Wirecard Fallout: Auditor EY Accused of Not Flagging $2.1B Black Hole Sooner

(Sundry Photography/Shutterstock)

A German shareholder body has accused “Big Four” auditor Ernst & Young (EY) of failing to spot a $2.1 billion black hole in Wirecard’s books soon enough.

Shareholders’ association SdK filed criminal damages against EY Friday for not flagging Wirecard’s accounting practices earlier, reports CNBC. The group holds EY, and two current and one former employee in particular, responsible for not alerting the authorities and investors sooner, which ultimately culminated in the precipitous drop in the Wirecard share price.

“[T]his was an elaborate and sophisticated fraud, involving multiple parties around the world in different institutions, with a deliberate aim of deception,” said EY in a statement to CNBC. It argued that “even the most robust and extended audit procedures” would have been unable to uncover this scale of “collusive fraud.”

Earlier this month, before the most recent revelations of accounting malpractice, law firm Wolfgang Schirp had filed a class-action lawsuit against EY for its failure to spot improperly booked payments in Wirecard’s 2018 accounts.

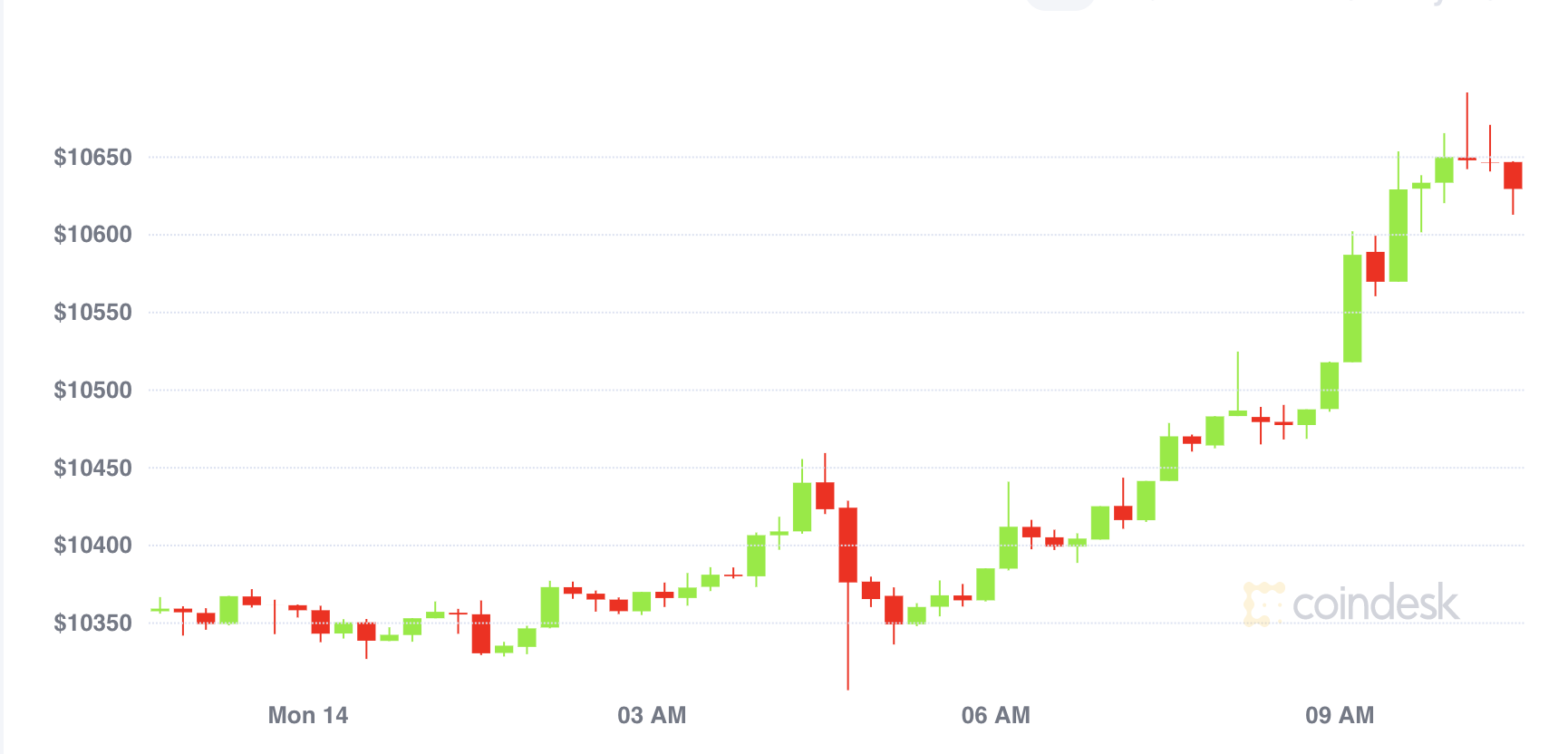

At press time, Wirecard stock traded at €3.50 (roughly $4). Shares had been worth $105 on June 17, before the company admitted employees had purposefully filed false or misleading statements “in order to deceive the auditor and create a wrong perception of the existence of such cash balances.”

For the time being at least, Wirecard remains a constituent member of the DAX 30, Germany’s most prestigious blue-chip stock index. The company filed for insolvency Thursday.

The capitulation of Wirecard has thrown many client businesses up in the air. For example, crypto payment card providers Crypto.com and TenX have used cards provided by a subsidiary, the U.K.-based Wirecard Card Solutions.

Crypto.com told CoinDesk on Friday it was moving to a new provider just hours after the Financial Conduct Authority (FCA) ordered Wirecard Card Solution to cease operations with immediate effect.

TenX told customers they would no longer be able to use their cards. “The TenX team is working to re-enable the affected services as soon as we can,” the company said in a statement.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.