With Mastercard, MetaMask Tests First Blockchain-Powered Payment Card

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

MetaMask is testing a Mastercard payment card, which it says is the first entirely on-chain card.

-

It will let users spend crypto “on everyday purchases, everywhere cards are accepted,” according to marketing materials CoinDesk reviewed.

02:33

Sam Bankman-Fried Says He Made ‘Mistakes’ at FTX; Binance CEO CZ’s Fortune Revealed

07:00

Oobit Co-Founder Aims to ‘Bridge the Gap Between Web3 and DeFi’ to Traditional Payments

15:24

Mastercard and Binance Cutting Ties on Crypto Card Is ‘Big News:’ Vanderbilt Law School Associate Dean

02:17

Powell Says Fed Is ‘Prepared to Raise Rates’; Mastercard, Binance Back Away From Crypto Card Partnership

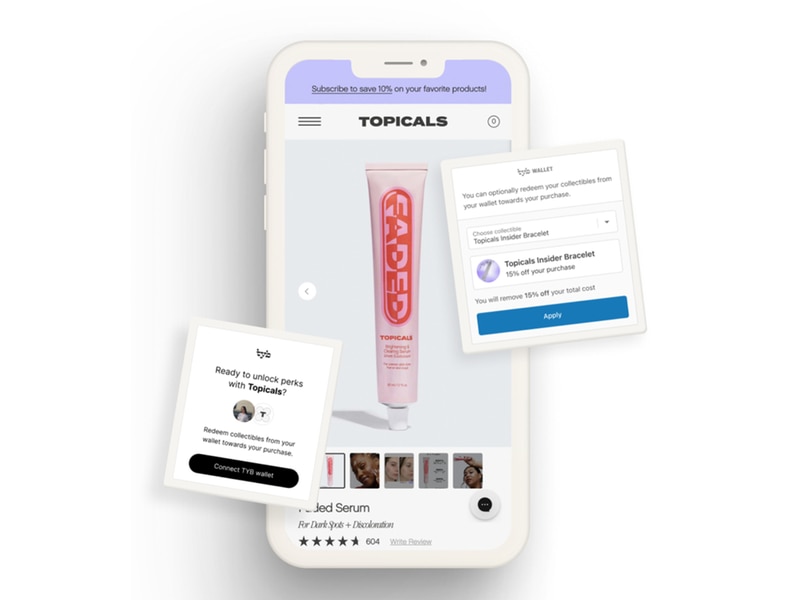

MetaMask, the popular cryptocurrency wallet for the Ethereum blockchain, is testing an entirely on-chain, Mastercard-branded payment card, according to promotional materials and a testing platform seen by CoinDesk.

Such a product would unite two giants of their respective fields. MetaMask is the biggest self-custody wallet with more than 30 million monthly active users, while Mastercard provides key plumbing in the conventional financial system through its credit- and debit-card network spanning the globe.

The MetaMask/Mastercard payment card would be “the first ever truly decentralized web3 payment solution,” allowing users to spend their crypto “on everyday purchases, everywhere cards are accepted,” according to the marketing materials.

Mastercard and its rival Visa have been quietly courting public blockchain developer communities and self-custody wallet providers of late. Mastercard has been working with hardware wallet firm Ledger as well as MetaMask, CoinDesk reported in October of last year.

Visa, meanwhile, has been working with the USDC stablecoin and the Solana blockchain on cross-border payments and smoothing out wrinkles like paying Ethereum gas fees.

MetaMask developer Consensys did not respond immediately to a request for a comment.

When contacted by CoinDesk, a Mastercard representative pointed to the firm’s statement from October: “Mastercard is bringing its trusted and transparent approach to the digital assets space through a range of innovative products and solutions – including the Mastercard Multi-Token Network, Crypto Credential, CBDC Partner Program, and new card programs that connect Web2 and Web3.”

Edited by Nick Baker.