Why Crypto Philanthropy Continues to Outperform the Market

In 2022, crypto news coverage sometimes felt like a 1970s made-for-TV movie, complete with cliffhangers, cartoonish villains and escapist melodrama. “Could one supervillain kill crypto’s glorious rise? Tune in next week to find out …”

To those on the outside looking in, the industry was getting pummeled. After months of prices trending downward, as the market felt like it was getting its sea legs back, Sam Bankman-Fried swooped in with the FTX debacle for one last kick to the knees.

Pat Duffy is co-founder of The Giving Block, a Shift4 company. He and his co-founder were also highlighted on the Forbes 30 Under 30 list in 2022 in the area of Social Impact for their work at The Giving Block.

Uncertainty like this is nothing new for crypto. We all know the cycle. Every few years, crypto is declared dead as prices drop. Traditional players stop paying attention and a silent growth phase begins as more investors and more developers enter the ecosystem.

We’re in such a phase now. But there’s one area of the crypto ecosystem that continues to grow strongly, despite the ups and downs in asset prices: philanthropy.

Last year, more nonprofits joined The Giving Block, the crypto philanthropy platform I co-founded with Alex Wilson in 2018, than ever before. More, in fact, than the record we set during the 2021 bull cycle. Through rain, sleet and SBF, nonprofits continue to march uphill to fundraise crypto.

The average nonprofit on our platform raised $26,000 soliciting crypto gifts in 2022, with some raising millions of dollars.

Motivated by the powerful tax incentive to choose crypto over cash, donors continued to reward the nonprofits that marketed their crypto options to their supporters. For the second year straight, more Google searches contained “donate crypto” than “donate stocks” because a growing number of crypto users are getting wise to asset-giving strategies. Chalk it up to the digitally native user base, or the fact that crypto remains a top-performing asset of the decade. Whatever it is, more people are going online looking to give crypto than stocks.

Today, the nonprofit sector is one of the leading industries in crypto adoption; half of the Forbes Top 100 Charities are now fundraising via crypto and non-fungible tokens (NFT). With thousands of nonprofits now involved in Web3, crypto philanthropy not only weathered last year’s storm but thrived in it.

