Why the Advisor Crypto Technology Gap Is Closing

Christopher Robbins is a nationally recognized journalist who has been featured as a speaker and panelist on topics including investing, personal finance and wealth management.

When I first became aware of cryptocurrencies a little more than a decade ago, no one I knew was investing in them.

That changed quickly, as people around me began to buy, hold and trade crypto, using trading and custody tools that quickly became more sophisticated and kept changing on pace with technology in general.

This article originally appeared in Crypto for Advisors, CoinDesk’s weekly newsletter defining crypto, digital assets and the future of finance. Sign up here to receive it every Thursday.

But when I first started writing for financial advisors in 2015, I witnessed a completely different picture – there were no mainstream tools for advisors to work with cryptocurrencies, and much of the technology that did exist looked like Flintstones appliances compared with the tools that traders and do-it-yourselfers were using.

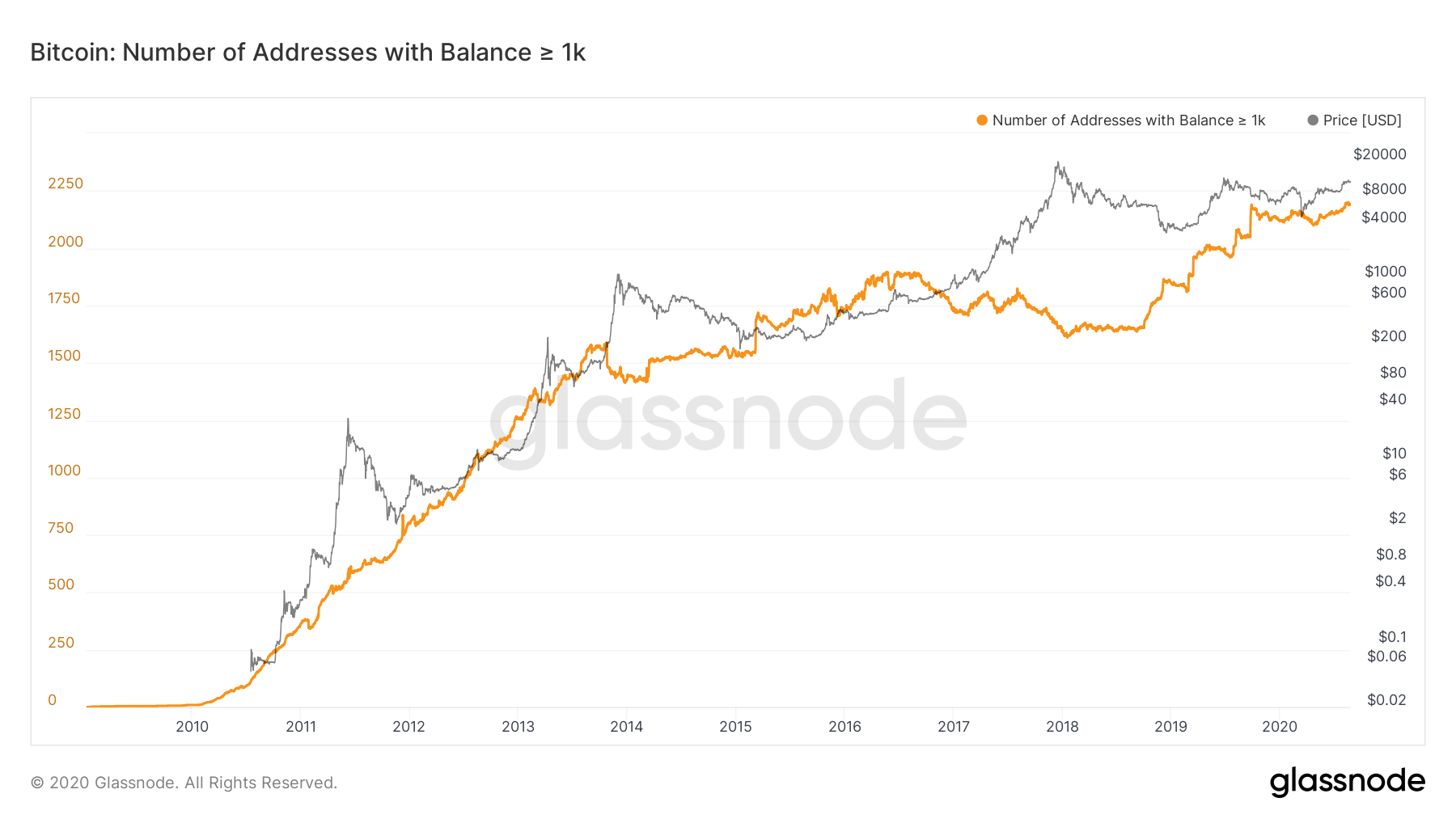

When bitcoin was launched in 2009 and cryptocurrencies burst into the global financial consciousness, the individual, the do-it-yourself investor, gained a technological advantage over the average advisor, mostly from being a first mover.

