Will FTX Token Selloff This Week Cause a Solana (SOL) Crash?

Bankrupt FTX exchange’s motion to sell its crypto assets into fiat currency is scheduled for a court hearing on September 13. On August 23, the firm filed a motion outlining its plan to convert its crypto holdings into fiat to make creditors whole.

As a result, creditors and token holders are closely eyeing the outcome of the hearing, which could lead to the recovery of as much as $3.4 billion.

Crypto Twitter (X) has also been awash with theories on whether this potential selloff will cause downward pressure on markets, especially Solana tokens.

FTX Selloff Fears Mount

FTX and Alameda first purchased SOL from the Solana Foundation in August 2020, six months after the launch of the mainnet beta.

As a result, the bankrupt firm now holds hundreds of millions of dollars worth of SOL, which is its largest holding. Estimates from court documents put the total at around 47.5 million tokens worth around $685 million. It also has a massive stash of FTT tokens.

However, as per the agreement at the time, most of it is locked in vesting until 2028. This means that the firm can only sell $100 to $200 million per week of its crypto assets.

I am seeing a lot of wrong information being spread about FTX liquidating their holdings

They can only sell up to $200m a week of assets $SOL is their largest holding but most of their Solana is locked up in vesting and can’t be sold for years pic.twitter.com/9dFseAABOx

— Johnny (@CryptoGodJohn) September 10, 2023

Not all were convinced this would be enough to save SOL from downward pressure. “The DeFi Investor” said:

“SOL price can still be impacted in the short term. But not as bad as everyone expects.”

Zanshin Capital founder Alan Schill was more bearish on the project, saying that nothing about this is positive for SOL, before adding:

“So much overhead supply it’s crazy. FTX is not the only SOL investor with tokens vesting. Not to mention all the bag holders from above. Better to focus on new projects to this cycle imho.”

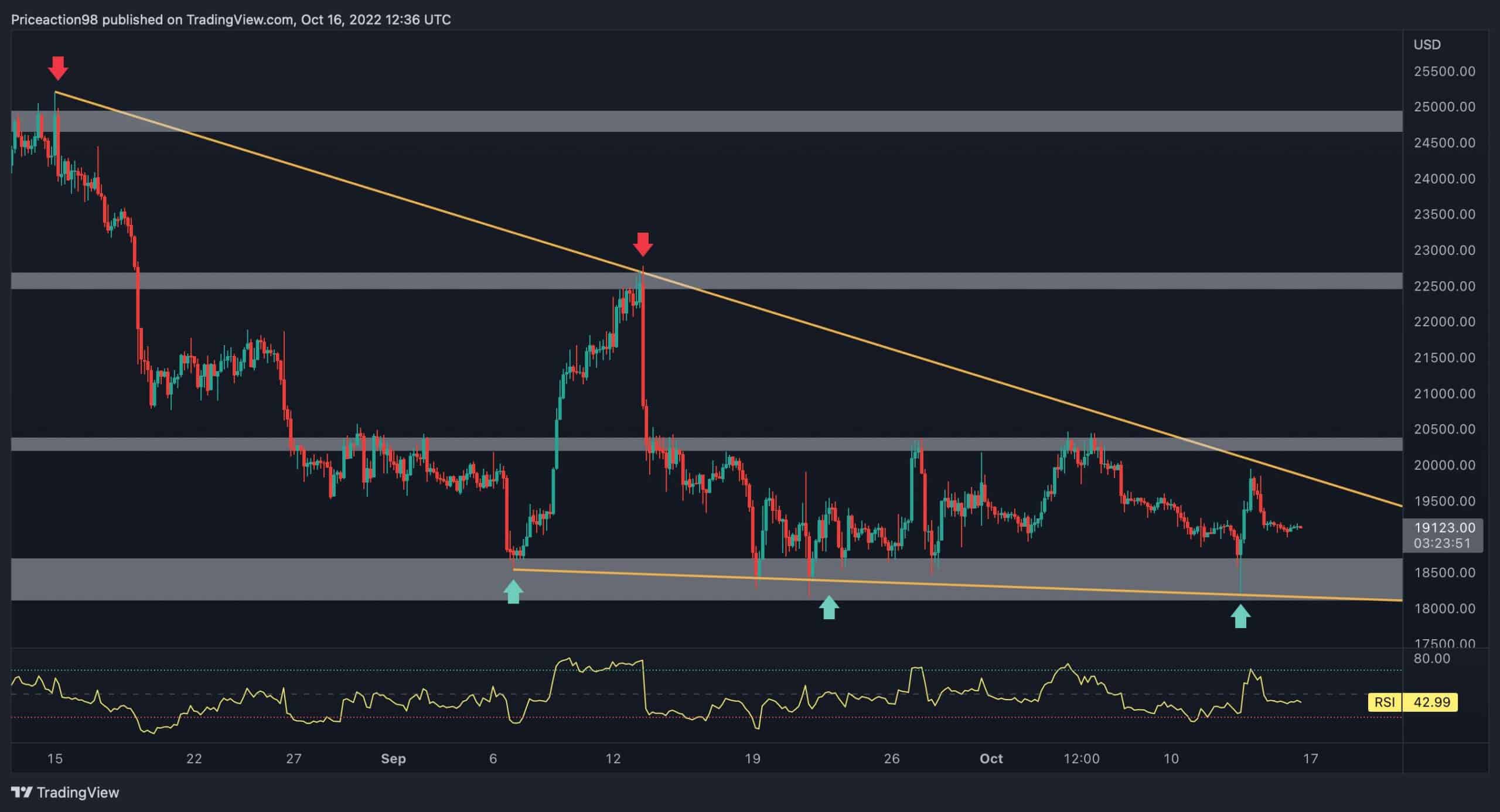

SOL Price Outlook

Nevertheless, jittery traders have already started to offload SOL over the weekend. As a result, the token is down 5.8% on the day, falling to an intraday low of $17.87. FTT has lost close to 9% on the day.

At the time of writing, SOL was changing hands for $18.18, having dropped 11% over the past fortnight as the selling pressure increased. SOL is currently at its lowest level since late June and the worst-performing crypto asset in the top 30 this Monday morning.

The post Will FTX Token Selloff This Week Cause a Solana (SOL) Crash? appeared first on CryptoPotato.