Why Coinbase’s Move Into Proof-of-Stake Matters

Is Coinbase going to solve the thorny challenges of proof-of-stake (PoS) blockchain governance or centralize those systems even further?

That’s the question experts in the space are pondering with the recent announcement that Coinbase Custody will offer staking support for Maker, Tezos and Cosmos. The move means institutional investors will be able to vote on blockchain governance matters directly through their Coinbase accounts.

“We’re hoping to bring online, frankly, the majority of institutional investors,” Coinbase Custody CEO Sam McIngvale told CoinDesk. “We’re growing these three assets under custody and hoping to see an increased turnout of these votes.”

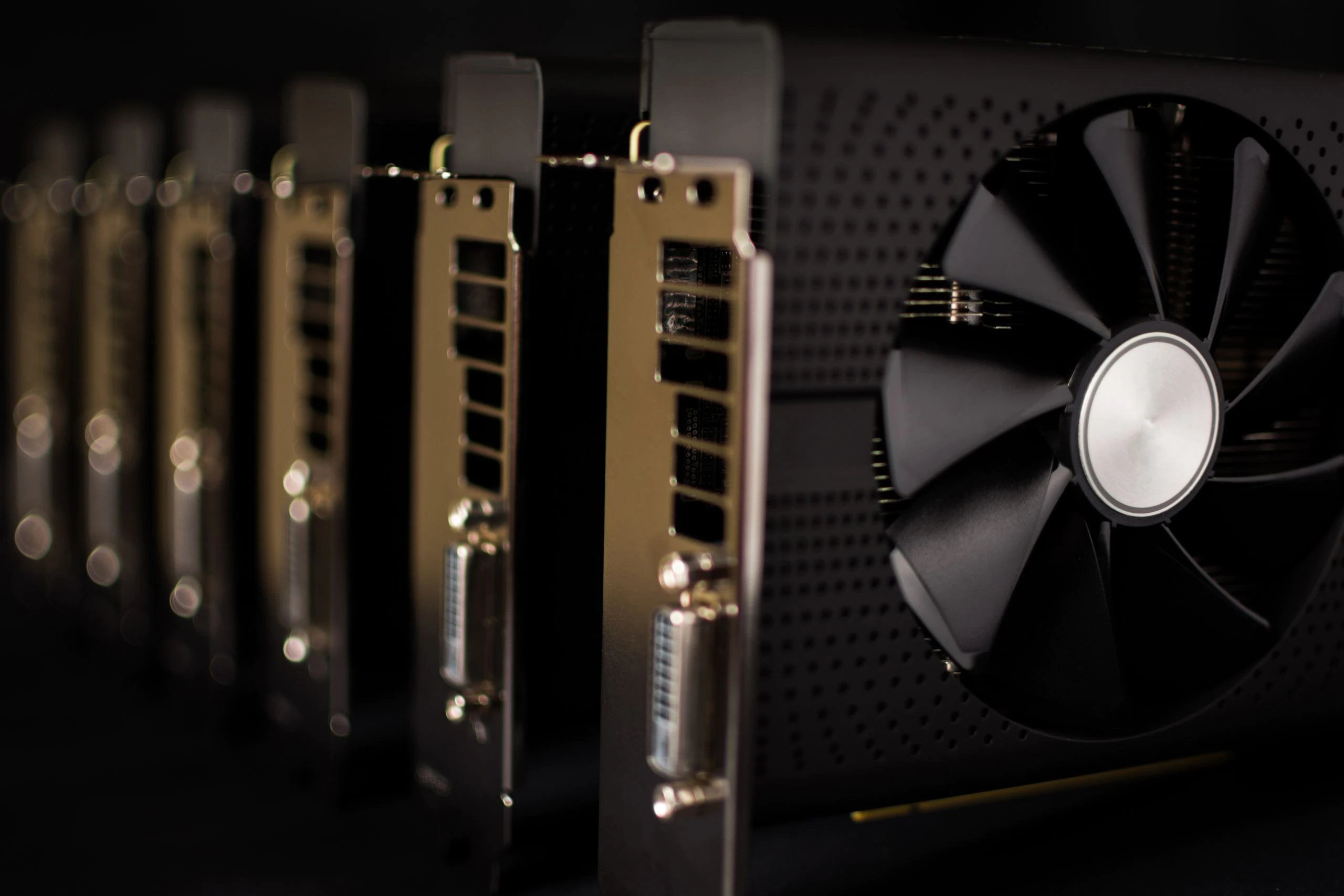

That this is possible is because blockchains like Cosmos, Tezos and Maker rely on PoS to secure their networks, unlike proof-of-work chains like bitcoin and (for now) ethereum.

