Will Bitcoin Hit $50,000 As SEC Has Window to Approve 12 Bitcoin ETFs, Or Does This Alternative Provide Better Exposure After Raising $200,000 in 48 Hours?

The US SEC has a seven-day window to approve twelve separate Bitcoin Spot ETFs.

The Bitcoin bulls have rushed back to the market as the window for approval opens, pushing Bitcoin as high as $37,980.

With the momentum around the Bitcoin ETF building, traders wonder if Bitcoin can hit $50,000 this week.

Meanwhile, the Bitcoin ETF (BTCETF) project is turning heads after raising $200,000 in 48 hours as investors believe it provides better exposure to the Bitcoin ETF approval than Bitcoin.

US SEC Has Seven Days to Approve Twelve Bitcoin Spot ETFs

A Bloomberg analyst has highlighted that the US SEC has a small eight-day window to approve 12 pending Bitcoin ETF applications.

According to James Seyffart, the window from the SEC started yesterday, November 9th, and extends all the way to November 17th for approval.

The window results from the US SEC extending deadlines for previous Bitcoin ETF filings, with November 8th selected as the date for the last day of rebuttal comments.

The approval could include ETFs for BlackRock, Bitwise, and VanEck, as well as the conversion of the Grayscale Bitcoin Trust.

If the SEC chooses not to approve during this window, the analyst still believes there is a 90% chance for approval by January 10th.

Can Bitcoin Hit $50,000 This Week?

With the hype surrounding the Bitcoin ETF approval continuing to build, traders wonder if Bitcoin can reach $50,000 this week.

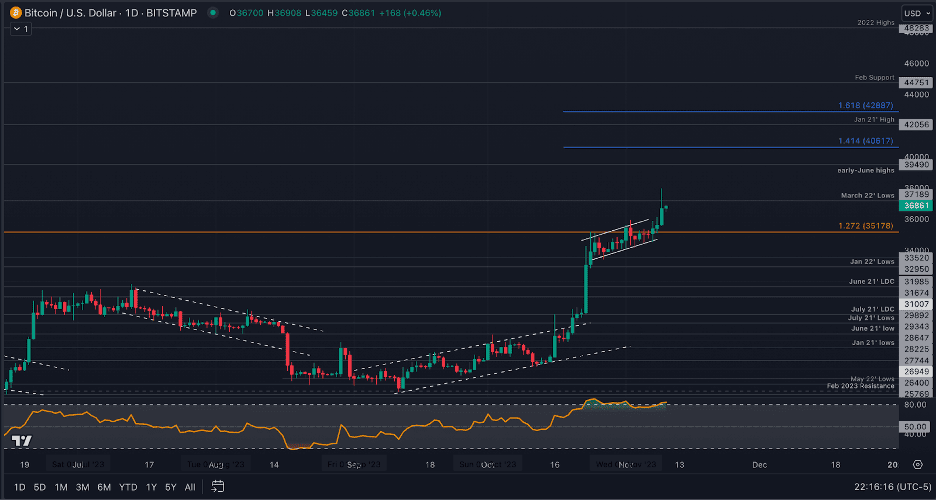

The news of the short-term window for approval caused the market to surge over 6% yesterday as it climbed as high as $37,980.

Bitcoin has been climbing ever since breaking the rising price channel toward the end of October – sparked by rumors of an approved Bitcoin ETF, which were later proven to be false;

Looking ahead, the first resistance lies at $37,190 (March 22’ lows). This is followed by resistance at $38,000, $39,400 (early-June highs), and $40,620 (1.414 Fib Extension).

Beyond this, Bitcoin would have to break resistance at $42,000 (Jan 2021 highs), $42,885, $44,750 (Feb support), and $48,285 (2022 highs) before having a chance to reach $50,000.

Does Bitcoin ETF Provide Better Exposure to the ETF Approval Than Bitcoin Itself?

While the momentum surrounding the Bitcoin ETF approval grows, a newly emerging project is starting to turn heads as traders predict it could provide better exposure to the ETF approval than Bitcoin itself.

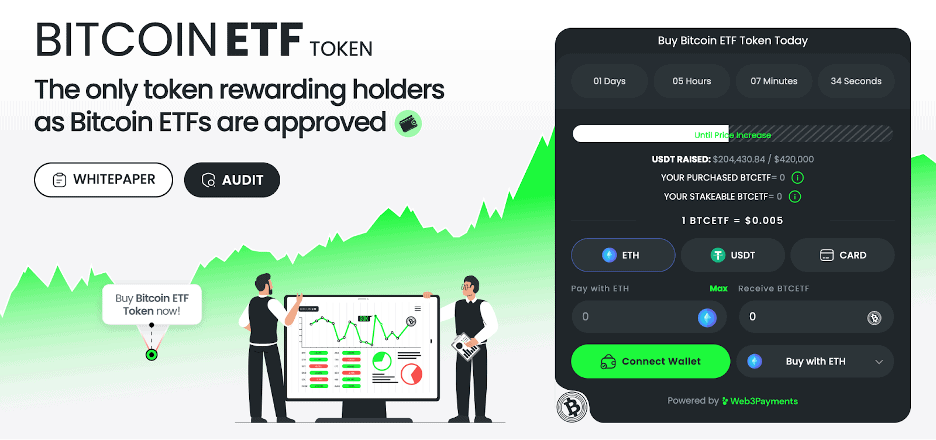

Bitcoin ETF (BTCETF) has raised a staggering $200,000 in just 48 hours as traders rush to the intuitive DeFi project directly linked to the Bitcoin ETF approval.

