Why You Can’t Have A PPE Curriculum Without Bitcoin

Bitcoin is clearly a social phenomenon worthy of study for a proper philosophy, politics and economics (PPE) degree.

In 1920, the toffs at the University of Oxford decided that those students with ambitions of entering public service needed a better degree to equip them for a modern, post-War world. They reasoned that, in order to understand social phenomena and govern effectively, you must have a firm grasp of philosophy, ethics and reasoning, politics and its history, and finally, economics.

The degree known as “philosophy, politics and economics” (PPE) would be born, and first delivered at Oxford in 1921, with no less than an Oscar winner, a princess, two Nobel Laureates, three British Prime Ministers, 12 non-U.K. prime ministers (representing Australia, Pakistan, Peru and Thailand), three foreign presidents (representing Ghana, Peru and Pakistan), and hundreds of other highly-senior members of public service all graduating. This excludes all the alumni from the hundreds of world-leading universities that now also provide a PPE degree.

Whether or not the degree has fulfilled the ambitions of its creators could be debated, but the logic of the program is sound. In order to understand complicated social phenomena, your knowledge needs to be deep and broad. In the 1920s, philosophy, politics and economics were probably enough to do the trick, but in October 2021, 13 years after the release of the Bitcoin white paper, understanding of exponential technologies and how they’re built and adopted is now a critical fourth pillar.

But before we get into the PPE of the exponential technology that is Bitcoin, let’s quickly define what “social phenomena” are, and whether Bitcoin classifies as one.

What Are “Social Phenomena”?

The term “social phenomena” can be broadly defined as “events, trends or reactions that take place within an established human society … evidenced through collective modifications of behavior” — which could effectively mean anything.

Examples of social phenomena include market and consumer trends, popular political movements or rebellions, social trends like crime or poverty, and religious movements. Indeed, the most successful popular movements in history came about because they offer adherents a full “PPE stack” for life, i.e., Western democracy is underpinned by a completely different philosophical, political and economic model than, say, communism. Indeed, your economics are virtually inseparable from your politics and philosophy.

Based on the definition and aforementioned examples, it would be fair to call the invention of Bitcoin an event that affected “collective modifications of behavior” that has rebellious underpinnings and is frequently called a religion — whether as a proud admission, or as a sharp criticism. Now that we’ve determined that Bitcoin is a social phenomenon, let’s have a look at the PPE stack that Bitcoin offers its adherents.

Bitcoin Philosophy

There is no shortage of Bitcoin philosophers, and you could spend hundreds of hours reading about and listening to the different schools of philosophical thought. Despite this, there are certain philosophical elements that are universal, and many are alluded to in Bitcoin’s founding document, these are:

- Bitcoin is voluntary and voluntary approaches are always superior to mandatory ones.

- Bitcoin is open and maximum transparency allows for a maximum number of eyes looking at the code and sharing ideas. How does any individual entity possibly compete with this?

- Bitcoin is fair. It cannot be created out of thin air or forcefully seized or redistributed. You must expend work in order to acquire bitcoin.

- Decentralization is always preferable to centralization when it comes to money (and many other things).

- Everyone has the right to send and receive value, without a third party, no exceptions — even for people we dislike. Either everyone is free to transact, or no one is.

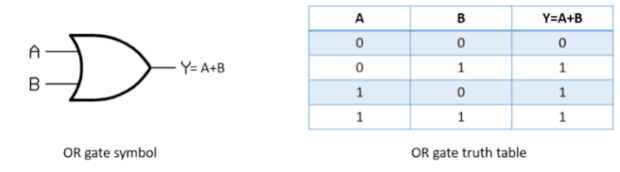

- A deflationary, fixed-supply asset is the superior money, and a peer-to-peer network that timestamps transactions by hashing them into an ongoing chain validated by hash-based, proof of work is the best way to achieve this.

- Everybody in the world should be able to easily keep a copy of Bitcoin at home so that everyone has the opportunity to be a truly sovereign Bitcoin citizen.

- If you do not voluntarily hand over custody of your private keys, your bitcoin cannot be taken away from you, ever. It is almost impossible not to get a religious tingle down your spine when you realize the implications of the impossibility of seizure.

Bitcoin Politics (Governance)

A cynic would say that politics are the activities of acquiring and maintaining power, and governance is what is done by those in power. To that end, there isn’t really any “political process” in Bitcoin, just decentralized, voluntary contributions that succeed on their technical merits.

