Will Crypto Markets React to $3B Bitcoin Options Expiring Today?

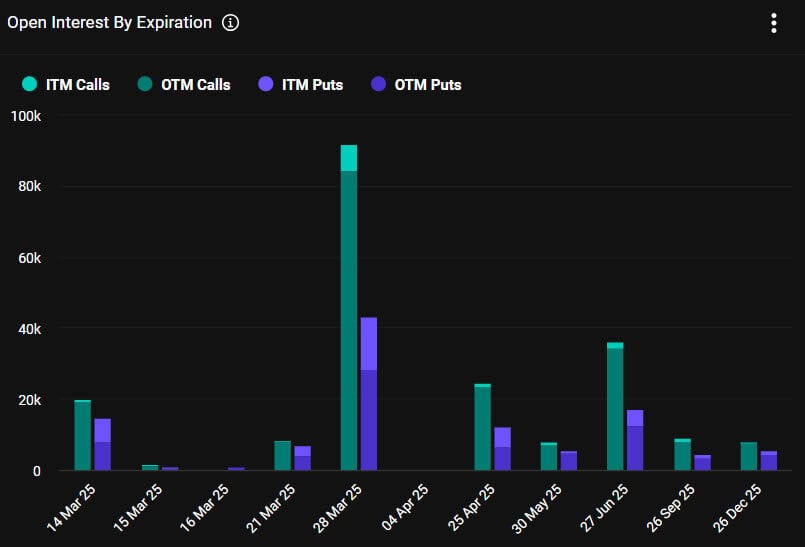

Around 35,000 Bitcoin options contracts will expire on Friday, March 14, and they have a notional value of roughly $2.9 billion.

This week’s event is a little larger than last week’s, but a mammoth end-of-quarter $11 billion options contract expiry is due on March 28.

The impact on spot markets is likely to be minimal as markets digest slightly lower-than-expected inflation data from the US this week.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.73, meaning that there are slightly more call (long) contracts expiring than puts (shorts).

Moreover, open interest (OI), or the value or number of BTC options contracts yet to expire, remains high at the $120,000 strike price, which is $1.4 billion, according to Deribit.

There is also almost $1.6 billion in OI at the $100,000 strike price and $1.3 billion at $120,000. However, the bears are getting bolder, betting almost $850 million that Bitcoin will fall to $70,0000.

Crypto derivatives provider Greeks Live said the group was still “predominantly bearish” on the short-term market outlook despite some positive CPI data.

“Traders are watching key potential support levels and discussing a potential bottom for BTC, with some suggesting $60k levels as a possible downside target.”

It added that “skepticism prevails” as the market faded the good CPI print quickly. Other industry experts and analysts have been baffled as to why there is so much bearish sentiment amid extremely bullish fundamentals.

In addition to the Bitcoin options, there are around 220,000 Ethereum contracts that are also expiring today, with a notional value of $416 million and a put/call ratio of 0.68. This brings Friday’s combined crypto options expiry notional value to around $3.3 billion.

Crypto Market Outlook

Crypto markets are back in the red this Friday with a 3.7% slump in total capitalization, which has fallen to $2.76 trillion.

Bitcoin fell back to $80,000 before making a minor recovery to reach $82,000 during the Friday morning Asian session. However, the asset remains weak, and analysts have predicted a fall to $70,000 in a deeper correction.

Ethereum remains at bear market levels, with prices failing to top $1,900 following a fall to $1,830.

The altcoins are generally mixed with larger losses for Cardano (ADA), Pi Network (PI), and Hedera (HBAR) and minor gains for XRP, Binance Coin (BNB), Tron (TRX), and Stellar (XLM).

The post Will Crypto Markets React to $3B Bitcoin Options Expiring Today? appeared first on CryptoPotato.