Why Libertarians Should Prioritize The Bitcoin Strategy Above All Others

Bitcoin offers libertarians the perfect vehicle for starving the state of its outsized control over personal freedoms.

Libertarians should prioritize the Bitcoin strategy above all others.

Libertarians generally believe in the non-aggression principle (NAP), meaning that it is wrong to initiate aggression against someone else’s person or justly-acquired private property. What does Bitcoin have to do with the non-aggression principle? The chief violator of the NAP principle is the state. And the chief reason the state is so large and so powerful is that it has access to cheap debt. Bitcoin fixes this.

Let’s explore:

Why The State Is So Large

If you have been forced into some form of lockdown, restriction, travel-ban, mask-wearing, jab-taking compliance over the last two years of Hysteria-19, it is obvious that states around the world have become extremely powerful.

As Robert Higgs outlined in his classic “Crisis And Leviathan,” the state expands dramatically during crises, but it doesn’t necessarily “give all the freedoms back” after the crises. We’ve notably seen this ratchet effect with 9/11 and the “Patriot Act,” which forever changed travel and various other freedoms that we used to have.

But what use is the desire for a state to expand its remit and reach, without the funding for such an endeavor? In a more honest system, the state and its politicians would have to explicitly tax the population, which is not so popular. The modern day fiat fractional reserve system enables cheap debt funding of bureaucracy and governmental enforcement of the “papers please” mindset.

What do you think would happen if Bitcoin’s “number go up technology” kept operating and fiat money kept devaluing? Government bureaucrats and thugs would experience reduction in their purchasing power, and it would effectively act as a “right sizing” of government.

Not Every Libertarian Is An Anarcho-Capitalist

Fine, but even still, it’s mostly true to say that you want a smaller-sized state than what we have today. Starving the beast is the only way to enforce some accountability here. Governments and complicit media have grown too large, too powerful, too influential and they have made the population weak and scared over time.

Even if you don’t believe that Rothbardian anarcho-capitalism is The Way, most libertarians would be happier if the state was smaller. So, why not push for adoption of the technology that will do precisely this?

Present Libertarian Strategies Have Not Been Successful

Trying to win at the ballot box has not been a fruitful strategy for most libertarians worldwide. The population simply does not understand the issues of socialism and statism, and they will gladly vote for more government-sponsored redistribution if the cost artificially appears to be low enough.

How many times have you genuinely seen libertarian directions being pursued politically and winning as a political strategy? Other than the Ron Paul U.S. presidential campaigns of 2008 and 2012, I have barely seen it. And, being fair, those campaigns were not a win politically, they were more of a win in supporting and engaging new ranks of libertarians into the movement.

Even if we could somehow convince the world or the U.S. government to adopt a gold standard, there’s not really anything stopping them from claiming “it’s an emergency” and that we need to drop the gold standard and “temporarily” close the gold window. In this way, Bitcoin provides stronger assurances about our money than gold ever could.

When you run a Bitcoin node, it checks all of the rules of the system and it is a more decentralized form of validation and enforcement of the rules. We’re less reliant on government and big banks or big gold vaults to defend the integrity of the system. Think of it like: Bitcoin is less corruptible than fiat money or the gold standard.

Well, What’s The Alternative?

Titus Gebel outlined the idea of free private cities on my show (“SLP161”). Imagine an opt-in city where you pay a subscription fee upfront with the rules set upfront as well. The “state” or public services in this instance would be far smaller than the current governments of the world, and there would be more competitive pressure between Bitcoin citadels or free private cities to ensure inhabitants are getting a good deal.

Alternatively, there are efforts in the direction of seasteading. Others like agorism-style strategies, and in this case, Bitcoin can obviously play a role in being able to support the private entrepreneur.

There might even be something to the idea of a Bitcoin and libertarian policies advocacy. But it doesn’t work without Bitcoin as an important part of the mix.

Without Bitcoin’s monetization continuing apace, there will be little incentive for politicians and political parties to support liberty-friendly policies. But in a world where Bitcoin is rapidly rising, and job opportunities are present in the industry, politicians like Texas Governor Greg Abbott will come out in support of the idea that Texas should be a competitive state for Bitcoin.

How Do We Execute This?

Stack sats and build alternatives to statism. This means that you should set up your automated sat-stacking plan, whether that’s with Swan Bitcoin or whoever else.

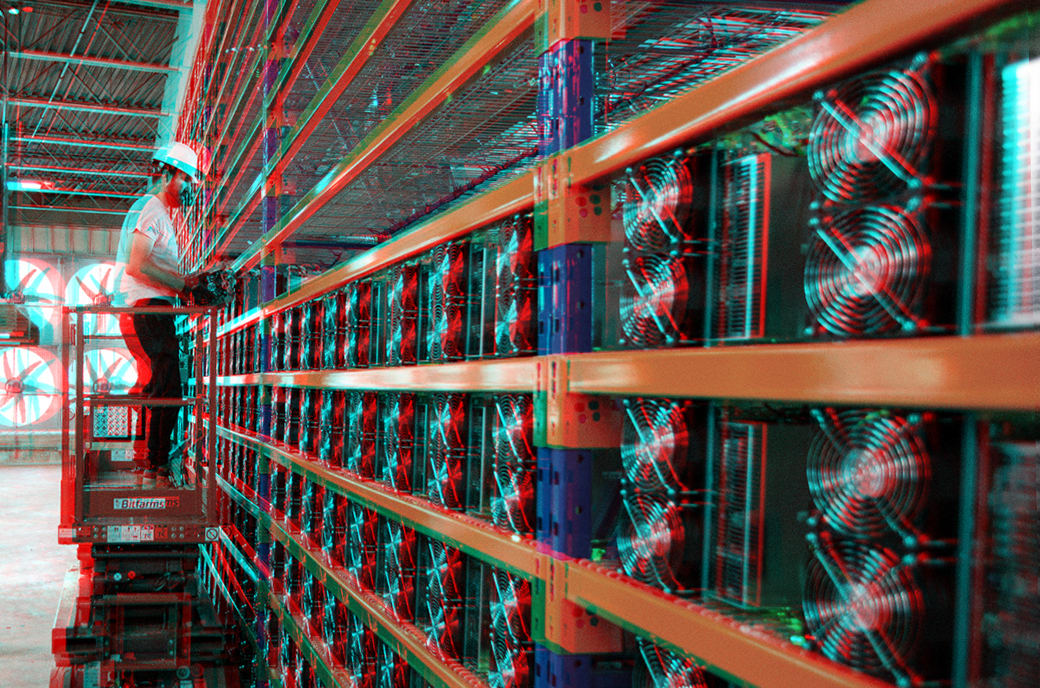

Or, if automated sat stacking isn’t your thing, you can earn bitcoin by selling your goods and services for sats, or you can mine it too. Buying non-KYC coins is another way to do it, too, either by meeting people at Bitcoin events, meetups, conferences or using platforms like Bisq or Hodl Hodl.

The point is to enact regular and steady accumulation of bitcoin, and HODL as much of it as you can to restrict the supply. In doing so, you are speeding the process of hyperbitcoinization: the monetization of Bitcoin, the non-state, free market money.

When you don’t like the current options, you have to go build something that makes it better. This is what Satoshi did. Bitcoiners follow this example, and if you’re a libertarian, you should too.

This is a guest post by Stephan Livera. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.