Bitcoin ETF is a project that aims to capitalize on the hype of the looming ETF approval ahead of time, providing direct exposure to the event through pre-determined milestones.

The project encompasses a staking utility and an intuitive burning mechanism that burns tokens as the Bitcoin ETF nears approval.

The fate of Bitcoin ETF is directly linked to the ETF approval, with its supply linked to major real-world milestones.

As a result, the closer the Bitcoin ETF reaches approval, the more BTCETF tokens are burnt.

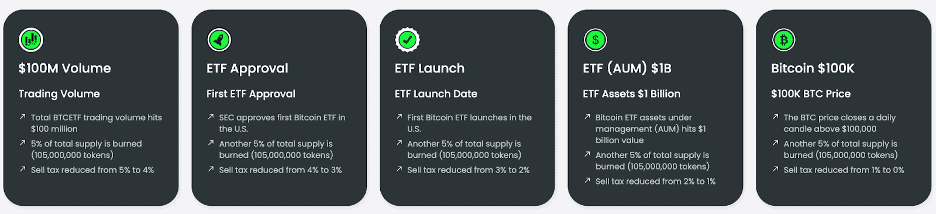

The milestones include achievements such as the SEC approving the first Bitcoin ETF in the US and the assets under management in the Bitcoin ETFs reaching $1 billion.

The following image breaks down all five milestones;

When each milestone is reached, the smart contract will burn 5% of the BTCETF supply, totaling 25% overall.

As a result, investors believe the price of BTCETF will surge after each milestone is reached.

In addition, the deflationary token integrates a sell tax, which is initially set at 5% to encourage long-term holding.

As each milestone is reached, the sales tax is reduced by 1% and will be removed entirely after achieving all five milestones.

With the Bitcoin ETF approval news hitting the headlines, investors are rushing to get positioned in Bitcoin ETF as they believe it provides better exposure to the event than Bitcoin does, with 50x potential.

The first stage of the presale currently sells BTCETF for $0.005. However, the price will increase in one day when the second presale stage begins.

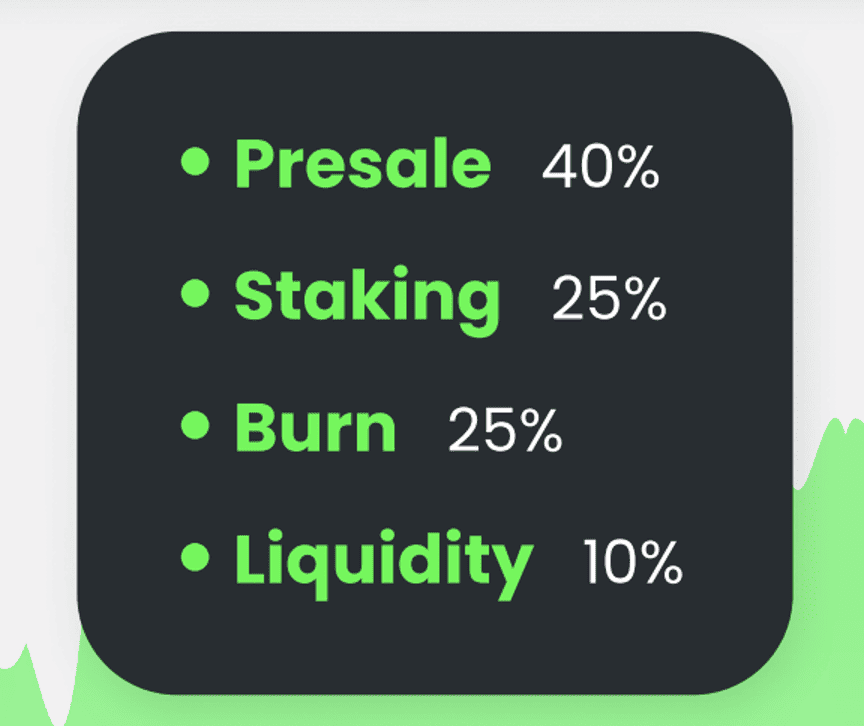

In addition, the total supply of the token is entirely dedicated to the community – with 40% sold in the presale, 25% reserved for community rewards, 25% allocated to the burning protocol, and the final 10% for exchange liquidity.

Overall, Bitcoin ETF harnesses the limitless potential of the incoming Bitcoin ETF approval into one project – providing direct exposure to the event through cutting-edge technology.

Visit the Bitcoin ETF Presale Today

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

The project in the above article is not related to Bitcoin or to a Bitcoin ETF. It’s a completely different token.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Will Bitcoin Hit $50,000 As SEC Has Window to Approve 12 Bitcoin ETFs, Or Does This Alternative Provide Better Exposure After Raising $200,000 in 48 Hours? appeared first on CryptoPotato.