Why Does MicroStrategy Continue To Feverishly Accumulate Bitcoin?

MicroStrategy’s bitcoin strategy is simple: sell software, take profit and store value… just not in dollars.

On March 12, Michael Saylor, CEO of MicroStrategy, announced that the company had accumulated another 362 bitcoin, worth $15 million, adding to its huge treasury of BTC. At this point, Saylor and MicroStrategy have demonstrated to the market that they feel the dollar price relative to bitcoin is irrelevant — they will accumulate bitcoin at any price.

The strategy behind this feverish accumulation is quite simple, really. Saylor has articulated that he believes the best way forward for the company is not to do anything else other than focus on its strengths: selling business intelligence software, taking its profit and storing value… just not in dollars.

In an interview late last year, CNBC host Melissa Lee asked Saylor the question “Are you a software company or a bitcoin hedge fund?” Saylor responded decisively.

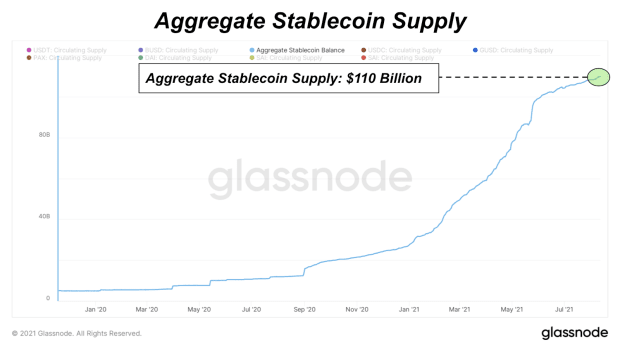

“We do have a software company generating cash, but if we simply swept the cash into fiat currency and allowed it to debase at 15 percent per year, we’d be losing as much on the balance sheet as we generated from the P&L, so that didn’t make sense,” he responded. “[Bitcoin] looks like it’s emerging as the primary treasury reserve asset for people that are looking for some way to avoid the great monetary inflation.”

Despite holding over 90,000 BTC, MicroStrategy continues to buy in $10 million to $15 million dollar clips. Since the start of this month alone the company announced purchases of 328 BTC for $15 million on March 1, 205 BTC for $10 million on March 5 and, most recently, 362 BTC for $15 million on March 12.

When one of the world’s largest publicly-known bitcoin holders continues to accumulate as much of the world’s only absolutely scarce monetary asset as possible, it begs the question:

What are you doing to stack more sats?