That said, the governance model of Bitcoin is very clearly defined, with Bitcoin Magazine’s very own Aaron van Wirdum writing about it extensively in 2016, and veteran industry analyst Pierre Rochard adding additional detail in 2018 — I would strongly recommend reading both for a thorough education on the topic. There is also a surprisingly thorough and unbiased account found in research published by the “Stanford Journal Of Blockchain Law And Policy” earlier in 2021. I summarize the above works below:

The Political Players In Bitcoin

In terms of who has actual political power when it comes to Bitcoin’s governance, it is the “users” and miners. All miners are users, but not all users are miners.

Although “user” can be a broad term, in this context it means “somebody who runs and uses a Bitcoin software implementation on their computer,” i.e., “runs a node.” When it comes to Bitcoin governance, simply holding bitcoin does not make you a “user” or give you any influence. The miners are tasked with producing blocks in line with the rules of the Bitcoin protocol, and over 90% of miners need to support any proposed protocol changes before they can be implemented.

Software Governance Vs. Protocol Governance

In the previous section, I referred to “users” as those who have downloaded and run a particular Bitcoin software implementation. The main, or “reference,” implementation is Bitcoin Core, however, other implementations like Libbitcoin, also exist.

An implementation is simply a way to communicate with and follow the Bitcoin protocol, and if you have the skills, you can build and use your own implementation. For everyone else, there’s Bitcoin Core (or an equivalent). Regardless of how the various software implementation teams decide to govern themselves, if users aren’t willing to download their software, they will have no impact on Bitcoin.

Bitcoin is whatever the consensus of the users say it is. Talk about the customer always being right!

Protocol Governance Process

Rochard outlines the five-step Bitcoin change and governance process as follows:

- Research/problem identification: Every solution starts with a problem. Solving these problems typically requires lots of research. Since it’s an open, voluntary platform, users are left to “scratch their own itch” when it comes to solving problems.

- Proposal: When a user has found a solution to a problem, they present this to the world through the Bitcoin Improvement Process, starting with the creation of a Bitcoin Improvement Proposal (BIP), and going through the long, technocratic and meritocratic process of critique and development (which can sometimes last many years) until the solution is ready for implementation in one of the various Bitcoin implementations. Not all BIPs see the light of implementation.

- Implementation: Depending on how robust the development peer review process was, and whether the proposal is contentious or not, implementation can be quick or slow. In the case of a highly-contentious proposal, Bitcoin Core developers, for example, would not implement a proposal without a supermajority of 90% or more of miners signalling support. The small minority still in disagreement are free to copy/paste Bitcoin’s code, and create their own version based on their rule set.

- Deployment: After the Bitcoin implementation software developers are convinced, it’s now time to convince the users to download and use this new implementation. At this point however, non-technical users can generally rely on the intense scrutiny of the process by miners, community members and developers, with technical users having the benefit of reviewing and understanding the public review process themselves if they so choose.

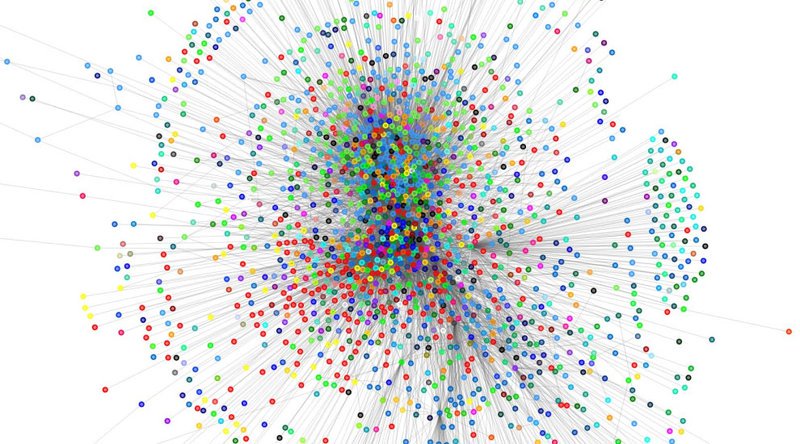

- Enforcement: This is the easiest bit of all — literally using software to check some math. All of the rules necessary to check this math lives on the tens of thousands of Bitcoin nodes around the world, and they will simply refuse and ban peers that aren’t complying with the latest consensus ruleset.

