With All Eyes on a Spot Bitcoin ETF Approval, Don’t Sleep on ETH (or ETHE)

A federal judge last month severely undermined the U.S. Securities and Exchange Commission’s (SEC) decision to reject converting the Grayscale Bitcoin Trust (GBTC) into a more alluring exchange-traded fund. The decision has many analysts now pricing in approval of a spot bitcoin ETF sooner rather than later. Analysts at Bloomberg put the odds of approval this year at 75%.

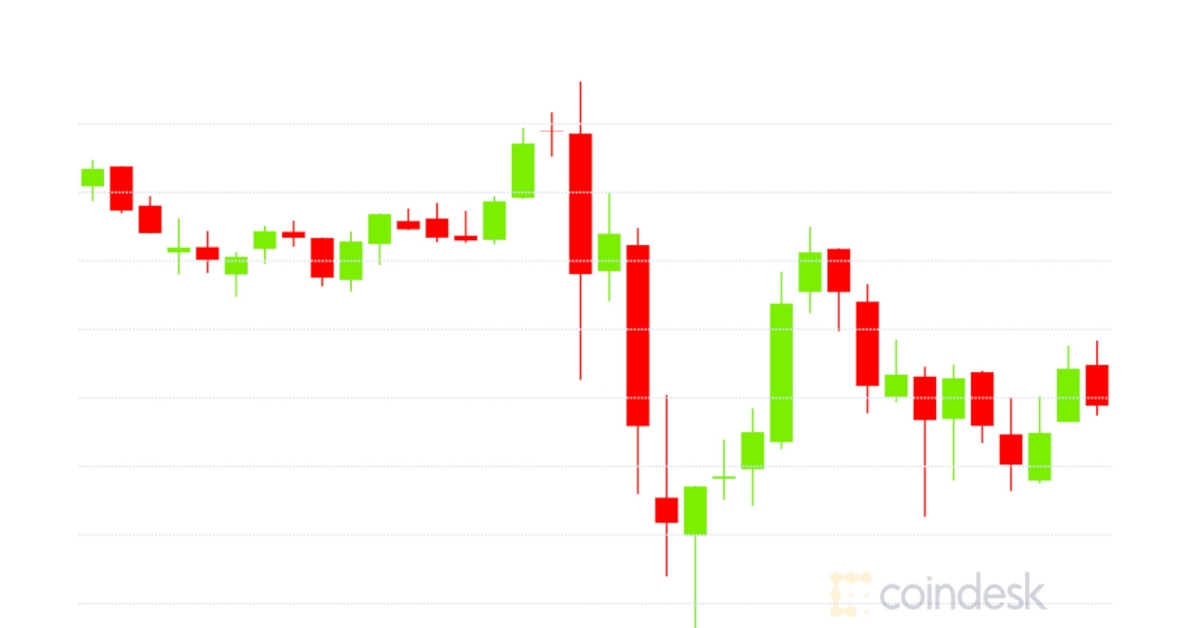

Market prices show this optimism, too, and not just for Grayscale’s bitcoin product. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) had traded at massive discounts to NAV – industry jargon for the value of all the bitcoin and ether, respectively, that they hold. But they’ve narrowed significantly. GBTC went from trading at a 46% discount to only 21%, while ETHE went from 59% to 29%.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

So, with everyone penciling in a bitcoin ETF as a matter of when and not if, bullish investors should just buy GBTC, and wait for a final approval, right? The theory goes that the discount will all but evaporate (as open-ended ETFs typically only trade at narrow differences to NAV), and as a bonus the underlying asset (bitcoin) might catch a bid – win/win. Perhaps. But the bigger opportunity could be Grayscale’s Ethereum Trust.

My view is if a U.S. spot bitcoin ETF gets approved, there should be little argument for holding up a spot ether ETF. And Grayscale itself has said it plans to convert ETHE and other products to ETFs. I wouldn’t hold your breath when it comes to SOL, ATOM or any other smaller crypto asset, but we have first-hand knowledge that ETH ETFs work. In fact, ethereum ETFs launched within weeks of the first bitcoin ETF. Regulators in Canada were comfortable with the product because there is a regulated futures market for ETH, allowing market makers to hedge risk while creating and redeeming units. I suspect that following a BTC approval, an ETH approval would not be far behind. ETHE’s discount is greater than GBTC’s, meaning a far greater arbitrage opportunity. Also, ETH markets are less liquid than BTC, so the incremental buying from an ETF could have a more material impact on price. And, in my view, ETH has better upside as the leading platform for Web3 development.

Futures ETFs have badly underperformed spot markets. Spot ETFs don’t have this problem. They’re a safe, sensible solution for investors and like many, I expect they’ll be approved. Just don’t take your eye off ETH (and ETHE).

Edited by Stephen Alpher.