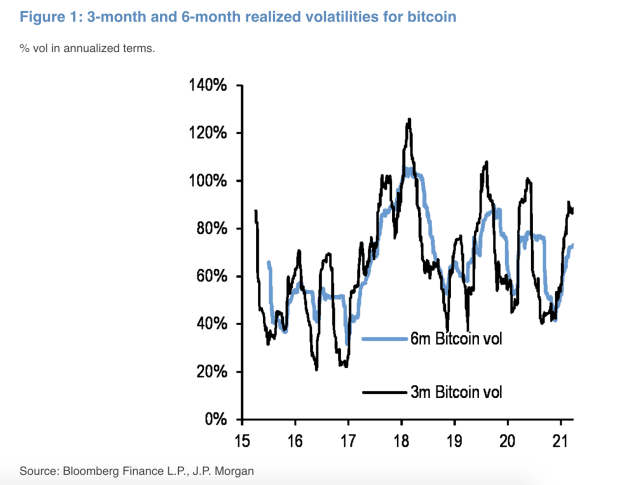

Zhu pointed out that it also takes time for private citizens to fully understand and trust cryptocurrency. Between price swings and security vulnerabilities, they may be leery of entering the market, he believes.

“Given the volatility in the crypto market and the negative news about problematic ICOs, individual customers can be cautious of tokens,” he said. “Security is also an issue. Blockchain technology is not perfect. We still need more R&D to develop ways to prevent potential threats such as the 51% attack, where an organization controlling the majority of network mining power can prevent transactions by others and allow its own coin to be spent twice (double spending). So long as these threats exist, many companies may not see blockchain as a practical tool.”

Part of a Bigger Picture

A successful push by the Chinese government to instill crypto confidence goes beyond better banking and protecting consumers, however.

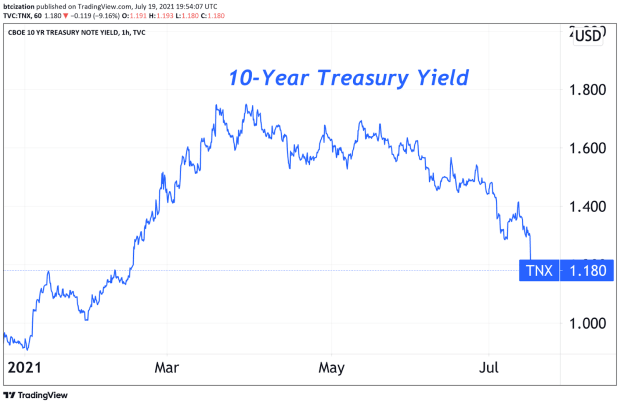

“The Chinese government is trying to shift the economy from manufacturing-based to a more value-added, services-based, to move from being the factory of the world to being the service provider of the world, which is a natural economic evolution that you would expect from any country as they try to level-up,” Zennon Kapron observed in an interview with Bitcoin Magazine. Kapron is the founder of Kapronasia, a Singapore-based firm focused on providing insights into Asia’s financial industry.

“China has always tried to stay ahead and it’s used technology as a way of leveraging that with things like AI, machine learning, and some of the camera/surveillance technology as a way for the country to differentiate itself. From an economic perspective, it’s a very challenging transition to make because you’re trying to shift demands from import/export to domestic consumption, while you’ve got a banking system that’s relatively new that has a lot of challenges internally. So the government wants to avoid risk to the financial system, as well as the economy as a whole, and largely a lot of the pushback that we’ve seen from the government on cryptocurrencies is because of that.”

While Kapron is guarded on the immediate impact of blockchain on banking within China, he sees a real near-future need for applying distributed ledger to other fields.

“If we look at health records and food provenance in China, in certain ways [blockchain] would allow China to become coordinated and move much quicker, so the government is very open to the idea of launching technology and seems to be very supportive of it. That support is coming from the idea that, first of all, there are challenges that can be solved and, second of all, if they establish a leading edge around blockchain that could be a competitive advantage for them going forward.”

For Zhu, however, the most tantalizing possibilities for blockchain, in China and elsewhere, lay firmly within the financial realm.

