Why Is Bitcoin Going Up, and Will It Crash Soon? What’s Next as Price Doubles to $40K

Why Is Bitcoin Going Up, and Will It Crash Soon? What’s Next as Price Doubles to $40K

Bitcoin’s prices reached all-time highs above $40,000 less than a month after breaking $20,000 for the first time. Since the start of the most recent rally, ostensibly begun in October, its value has increased fourfold.

So for pros and newbies alike, or if you want to be the cryptocurrency expert at your next Zoom party, it’s natural to ask: Why are prices going up, and will bitcoin crash?

Bitcoin (BTC) was just invented 12 years ago as a new type of electronic payment system, built atop an Internet-based computing network that no single person, company or government could control. The reality is that the cryptocurrency’s trading history is so short, with methods for valuing the asset still largely untested, that nobody really knows for sure what it should be worth now, or in the future.

That hasn’t stopped digital-asset investors or even Wall Street analysts from putting out price forecasts ranging from $50,000 to $400,000 or beyond.

Based on CoinDesk’s reporting, here are a few key reasons why bitcoin prices have recently rallied:

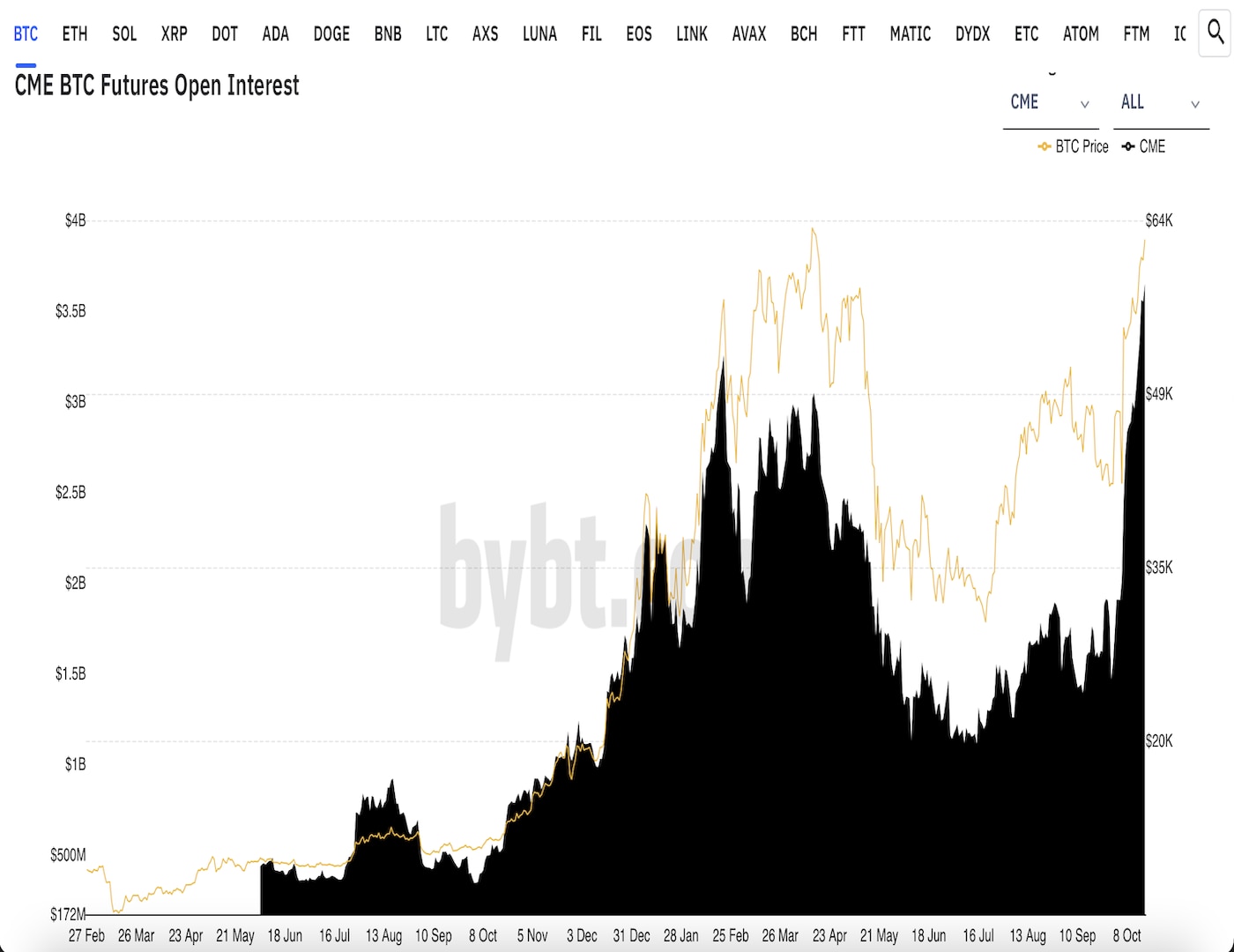

- Demand from institutional buyers, many of them eyeing bitcoin as a hedge against inflation. The cryptocurrency is seen as a hedge against inflation because, under the network’s original programming, only 21 million bitcoins can ever be created; so there’s a contrast with central banks like the Federal Reserve that can decide based on a committee vote to print more money. Big asset managers including Tudor Investment and Guggenheim Partners have announced bitcoin purchases or wagered on prices using futures contracts on the Chicago-based CME exchange. Even old-line Wall Street firms such as Morgan Stanley have weighed in with bullish pronouncements. Analysts for JPMorgan Chase, the biggest U.S. bank, recently predicted a price of $146,000 over the long term.