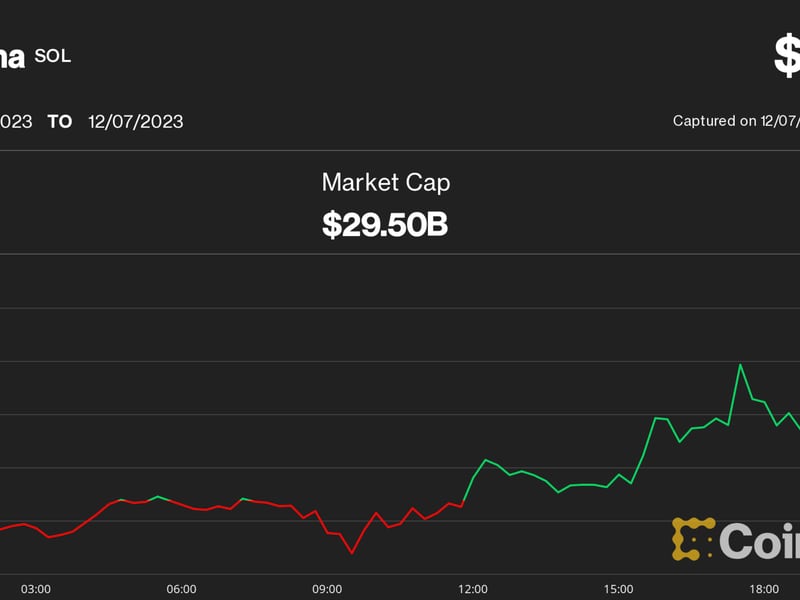

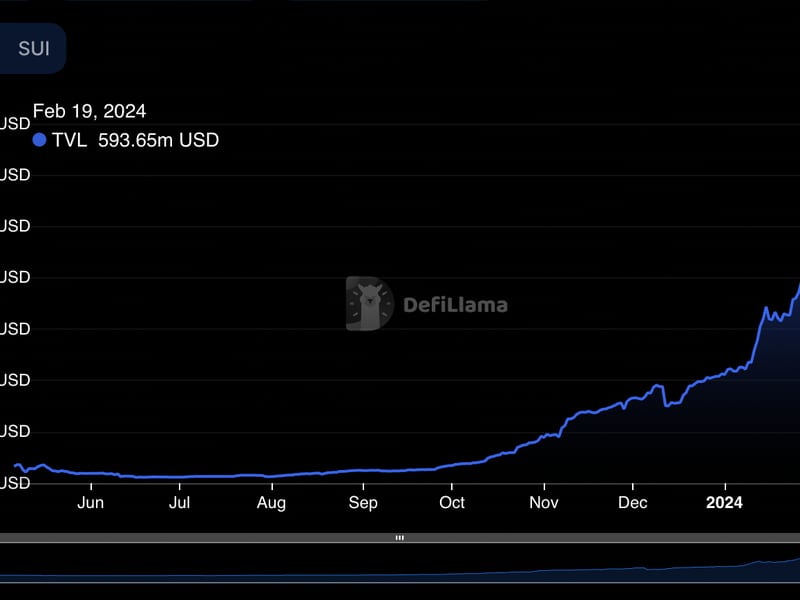

Based on the Crypto Philanthropy Adoption Index (CPAI), which compares the total in crypto donated via The Giving Block compared to the average price of bitcoin (BTC) over time, we can measure if changes in crypto giving are outperforming or underperforming the crypto market as a whole. Since we began tracking it in 2020, crypto philanthropy has outperformed crypto markets every year. In 2022, for example, crypto donors collectively gave $172 per every dollar in bitcoin’s market value, a 41% increase compared to 2021. Blending historical donation data from our platform with years of bitcoin price data, we’re also able to forecast crypto philanthropy’s growth over the next decade.

$10B in crypto donations to charities this decade

Most experts expect the crypto market cap to rise over time (although it’s roughly halved over the past 12 months). Given this expectation, it’s fair to assume that crypto philanthropy will grow as well. Taking the last three years of CPAI data, we were able to develop the first forecast for how crypto philanthropy will grow alongside the market.

Based on the last five years of bitcoin price data, charitable crypto giving is expected to drive $10 billion to nonprofits by November 2032, just on our platform alone. Today, that would mean cryptocurrency would account for about 2% of all U.S. charitable giving.

Below are other trends in crypto philanthropy that we’re watching.

Stablecoin donations reign supreme, for now

As we face another year of market uncertainty, we’ll continue to see stablecoins take donation volume market share, demonstrating the growing use of stable-value cryptocurrencies as payment methods. In 2022, USD coin (USDC) was the most donated crypto, clocking in at 44% of our donation volume. This was followed by ether (ETH) as the second-most donated cryptocurrency at 24% of donation volume and bitcoin in third place at 17% of donation volume.

Web3 philanthropy is driving the most awareness

In 2022, we continued to see NFT philanthropy and decentralized autonomous organization (DAO) philanthropy grow, proving that you don’t need to just donate bitcoin to make a difference. We predict that we will continue to see the Web3 community come together during difficult times the way they did during the Ukraine humanitarian crisis in 2022 and the earthquake that devastated parts of Turkey and Syria earlier this year.

Crypto has become the norm among leading nonprofits

Almost half of Forbes’ list of “America’s 100 Top Charities of 2022” accept cryptocurrency donations, up from just 12 of them in 2019. Of those 49 crypto donor-friendly charities, 38 of them use The Giving Block as their crypto fundraising system, including four of the list’s top five biggest charities (Feeding America, United Way Worldwide, St. Jude Children’s Research Hospital and Direct Relief).

Tax literacy is bringing more crypto donors online

Motivated by the powerful tax incentive to choose crypto over cash (in short, like stock donations, direct donations of appreciated crypto aren’t subject to capital gains taxes and may also be deducted from the donor’s overall gross income), donors continued to reward the nonprofits that marketed their crypto options to their supporters. Chalk it up to the digitally native user base, or the fact that crypto remains a top-performing asset of the decade. Whatever it is, more people are going online looking to give crypto than stocks.

For as long as millions of people in the U.S. remain incentivized to give crypto over cash, crypto will continue being a force for good in the nonprofit industry. This trend is good for the planet, but the crypto industry could see tremendous opportunities to benefit as well.

Nonprofits are starving for partnerships from companies, projects and influencers in this industry. These are the relationships that put their brand in front of one of the most valuable donor demographics – crypto donors.

The world needs reasons to see the positive impact that crypto is having. As we pick ourselves up and dust ourselves off from the FTX collapse, regulators are making decisions that will determine what the growth of crypto looks like. We have a chance in 2023 to bring the largest crypto voices together with the largest voices in the charitable sector. If that happens a lot this year, nonprofits will be more ready to solve our world’s most pressing problems, and the world will be more ready for crypto.

Edited by Ben Schiller.