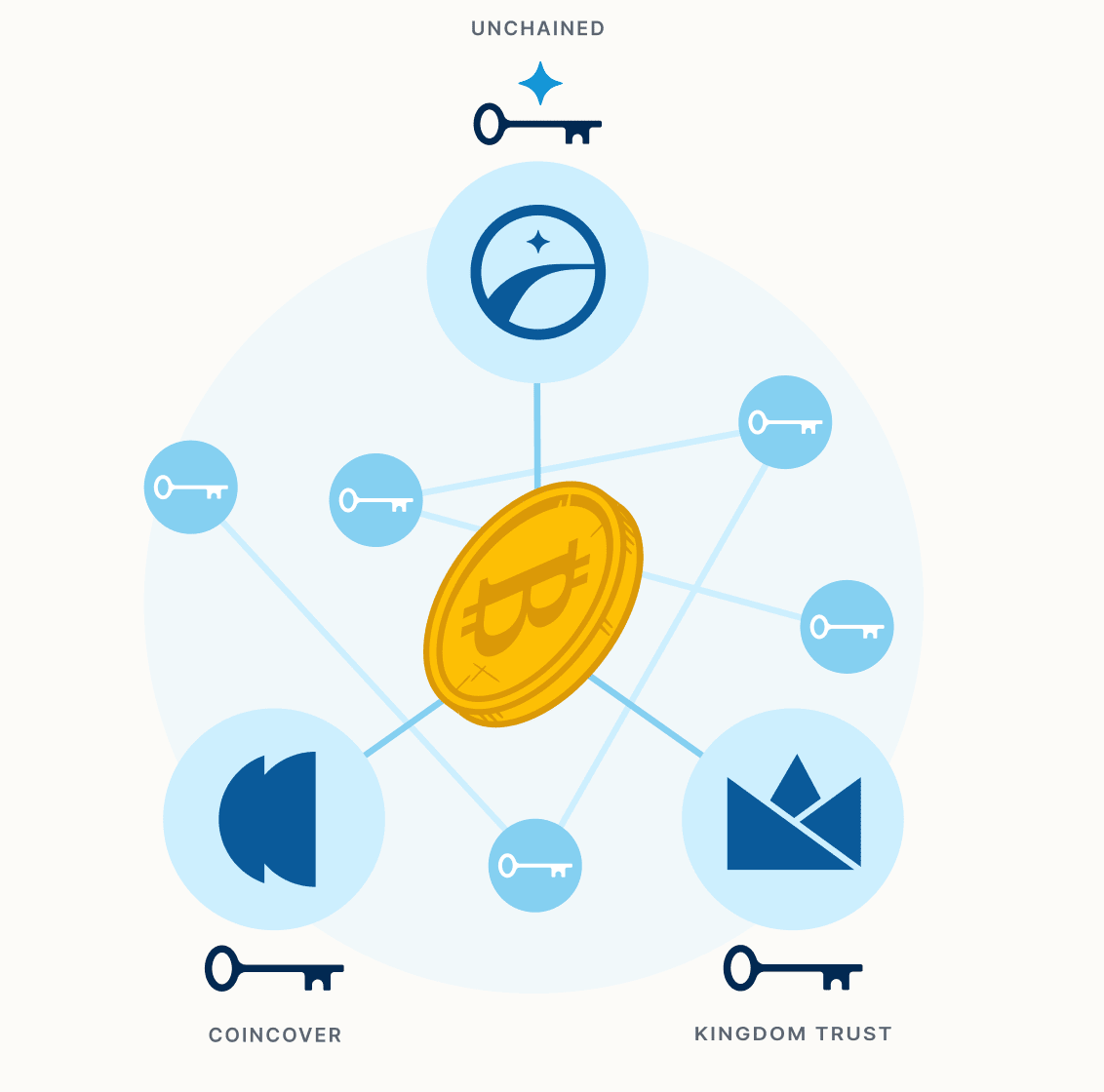

“Blockchain can provide a comprehensive solution to multiple problems in the current financial industry,” he stated. “First off, it provides a decentralized structure, which will break the data monopoly of big, traditional banks and allows individual customers to control their own information. Second, the information on the chain cannot be changed or tampered with, which helps to enhance data security, one of the most important aspects in credit and banking. Third, while enhancing data security, blockchain also helps improve transparency, because every action is recorded on a smart contract and is always trackable.

“In my opinion, the philosophy behind blockchain is security and sharing,” added Zhu. “This technology connects people around the world, allowing them to access reliable information in a more efficient manner.”

Zhu has applied this outlook to his twin goals of growing his company, DCC, while also improving the CBAC’s prospects. For the industry to succeed, he believes it needs to embrace the same cooperation that blockchain facilitates by design.

“Collaboration is very important for companies in the tech sector, especially in an emerging industry like blockchain,” he said. “By joining the CBAC, I’d like to create a connection between the Chinese government authorities, as well as unite projects from both geographies and accelerate development processes. We would like to help our peers and DCC connect with additional experts in the space so that we can grow together at a much faster rate.

