Why I Bought Bitcoin As A Gen Z

In a world of darkness, Bitcoin is a light for a lost generation.

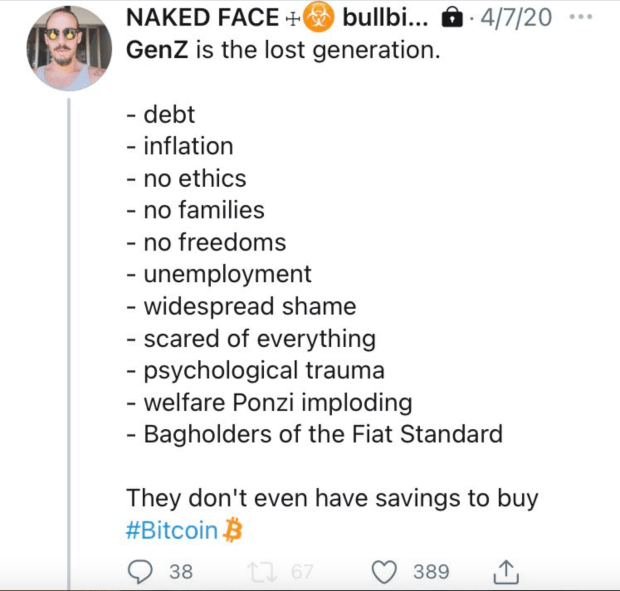

I couldn’t have said this any better myself.

So, why did I buy bitcoin when I was 18, and why do I continue to buy now at 21?

After my high school graduation, I was no longer a kid anymore, I was an adult. Being an adult is expensive. Eventually most adults want to buy a car, a house, fund their lifestyle, go on vacations, retire, etc. That is all extremely expensive and can seem like an impossible task to afford taking into account the setbacks that come with our generation.

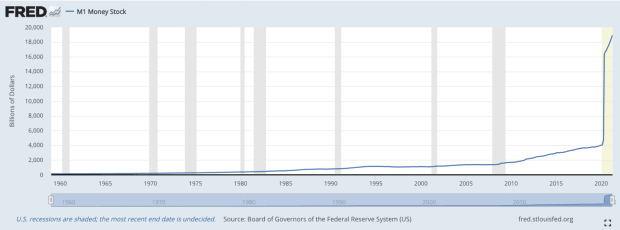

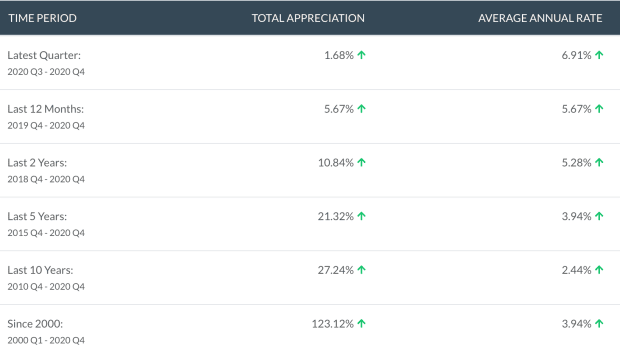

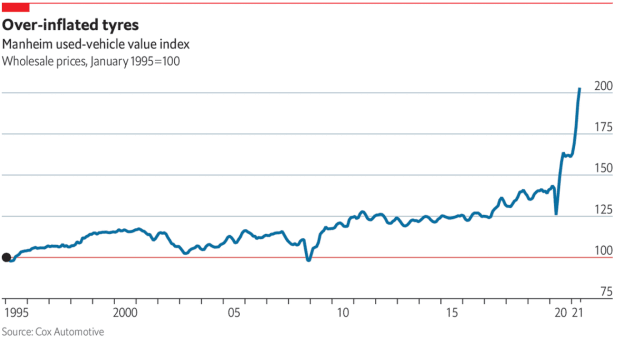

We are taught to save our wealth in U.S. dollars, which are constantly being devalued due to the Federal Reserve printing more dollar bills, especially with the MASSIVE amount printed in the past year. As inflation creeps in, the prices of nearly everything we wish to afford (cars, houses, food, etc) go up in price. We’re holding money that is devaluing while the prices of things we wish to acquire skyrocket. Double rekt.

Because we are getting double rekt, most assets have become completely out of reach for the average person. This forces people to take on debt to purchase what they need. Taking on huge debt has historically proven to be disastrous for one’s financial life. It ruins you, and it can have unintended consequences in other areas of your personal life. For example, a study found that “couples with no assets at the beginning of a three-year period are 70 percent more likely to divorce by the end of that period than couples with $10,000 in assets.” Imagine losing your significant other due to stress over money; these are life changing consequences.

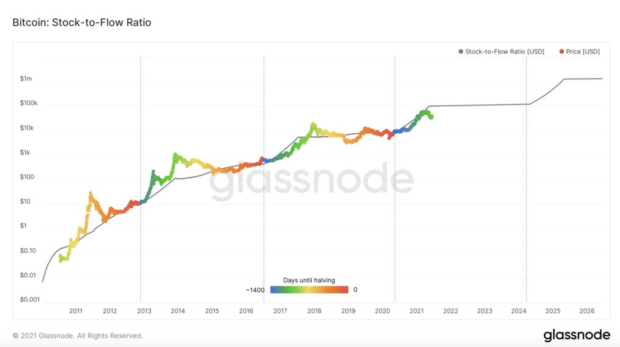

Buying bitcoin fixes this by having a set in stone supply of 21 million coins that no central bank, government, corporation, or individual can print more of. I can sleep easy at night knowing nobody is printing away my life’s savings. Over time I acquire more bitcoin, the price of BTC skyrockets, and everything around me gets cheaper. The price of bitcoin outperforms the cost of whatever I want; so now I can afford the house, car, lifestyle, early retirement, and still have money left over.

Here is the inflation on housing in my home state of Virginia via NeighborhoodScout. These numbers mean that if you’re saving in U.S. dollars and aren’t getting raises every year that beat these numbers, then you have no chance of owning a house. You need to put your money into something that outpaces this so you can buy a house and still have some left over.

Want a car to travel so you can make your life easier? Well used cars have also become much more expensive and out of reach in the last year:

The reasons above led me to diving deeper into bitcoin, and realizing how important it is that I save my wealth in the best form of money there is. I wanted something hyperinflation proof. Bitcoin, “the apex predator of money,” is the best store of value for me to safely secure my wealth, and be able to purchase everything I need without going into debt.

As Francis stated in the tweet at the top of this article, I too did not have any savings other than the $500 I had from working the summer before. So I got a job and started working like a dog to earn U.S. dollars to buy bitcoin. I haven’t stopped and don’t plan on it. And in real time my thesis above has played out to perfection. Accumulate BTC, the price goes up and outperforms the stuff I wish to acquire, and now I have the funds to purchase what I need with BTC left over. No more stress, debt, or uncertainty about my future. Now that I have nothing holding me back, I can live my life to the fullest.

As a Gen Z, bitcoin changed my life, and it can do wonders for my Gen Z brothers and sisters as well.