Why Civil’s response to its failed ICO sets an excellent example for blockchain projects

Civil, a project focused on revolutionizing journalism through blockchain technology, recently shared some thoughts on their failure to reach their $8m soft cap ICO target. The project had received lots of media attention and was already partnered with Forbes to help the magazine publish cryptocurrency related articles on the blockchain as a test pilot.

What is Civil?

Civil is a decentralized marketplace for sustainable journalism. Their protocol limits the need for 3rd parties like advertisers and centralized publishers to influence how news is created and distributed. Civil’s goal is to support independent newsrooms that are focused on producing high-quality local, international, investigative and policy journalism.

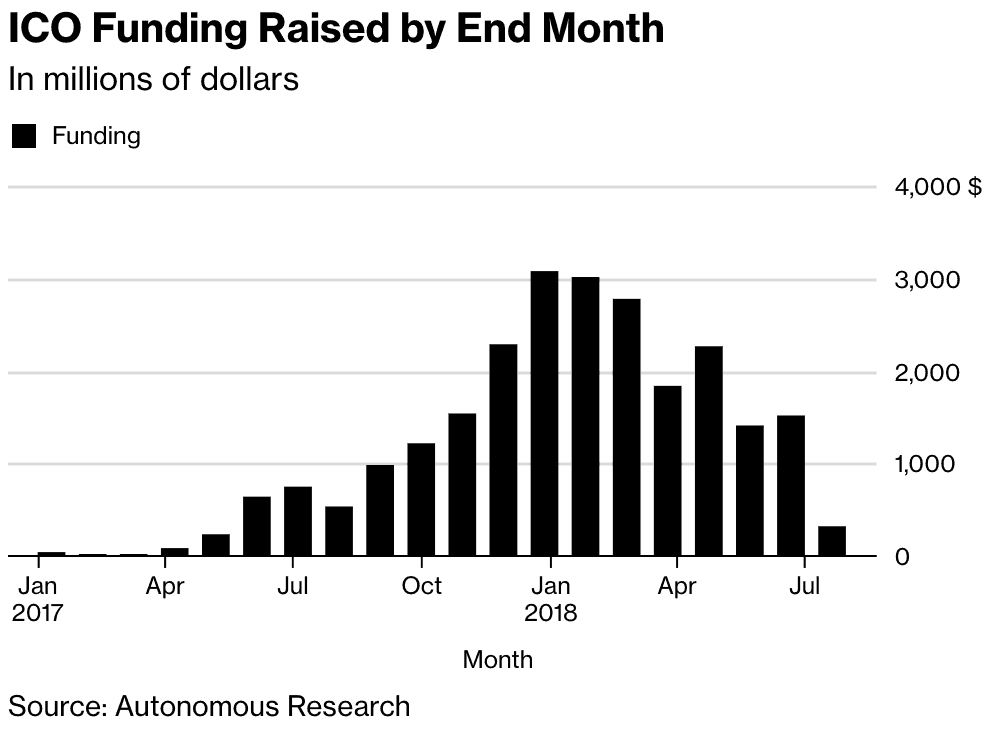

Although companies failing to reach their ICO target is nothing new, it’s clear that the current bear market has made it more difficult for sophisticated, well promoted and better-partnered projects to reach their targets. Bloomberg reported in September that ICO funding had reached its lowest point in 16 months, with just $326million raised by all ICO’s in August.

Retail investors have become more skeptical about whether they can earn profits from investing in ICO’s. As long as the crypto markets remain unregulated, and frequent reports about failed blockchain projects continue to surface, ICOs will likely continue to have a hard time replicating the success of 2017.

Despite the failure to reach their target, Civil’s blog post sets an excellent example of how blockchain projects ought to respond to failed ICO raises. The company acknowledged and thanked the “Nearly 3,000 people who were willing to jump through the hoops required to buy CVL tokens”. They stated that they would be implementing a “newer, much simpler token sale” in the near future, and provided CVL token buyers with the option to opt into the new sale, request an immediate refund, or be automatically refunded by October 29. The company also ensured their followers that they were well funded to continue pursuing the project despite the ICO setback.

Plan B for failed ICOs

In a climate where most failed ICO projects simply disappear or scramble to come up with a plan B, Civil is displaying a unique level of transparency and planning that should be expected from all companies, especially those committed to increasing transparency in industries like Journalism and Banking.

The Civil community is still supporting them, as many investors even offered to have Civil keep their funds despite not reaching the soft cap target.

Although details on the new, more straightforward token sale have yet to be disclosed, the commitment from members of the Civil community should only help the team succeed in hitting their soft cap target during their next public fundraising round.

The post Why Civil’s response to its failed ICO sets an excellent example for blockchain projects appeared first on CryptoPotato.