- The U.S. dollar’s decline in foreign exchange markets. The U.S. Dollar Index, a gauge of the dollar’s value against major world currencies like the euro and Japanese yen, slid 6.8% in 2020 and is down again in 2021. That’s key for bitcoin, since the cryptocurrency’s price is mostly denominated in U.S. dollars. Possible reasons for the greenback’s decline include the Federal Reserve’s $3 trillion-plus of money printing over the past year, which is roughly three-quarters of the entire amount previously created in the U.S. central bank’s 108-year history. Images of protestors storming the U.S. Capitol on Wednesday probably didn’t burnish America’s leadership role on the global stage, and now many economists are predicting that big spending plans under a Democratic-controlled government would lead to new stimulus bills and potentially outsize government budget deficits for years to come. Much of those extra costs could be financed through additional Fed money printing.

- Retail purchases. Many individuals are speculating on bitcoin prices, and it’s become increasingly easy to buy bitcoin, with big services like PayPal enabling purchases last year. Analysts for the digital-asset firm ByteTree noted this week that blockchain data appear to show a high concentration of bitcoin purchases in the amount of $600 – the same amount as the American stimulus checks sent out in the latest U.S. coronavirus emergency aid package.

All this may have led to a tremendous rally over the past few months. But could bitcoin prices crash? Of course they could, several analysts told CoinDesk.

The cryptocurrency’s price is notoriously volatile, and substantial and unexpected price swings aren’t uncommon. Below is a sampling of comments from cryptocurrency analysts and other financial experts on how a pullback might look, and what might cause it.

- Bitcoin “has been and remains extremely volatile,” said Joe DiPasquale, CEO, BitBull Capital, a cryptocurrency-focused hedge fund. As recently as Monday, he noted, after prices had climbed to a new all-time high, they tumbled almost $7,000. “What causes this is that people can use lots of leverage, so they can easily get washed out.” He sees a correction as possible, though there appear to be plenty of interested buyers around $28,000, so that level might function like a price support.

- There hasn’t been a single year since 2013 when prices have not fallen at least 25% from a high point reached earlier in that year, said Gavin Smith, CEO of the digital-asset firm Panxora. He said he wouldn’t be surprised to see bitcoin prices rise to $70,000 or $80,000, nor a setback of 40%. Medium term, he’s bullish: “Over a three-year period, this is a great asset.” But over the long term, there’s a risk that technological developments could overtake bitcoin. “Even with quantum computing, there’s nothing on the horizon that indicates that could happen,” he says, “but it’s always dangerous to completely ignore the risk.”

- Bitcoin prices could rally two to three times from their current level before falling back to about where they are now, said Mike Venuto, co-portfolio manager of the Amplify Transformational Data Sharing exchange-traded fund, which invests in blockchain-related stocks. That would imply a retracement of more than two-thirds from that hypothetically new all-time high. “What’ll cause a crash more likely is overexuberance on the upside. I don’t think we’re there yet.”

- “There will be swings, and yes, the swings will be wild,” said Denis Vinokourov, head of research for the cryptocurrency prime broker Bequant. “You have a lot of retail flow that tends to panic.” He sees prices going up, in the long term, at least partly based on the bullish expectations of big Wall Street firms. “Can it go to $4,000? Yes.” One potential trigger for a rapid sell-off could be any actions brought by authorities against tether (USDT), a privately issued, dollar-linked digital token known as a “stablecoin” that has become a key source of liquidity in digital-asset markets. New York State prosecutors are currently battling Tether in court due to its finances.

- “The history of financial markets is the history of bubbles,” said James Angel, Georgetown University finance professor. He notes that authorities could move to crimp the bitcoin rally if they start to get worried that it’s becoming a threat. “Almost everybody who tries to start their own money does so in competition with a national currency, and it usually gets shoved aside by regulators.”

- “While we’re currently seeing an unequivocal expression in the market’s bullish sentiment, a correction could well be on the horizon,” said Sui Chung, CEO of CF Benchmarks, a cryptocurrency provider. “This is a natural part of market mechanics. While it may dampen near-term enthusiasm, it will ensure future price rises remain grounded.”

- “There is likely to be profit taking along the way, causing temporary dips,” said Guy Hirsch, managing director for the U.S. at the trading platform eToro. “But given the extraordinary amounts of adoption by institutions, it would be a surprise if bitcoin dropped below $20,000 any time soon.”

So for the Zoom party, you can tell them: Yes, according to the experts, a crash is probably coming, but that’s typical for bitcoin, and if history is any guide, prices will probably recover.

Just don’t tell them when.