Bitcoin Economics

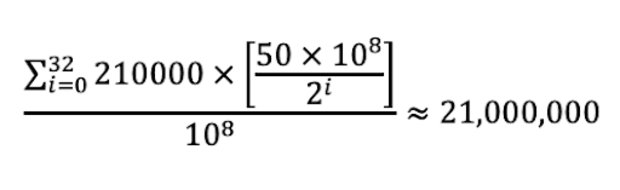

While an entire library can be written about Bitcoin economics, the executive summary is Bitcoin’s supply formula, below:

Bitcoin offers users the following economic guarantees:

- Fixed supply, enforced by codes

- Highly inelastic, diminishing, predefined issuance, regulated by the difficulty adjustment

- Property rights

Bitcoin frees users from the following economic burdens:

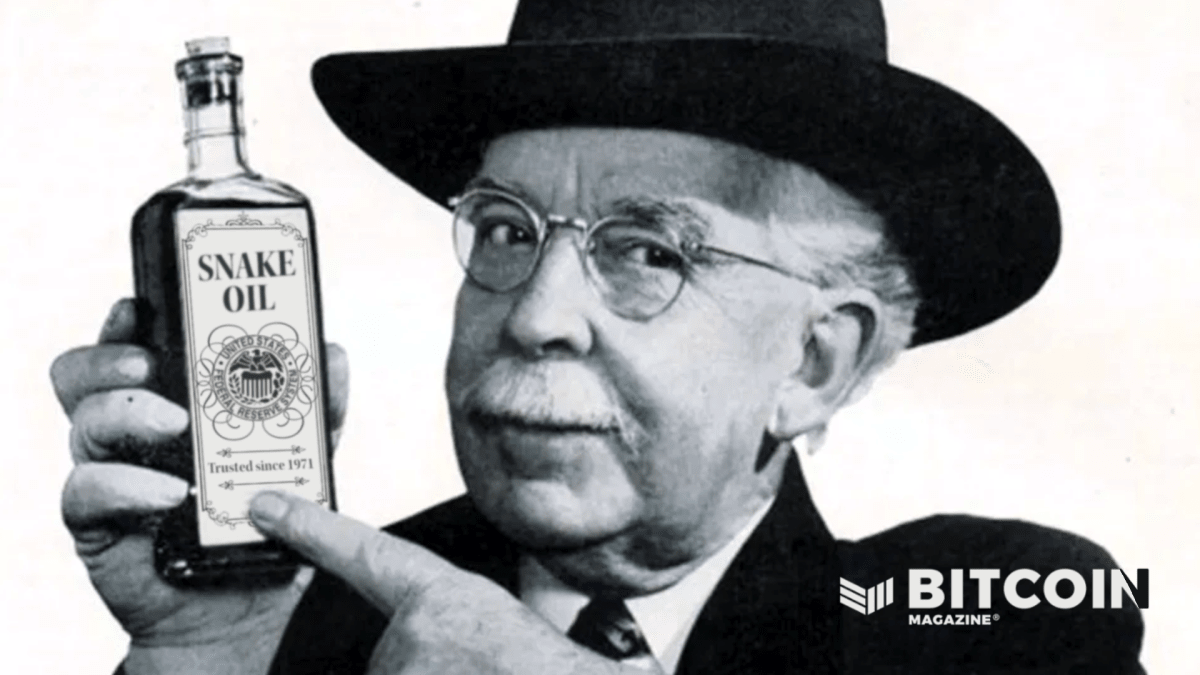

- Government and central bank incompetence and malfeasance

- Seigniorage, inflation and hyperinflation

- Unfair taxation and regulation

- Counterparty risk

It is out of this economic simplicity that the hardest money ever known to man has emerged.

The Bitcoin PPE Full Stack

It isn’t just the robust technical and economic underpinnings that make Bitcoin revered by so many, but also the philosophical and political full stack that provides Bitcoiners what is effectively a blueprint for life.

Freedom, transparency, honesty, meritocracy, fairness, voluntaryism and hard work are great things one should strive toward, whether it is in developing money or living life and setting a good example for others. The greatest and most enduring movements in history, be they political, social or religious, have been accompanied by a full PPE stack, and with a full stack as powerful as Bitcoin’s, it is on track to being the greatest movement the world has ever or will ever see.

There is no doubt that teaching of Bitcoin philosophy, politics and economics should be included in any serious PPE programs that claim to be producing our next generation of leaders.

This is a guest post by Hass McCook. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.