PoS relies on participants essentially buying into the blockchain’s decision-making council. In backing their votes with deposits – staking their claim with real assets – they often earn token rewards for fueling the network’s growth. But, in turn, these networks are beginning to face the same challenge democracies have grappled with for centuries:

How do we incentivize voting?

Lessons from Maker

This Coinbase Custody addition was driven by institutional demand, since few PoS token holders so far are actually participating in governance.

According to Becker, nearly 10 percent of Maker tokens were involved in a recent vote to hike fees related to ethereum-pegged stablecoin loans. While cryptocurrency researcher David Hoffman estimated only 0.58 percent of unique wallets holding Maker participated, Becker told CoinDesk the turnout was high among institutional holders that are able to vote. Indeed, he said the most recent fee-raising proposal had the highest turnout to date with 61 voters.

For many institutional holders, Becker argued, compliance requirements can still complicate the logistics of using tokens to vote.

“If you’re an institution and you represent third-party investors,” Becker explained, “you do need third-party custody as extra protection, to make sure those assets are looked after in a safe manner.”

That’s where the recent move by Coinbase comes in.

On one hand, a Coinbase voting interface could boost turnout by being convenient for the largest Maker holders, including Polychain Capital (founded by Coinbase’s first employee), 1confirmation (founded by an early Coinbase employee) and Andreessen Horowitz’s crypto fund (co-managed by a Coinbase board member).

On the other, Tezos holder and veteran crypto investor Meltem Demirors tweeted that Coinbase Custody could become a “wallet-driven proxy voting platform that influences, gathers, aggregates, and reports on user behavior.”

In response, Coinbase’s McIngvale said the custody solution is a business-to-business tool for institutions, not individuals. So there is scant “user behavior” to track.

Plus, he said there aren’t currently any plans to analyze or utilize voting data, adding:

“We are here to provide support, pure infrastructure and services to enable our clients to participate in these networks however they want to. What they’re doing is not really our business. In fact, our business is to protect their anonymity as best we can, and the security of their funds.”

McIngvale said the exchange already custodies roughly 4 percent of Maker tokens, less than the 6 percent Andreessen Horowitz owns by itself. Meanwhile, the Maker Foundation, which employs MakerDAO COO Steven Becker, owns more than 22 percent of the total Maker supply and only sells these tokens to institutions that previous holders like Polychain deem to be committed to participating in governance, according to Becker.

Tendermint Inc director Zaki Manian, co-creator of the Cosmos ecosystem, told CoinDesk each of the three PoS assets Coinbase Custody will support requires a unique approach to governance options based on whether the systems automate changes, like Tezos, or merely show sentiment, like Cosmos.

Either way, governance is often inseparable from politics.

“If a big validator [staker] votes for something early, it gives that proposal a lot more legitimacy,” Manian said, adding:

“I have a thesis that they [Coinbase Custody] are going to have a hard time keeping them [stakers] because … custody is designed not to be a nimble business and staking has to be a nimble business.”

So far, staking votes have appeared to revolve around money rather than infrastructure. Comparable to semi-automated Maker votes about stability fees for stablecoin loans, the first Cosmos vote was an affirmative move toward inflation.

“It’s going to be interesting because part of the dynamics of proof-of-stake is how frequently do people just vote to give themselves more money?” Manian said.

Binance wants in

Coinbase is hardly the only giant entering the game of stakes.

On April 3, Binance’s custody provider Trust Wallet also announced plans to support Tezos staking features by the end of Q2 2019. Unlike institution-centric Coinbase Custody, retail-friendly Trust Wallet will create delegation features on the mobile wallet first, then potentially add voting options down the road.

“We’re already talking to the Cosmos people to bring that [staking] technology to them,” Trust Wallet founder Viktor Radchenko told CoinDesk. “It’s going to be all open source so that any community, like Maker, who would like to come in and have this functionality will be able to do it.”

Radchenko said he believes custody providers and wallets should offer simplified interfaces for users “to be involved in the blockchain itself” when it comes to PoS governance.

From Manian’s perspective, exchange competition will benefit stakers and token buyers.

“Binance and Coinbase are both going real hard on bringing these features to various customer bases,” he said.

Additionally, Manian said the “elephant in the room” is whether exchanges like Binance and Coinbase will offer governance derivatives – the ability to buy votes without owning the underlying assets – to retain institutional stakers as the competition heats up.

So far no exchange has announced any intention to offer such derivatives. To the contrary, Radchenko said that token holders and issuers may be too preoccupied with voting dynamics these days, given how nascent the technology is.

“We plan to bring that functionality [voting] a little bit later just because there’s less usage [than staking],” Trust Wallet’s Radchenko said. “Governance features will come a little bit later, maybe not even this year.”

As for the value Coinbase aims to offer institutional players, McIngvale said:

“We’ll work with our clients to figure out how to grow their impact as they start to participate in more and more governance processes.”

Coinbase image via Shutterstock