Will Bitcoin Benefit Further From Goldman Sachs’ Dollar Debasement Warning

Yesterday, Goldman Sachs warned that the US Dollar stands a severe risk of losing its status as the world’s reserve currency. This comes amid rising concerns regarding inflation in the United States. Will this lead to Bitcoin price rallying further in the near future?

The Demise of the Dollar’s Dominance is Near: Goldman Sachs

As per a Bloomberg article, US-based investment banking giant Goldman Sachs, in a report, has issued a stark warning about the US Dollar. It said that the greenback is in dire danger of ‘losing its status as the world’s reserve currency.’

This is a direct result of the Federal Reserve’s efforts to ‘rescue the pandemic-stricken US economy’ through consecutive fiscal stimuli, the report said.

With the FED’s balance sheet already doing ‘$3 trillion rounds’, and the Congress okaying an another ‘stimulating move,’ the dollar could kiss goodbye to its forex market dominance.

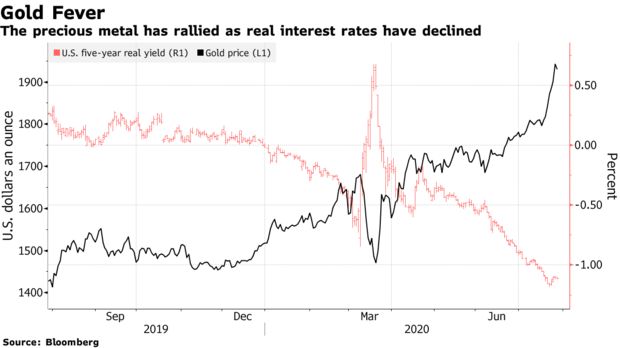

Not a Possibility but Gold’s Rally Says it All

However, Goldman Sachs believes that the above is not a necessary possibility. Still, the caveat reflects the sentiments of scores of investors who have been jumping markets from cash to gold.

“Gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their fiat currencies and pushing real interest rates to all-time lows,” wrote Goldman strategists including Jeffrey Currie. There are now, they said, “real concerns around the longevity of the U.S. dollar as a reserve currency.”

The yellow metal’s record-breaking rally to almost the $2000/ounce mark speaks volumes about the dismal state of the world’s collective economic condition.

Will Bitcoin Benefit Further?

As reported by CryptoPotato, investors have been following QE moves made by various governments.

Anticipating incessant money printing and heightened financial uncertainty, they have already set foot in the Bitcoin and gold markets. BTC price surged by almost 15 percent in the last 24 hours.

According to Messari’s Eric Turner, profitable DeFi investors may also be driving Bitcoin prices higher by utilizing their ‘yield farming gains’ to buy more BTC. But will the top cryptocurrency see more gains?

Yes, as per Charles Edwards, digital asset manager at Capriole. The propounder of Bitcoin’s Energy Value theory feels that this latest rally is solid as it happened in correlation with gold and not stocks.

This is just the start, and there’s more to come.

This huge $2000 move in #Bitcoin is all the more sweet given it was done with Gold, not stocks.

In a tumultuous year, Bitcoin is proving itself a safe haven. Crushing all other asset classes and up over 50%.

You just have to be patient.

Just. Getting. Started. pic.twitter.com/LKcpL4SF0E

— Charles Edwards (@caprioleio) July 27, 2020

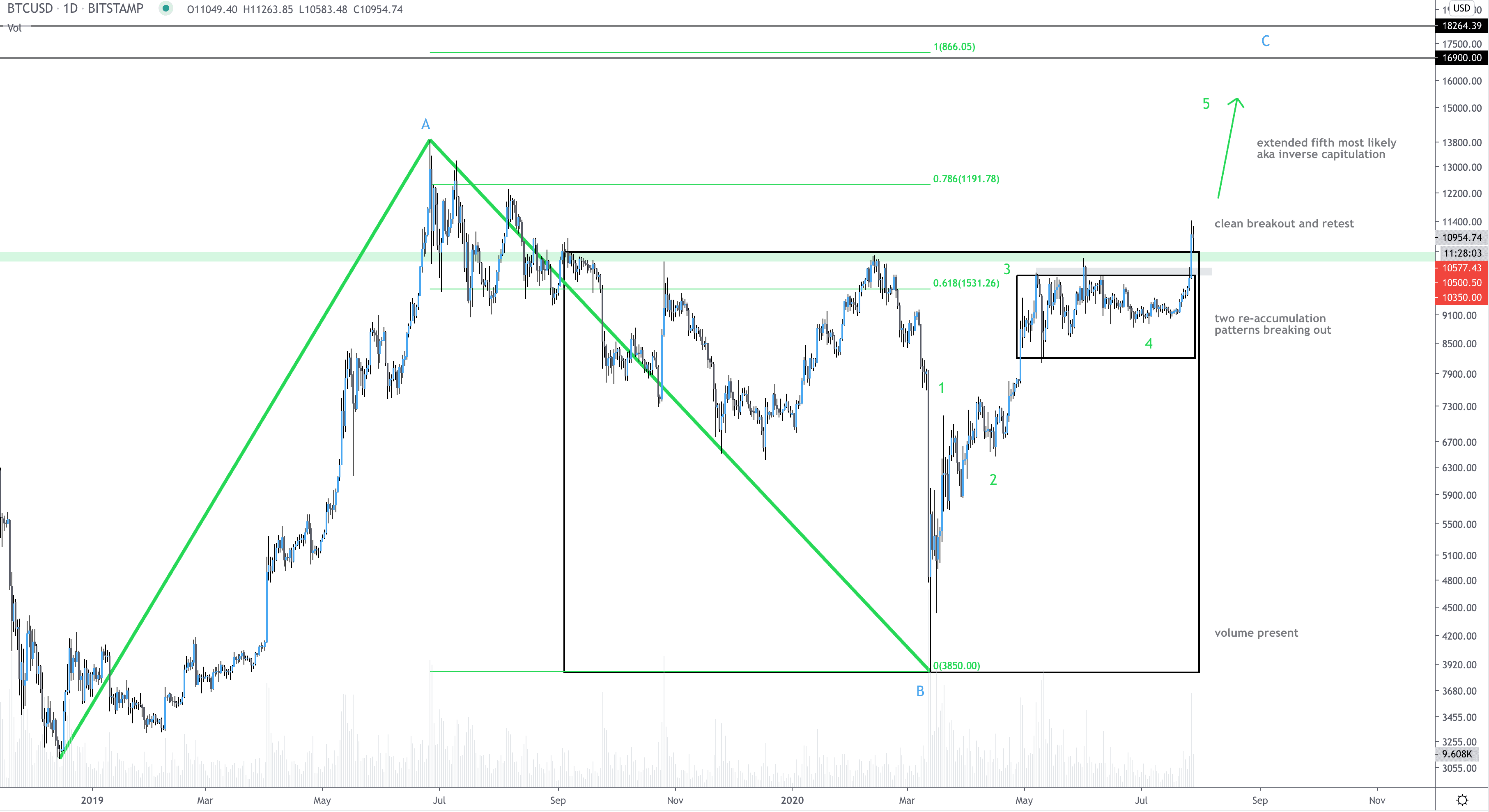

Also, a popular Twitter-based crypto trader and market analyst, said that the technical setup is ripe for Bitcoin price to shoot towards the $18,000 level.

In his tweet ‘Ethereum, Jack’ said:

BTC giving the cleanest breakout-retest setup I have seen in a very long time whilst each corrective wave since 4K has been vertical re-accumulation

The post Will Bitcoin Benefit Further From Goldman Sachs’ Dollar Debasement Warning appeared first on CryptoPotato.