Why Circle’s USDC Is Dumping Tron

Circle apparently thinks Tron isn’t up to snuff. On Wednesday, the major stablecoin issuer announced it will cease minting on the layer-1 blockchain effective immediately — the first move in a “phased transition” to completely vacate the network founded by Justin Sun, who faces legal challenges in the United States.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

“As part of our risk management framework, Circle continually assesses the suitability of all blockchains where USDC is supported,” the company wrote in a statement. It added the decision came after an “enterprise-wide” effort to “ensure that USDC remains trusted, transparent and safe.”

The move may come as a surprise to some given that Tron, known for its comparatively low fees and quick settlement times, is home to a booming stablecoin business.

Since at least 2021, there has been more tether (USDT) on Tron than on Ethereum, driven by the popularity of using Tron-based USDT to move funds between exchanges and growing use for consumer purchases in developing markets.

Circle hasn’t said much about its “enterprise-wide” review, apparently involving the company’s compliance and corporate divisions. It is not clear, for instance, whether this is a reactive move involving Tron-related security concerns, or a preemptive move meant to get ahead of potential legal hangups involving Tron and its celebrity founder Sun, 33.

Pulling up the drawbridge between Circle and Tron may be the latest sign of a growing divide between regulatory-compliant crypto firms (or at least those that signal compliance friendliness) and black, or gray, market crypto use. Binance, for one, sued by the Department of Justice, delisted USDC some years ago, without clear explanation.

The lines in the sand between white, gray and black market uses are not fully clear, and ever-shifting. But indications of this are everywhere, including Coinbase and Kraken’s unprompted decisions to delist privacy coins, or the rising number of know-your-customer (KYC) requirements meant to improve surveillance of crypto flows.

Saying Justin Sun is a controversial figure shouldn’t itself be controversial. In March 2023, the SEC accused Justin Sun of committing securities fraud by fraudulently inflating TRON trading volumes and misleading investors through undisclosed celebrity endorsements — charges Sun said are baseless. This is to say nothing of the rumors floating around about the former Grenadan diplomat.

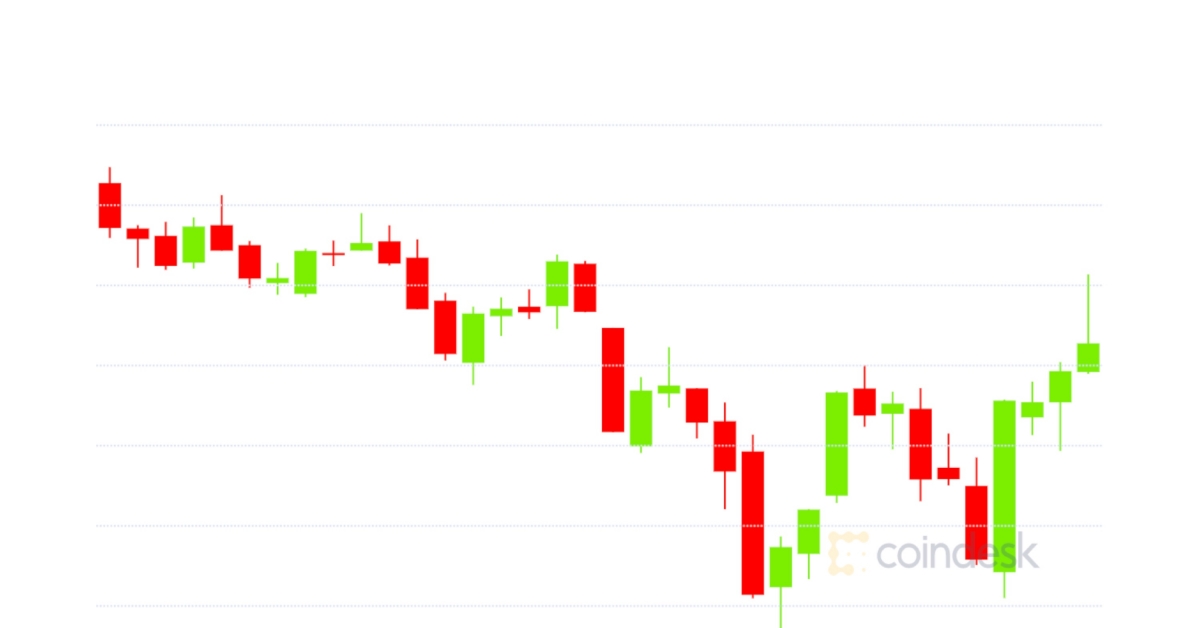

That said, Circle’s move could say more about USDC than it does about Tron. Up until last year, the growth of Circle’s stablecoin, USDC, was accelerating and looked set to outpace its primary competitor, USDT. But due to a confluence of factors, including rising interest rates that have benefited USDT more than USDC, and a destabilizing (though short-lived) depegging event in early 2023, Circle has been giving up ground.

The company prides itself on being the regulated, compliant and transparent answer to Tether, which has been shrouded in intrigue since its inception. Circle filed initial paperwork for its second attempt at an initial public offering in January, meaning it is likely in active conversations with the U.S. Securities and Exchange Commission (SEC) during the agency’s review process.

This was not the first step Circle took towards divorcing Tron, one of the 11 blockchain networks supported by USDC. In a letter last fall, in response to allegations USDC was used in terrorist financing, Chief Strategy Officer Dante Disparte claimed Circle terminated accounts belonging to Justin Sun and his companies months earlier, in February 2023.

It’s not clear why Circle cut off Sun at the time, though Disparte’s statement was in response to a Nov. 9 letter from the nonprofit ethics group Campaign for Accountability, which claimed Circle had extensive ties to the Tron Foundation and the cross-chain protocol SunSwap, which was accused of facilitating money laundering. That same month, Reuters reported that Tron had overtaken Bitcoin as the go-to platform for terror organizations.

Is Circle acting with an overabundance of caution? Is it trying to protect its reputation by decoupling from some of crypto’s more unsavory elements? How well does the world truly understand Sun? Is this part of an overall realignment in crypto, where certain “regulatory-forward” organizations will close ranks — whether justified or not?

Taking a page out of convicted felon Sam Bankman-Fried’s book, who feigned interest in compliance while defrauding the world: maybe the expected value is worth the costs. While nearly half of all circulating tethers trade on Tron (~$50 billion), only $335 million out of the total $28 billion USDC in circulation are currently on the network.

How conscious is that coupling?