“Any new industry, at its birth, will experience volatility before the period of stable, healthy growth. I’d like to work as an active member of the CBAC on the development of industrial regulations, so that the blockchain industry will become more organized, allowing individual companies to fully unleash their potential.”

Coming to America

With the launch of a New York City presence, the CBAC is looking to foster collaboration not just between companies but between countries. Despite the many stumbles of Wall Street and the SEC in their approaches to crypto, Zhu maintains that both entities represent a “gold standard” of regulation, and the CBAC NY is in place specifically to model their best practices.

“As many countries are exploring and experimenting regulations for the blockchain industry, the U.S. is at the forefront and is doing a good job of placing certain safeguards and protection for investors stepping into the ICO world,” he said. “For example, the SEC is taking steps to create regulatory standards with the ‘Howey Test’ which determines whether cryptocurrencies are securities and thus subject to federal securities laws. Also, the United States Securities and Exchange Commission’s Office of Investor Education and Advocacy (OIEA) has published a report that seeks to warn investors of the potential ‘risks associated with self-directed Individual Retirement Accounts (self-directed IRAs)’ in which ICOs and cryptocurrencies are highlighted.”

Backed by the Beijing Municipal Bureau of Financial Work, the CBAC NY’s mission is to arrange meetings with U.S. regulators and lawyers to gain insight into how the U.S. is setting such standards. From there, the organization will work to push those standards to the top of regulatory authorities in China to help create change. Ultimately, China’s Ministry of Industry and Information Technology develops policies for the blockchain industry.

Seizing Momentum

A range of attendees present at the CBAC NY launch, including blockchain projects, entrepreneurs, regulators, academics, investment firms and exchanges across China and the U.S., indicated the high stakes and hopes for the organization’s success.

“The promise of decentralization and the new platforms and applications currently in development is to lead towards a much more connected world that will make financial value transfer faster, easier, and cheaper,” David Namdar, co-head of trading for the crypto asset merchant bank Galaxy Digital, told Bitcoin Magazine. “As the regulatory landscape develops globally, the CBAC can be instrumental in helping China to regulate blockchain in a way that leads toward greater involvement in an improved global financial ecosystem.

“I have been spending more and more time in Asia this year as we’ve expanded Galaxy Digital to Hong Kong and Tokyo,” Namdar continues, “and have been blown away by the amount of activity and enthusiasm around cryptocurrencies and blockchain applications. In China, I believe there is a lot of momentum as more and more people become educated about the space and understand the technology and it’s potential. However, it continues to be an important challenge to promote innovation around actual uses while curbing speculation.”

While classifying the record of non-profit organizations in influencing Chinese government policy as “hit or miss,” Kapronasia’s Zennon Kapron sees how an improved blockchain ecosystem could translate into major gains for the country with the world’s largest economy in terms of purchasing power parity.

“Certainly, China has become an epicenter of blockchain development,” he stated, “and China moves at China speed: [For example] we did a study a couple of years ago and we looked at cash usage in China. You think about China being a very cash-driven society. 60 percent of all retail transactions in 2010 were done with cash, and we expect that to drop in half to 30 percent by 2020. That shift, considering the population and considering the amount of money that that represents is massive. China can move very quickly on something like this, and so when we look at blockchain development in general and then regulation around blockchain, China could very well be a leader in this space as we go forward.”

“In China, the blockchain industry is growing quickly,” Zhu affirmed. “According to CoinTelegraph, in 2017, the most patent filings for blockchain technology to the World Intellectual Property Organization (WIPO) came from China, so we anticipate further applications of blockchain in China in the form of innovation in technology and banking/Internet finance. As I mentioned earlier, China is already using blockchain in a legal context and this type of growth will only continue to increase.”

With its massive footprint, rich resources, deep talent and influencers like the CBAC at work, China looms as a tempting frontier for outside operators in search of the ultimate blockchain destination.

“One of our core missions is to help grow the entire industry globally through technological development, investment and sensible regulation,” says Namdar. “Groups like the CBAC play an important role in education and cross-collaboration efforts with wide-reaching global impact.”

Still, in the eyes of educated observers like Kapron, it’s too early to say definitively if China, crypto and blockchain technology are bound for a copacetic outcome.

“I think we’ve seen very positive output from them in terms of their opinion and the way they think it could go, but that could change rapidly if there is a risk to the financial system,” he said.

“We’re at the very early days right now, and, for most investors or either funds or individuals overseas that are looking at investing in Chinese blockchain projects, it’s critical to understand the ecosystem. There are potentially outsized returns in China from some of these platforms, but it still remains to be seen how successful they are and how much the government allows things to move forward.”

This article originally appeared on Bitcoin Magazine.