Today, that gap between individual investor and advisor has almost closed as new tools and platforms are rolled out for financial planners, enabling them to advise clients on and work directly with cryptocurrencies. The traditional financial industry is finally catching up.

“Cryptocurrencies as an industry and asset class began with people going individually into tokens, but now there’s an asset management and advisor infrastructure being built,” said Henry Yoshida, co-founder and CEO of Rocket Dollar, which provides self-directed retirement accounts to individuals who want to use their retirement savings to invest in any alternative asset, including crypto. Yoshida is a former Merrill Lynch advisor who went on to found MY Group LLC, a retirement advisory firm with $2.6 billion in assets under management and then robo-advisor Honest Dollar, which was acquired by Goldman Sachs.

“Traditionally, regular people could only purchase mutual funds, and only advisors and an exclusive group of investors could buy stocks and bonds and other assets,” he said “It’s the exact opposite in crypto; it started with the people first, and only now are we getting the technology, regulations and infrastructures for advisors.”

Dan Eyre, CEO of Blockchange, an asset management program and separately managed account (SMA) platform for digital assets, said that the technology to open advisor access to cryptocurrencies already existed in 2009, but few of the larger players in advisor technology and custody services took the asset class seriously.

“These tools should have been there all along, but until last year, a lot of the bigger players didn’t see a lot of legitimacy in the asset class and were kind of waiting, hoping for it to die out,” said Eyre. “By the time it really caught on, they were behind the curve, while the innovators were further ahead. It’s because this asset class is fundamentally new. It’s not repackaging something that already existed, it’s rebuilding it from the ground up.”

For one thing, Eyre said that traditional custody and access tools and infrastructure don’t work well for digital assets because digital assets are traded frequently and on a round-the-clock basis.

Blockchange is built on top of crypto exchange Gemini’s custody and infrastructure offerings. Through a recently announced partnership with Equity Trust, the company now offers access to Automated Customer Account Transfer Service (ACATS)-eligible individual retirement accounts, which reduces the waiting period to transfer assets into an IRA – an important consideration when investing in markets that move as fast as cryptocurrencies do. Gemini’s offering makes it possible for advisors to access and work within their clients’ cryptocurrency accounts.

Onramp Invest, another service offering similar side-by-side access for advisors and the end investor, launched in July.

Giving crypto a familiar face

Blockchange, for example, also gives advisors the ability to customize its client interface and offers or is pursuing integrations with major portfolio accounting platforms like Black Diamond Capital Management, Envestnet | Tamarac, Morningstar Office and Orion.

It’s the integrations, not new technology, that will open the world of cryptocurrencies to financial advisors, said Cory Klippsten, co-founder of Swan Bitcoin, which allows do-it-yourself investors to buy bitcoin through automatic deductions or in one step and which is planning to roll out a service for financial advisors this fall.

“It’s been hard for advisors to set themselves up to work with cryptocurrencies, but the ability has been there,” Klippsten said. “What they need is technology that integrates with the Black Diamonds, Addepars and Envestnets of the world, the different tools and reporting systems that the advisor industry already trusts and relies on. That will make bitcoin and other crypto look very similar to the other products they are already used to dealing with. It’s the key to opening up that market.”

It’s important for both advisors and clients to have technology platforms that look and behave like the technology they are already accustomed to, Klippsten said, and that allows advisors and financial firms to charge fees for providing advice on cryptocurrency.

Much has been said about the prospect for a spot bitcoin exchange-traded fund in the U.S., with many advisors holding out hope that one will provide easy access to the cryptocurrency asset class without the need for new technology or custodial relationships.

“Futures ETFs don’t solve advisors’ problems, that’s for institutions to trade,” he said. “Every time the futures contract rolls over, you’re going to lose 5-10%. You’ll end up with half as much in bitcoin as someone who buys the same amount of a spot ETF.”

Eyre pointed out that spot ETFs, like many of the already launched private products and trusts, are blunt instruments that give exposure to only one kind of token, or a fixed index of tokens, but cryptocurrency markets move very fast. SMA services like Blockchange offer a digital platform on which advisors and asset managers can build, manage and allocate to their own strategies or third-party models.

“It has taken too much time to get here, but I think we are now arriving at a point where the tools are finally there, they’re operational, they’re being used, and they’re creating value for clients,” Eyre said. “The days are numbered where advisors or managers can say we don’t have a plan or a strategy for digital assets.”

Subscribe to Valid Points, our weekly newsletter about Ethereum 2.0.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.