Wild Bitcoin, Ether Price Swings Amid Spot ETH ETF Decision Triggers $350M Liquidations

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

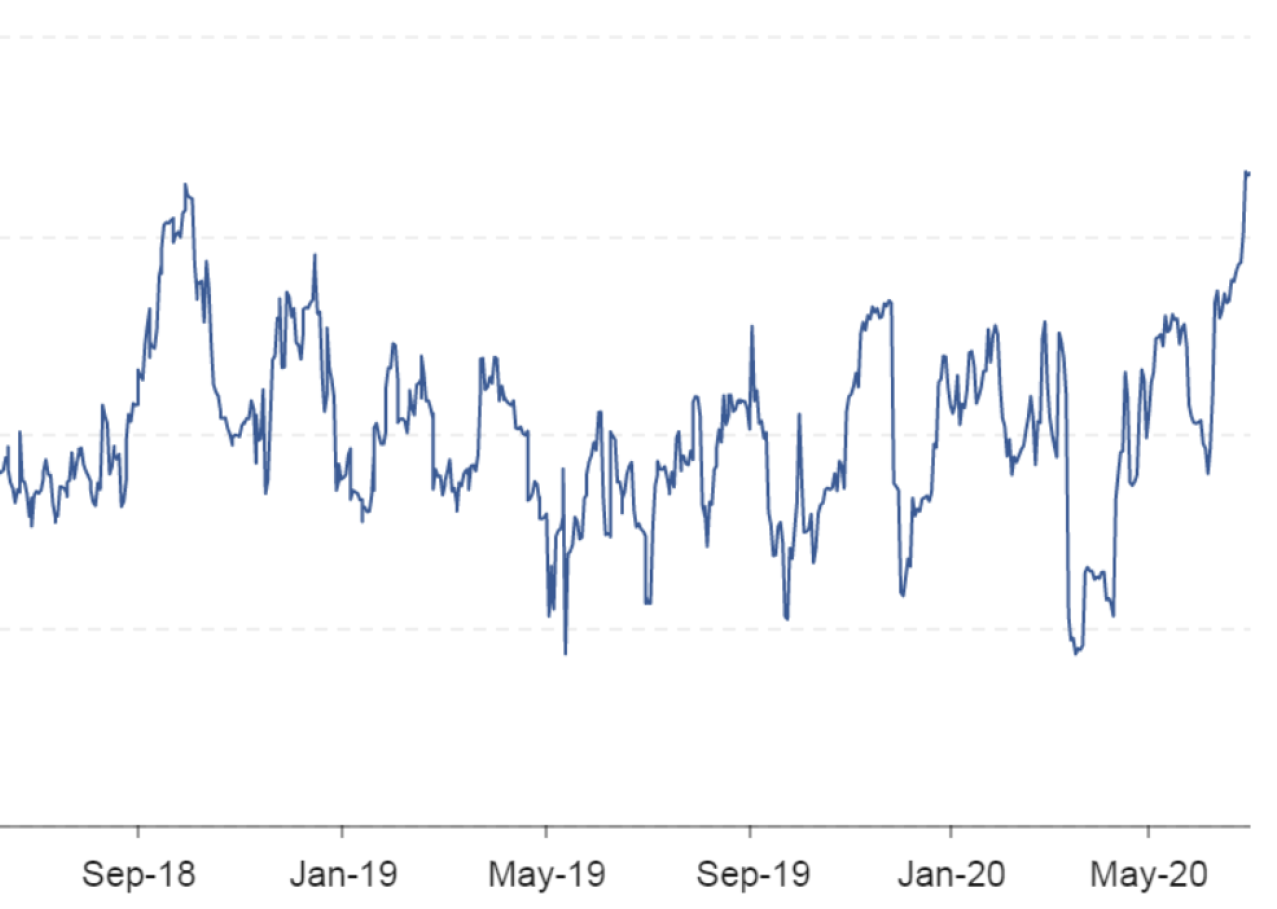

Crypto prices endured wild swings on Thursday as traders anxiously awaited a U.S. regulatory decision to list spot-based ether exchange-traded funds.

Within a nerve-wracking hour leading up to the eventual approval, ETH first tumbled to $3,500 at around U.S. traditional market closing time, then surged to near $3,900 as the first unconfirmed reports of an approval appeared to eventually settle above $3,800 following the confirmation.

Bitcoin (BTC) saw a similarly hectic episode sinking to the low-$66,000s, then spiking to $68,300 before paring gains below $68,000. However, ETH performed stronger, advancing 1.5% over the past 24 hours, compared to BTC’s almost 3% decline during the same period. The broad-market CoinDesk 20 Index was down 1.6% during the day.

Amid the volatile episode, liquidations across all leveraged crypto derivative positions soared to over $350 million during the day, the most since May 1, CoinGlass data shows.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/USZAYDJTBJHSNLER3KSNEQYEC4.jpg)

Liquidations happen when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money down or “margin” – if the trader fails to meet the margin requirements or doesn’t have enough funds to keep the trade open.

The lion’s share of the wiped-out positions were longs betting in rising prices, worth roughly $250 million, suggesting that over-leveraged traders were caught off-guard by the sudden price plunge. ETH traders took the biggest hit, with $132 million of liquidations, followed by $70 million in BTC derivatives liquidations.

Edited by Aoyon Ashraf.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8b1395a8-12af-4705-9fe5-b862b248250d.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.