Winklevoss’ Gemini Would Back New Bitcoin ETF Application in Canada

The ETF is planned to be listed on the Toronto Stock Exchange (TSX) under the ticker “BIT.U.”

Winklevoss’ Gemini Would Back New Bitcoin ETF Application in Canada

A prospectus for a new bitcoin exchange-traded fund (ETF) has been filed with the Ontario Securities Commission in Canada.

Arxnovum Investments Inc filed documents for the “Arxnovum Bitcoin ETF” on Monday. The ETF is planned to be listed on the Toronto Stock Exchange (TSX) under the ticker “BIT.U.”

The manager behind the ETF application is Shaun Cumby, CEO of Arxnovum Investments. Previously, Cumby held the position of CIO at 3iq Corp – the Canada-based digital asset manager behind the launch of the Bitcoin Fund (TSX:QBTC.U), called the world’s first regulated bitcoin fund.

The New York-based, Winklevoss-owned Gemini Trust company will be the sub-custodian of the bitcoin held by the ETF. The sub-custodian is a trusted company qualified to custody the product’s assets held outside of Canada.

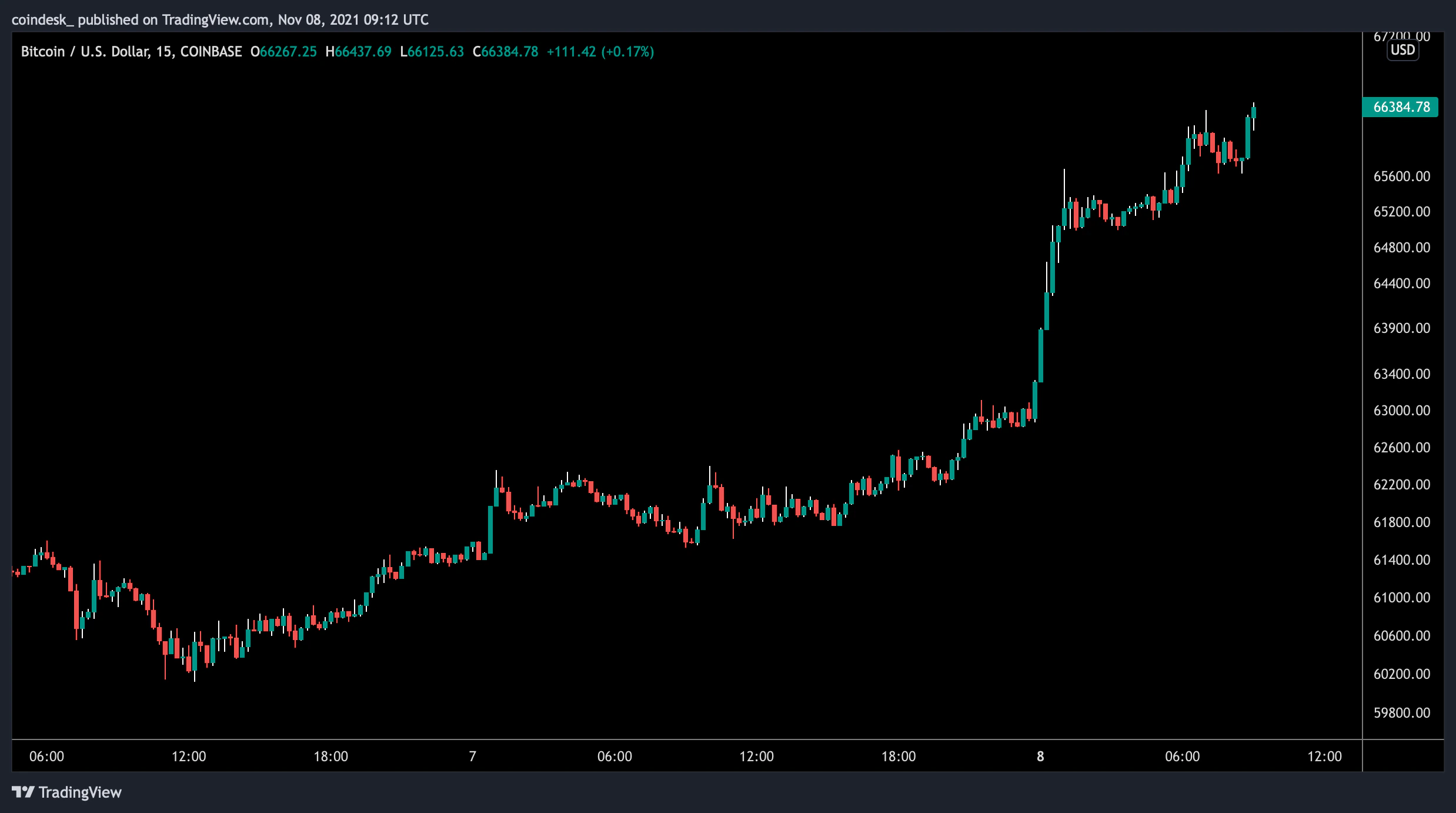

According to the prospectus, the proposed bitcoin ETF will provide investors with exposure to bitcoin and daily price movements of the U.S. dollar price of bitcoin by investing in bitcoin and/or bitcoin futures contracts, and/or other derivative instruments that provide economic exposure to bitcoin.

It may trade in bitcoin futures listed on the Chicago Mercantile Exchange and other commodity futures exchanges regulated by the U.S. CFTC Commodity Futures and Trading Commission.

The Arxnovum Bitcoin ETF may also hold cash, cash equivalents, and or other fixed-income securities.

The prospectus says an investment in the bitcoin ETF is considered “high risk” and if conditionally approved there is no assurance that the TSX will approve the listing application.

A bitcoin ETF has been eagerly anticipated as a sign of institutional acceptance for bitcoin, but, in the U.S., all ETF applications to date have been turned down by the U.S. Securities and Exchange Commission.

A number of similar products, such as exchange-traded products (ETPs), have been launched in Europe.