Why Didn’t You Sell the News of Ethereum’s Shanghai Upgrade?

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/vnZ-Veq8nIL_1EZIUunhEHOvN6s=/arc-photo-coindesk/arc2-prod/public/UO3R6YECBFGEBJASELT5ZK754A.jpg)

Daniel Kuhn is a features reporter and assistant opinion editor for CoinDesk’s Layer 2.

He owns BTC and ETH.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

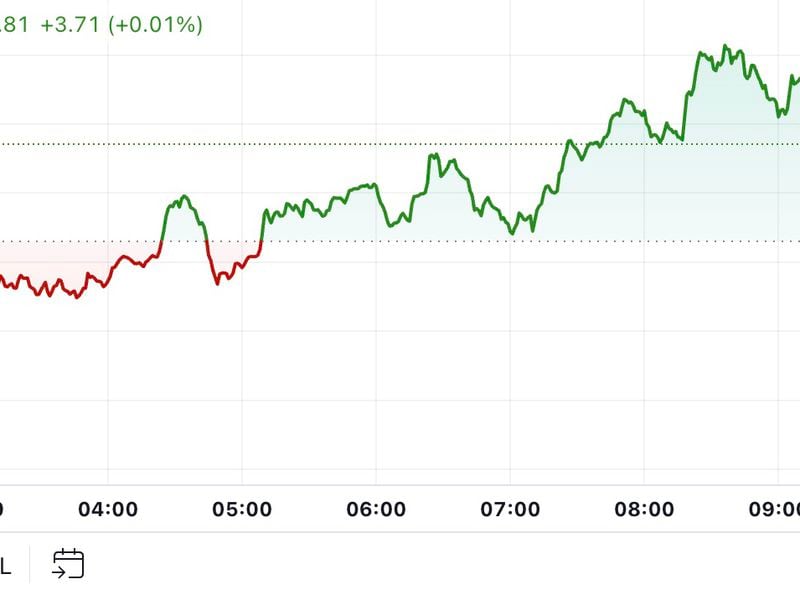

Going by the numbers, it seems like many ether (ETH) stakers have decided to hold onto their coins. Although several analysts predicted the just-completed Ethereum Shanghai hard fork (along with the separate Capella upgrade, together known as “Shapella”) would be a “sell-the-news” moment, ETH has actually climbed to eight-month highs. The second-largest crypto by market capitalization was trading above $2,000 for the first time since last summer, after gaining ~3% during trading hours in Asia.

What this says about the viability of Ethereum, and the outlook for the price of ETH, is an open question. Shanghai, the backwards-compatible hard fork, unlocked the ability for Ethereum stakers to withdraw tokens they pledged to the Ethereum deposit contract used to validate the proof-of-stake network as well as the token payments they received for doing so. Many stakers initially pledged 32 ETH to become validators in 2020, and haven’t really had access to their coins since.

This article is excerpted from The Node, CoinDesk’s daily roundup of the most pivotal stories in blockchain and crypto news. You can subscribe to get the full newsletter here.

So the 18 million-plus ETH currently staked (worth about $33 billion) has not led to a torrent of sales. Loyal CoinDesk readers likely knew the “selling pressure” on ETH was overstated. As Amphibian Capital CEO James Hodges wrote on Monday, the vast majority of ETH validators were in the red leading up to the event, making it unlikely they’d cash out at a loss. Now that crypto prices are rising, led in particular by bitcoin, which broke the important $30,000 psychological threshold this week, fortunes may reverse.

What’s most interesting for many is not how ETH tokens trade, but their synthetic counterparts known as “liquid staking derivatives.” These LSDs, as they’re often called (not to be confused with the entheogen) are essentially bearer instruments for staked ETH that allow users to trade an ETH proxy while still earning staking rewards. The biggest offerings from Lido, Rocket Pool, Frax and Stakewise all hit the market relatively recently. The question post-Shanghai is what role these assets will play.

LSDs still have tremendous value by allowing users to essentially double their holdings, for a fee. Put up ETH in a non-custodial platform and it’s still yours, along with a shiny new stETH or rETH or Coinbase’s cbETH. This makes these assets critical for creating and maintaining ETH liquidity (as well as part of the validation process). However, actual ETH has generally traded above the price of particular LSDs, in a similar way that you often see price discrepancy between a managed investment trust and its underlying assets (due to increased risk and fees).

The Shanghai update shows that Ethereum developers are continuing to successfully build out a network in real-time. Basic infrastructure is still being built on the main network, leaving opportunities for free-market alternatives to spring up in the wake. Initially allowing ETH stakers to participate in decentralized finance (DeFi), the total value locked in LSDs actually surpassed decentralized lending last month. The whole pie seems to be growing, which is good news.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/vnZ-Veq8nIL_1EZIUunhEHOvN6s=/arc-photo-coindesk/arc2-prod/public/UO3R6YECBFGEBJASELT5ZK754A.jpg)

Daniel Kuhn is a features reporter and assistant opinion editor for CoinDesk’s Layer 2.

He owns BTC and ETH.