Why Chamath Is Wrong About Inflation

Recent comments from Chamath Palihapitiya indicate that he doesn’t understand how inflation or monetary sovereignty really work.

While billionaire Chamath Palihapitiya has been an early, vocal proponent of Bitcoin for nearly a decade now, his grasp of Bitcoin’s ethos seems to be fraying. Setting aside his recent snafu with Bitcoin veteran and advocate Surfer Jim, Chamath doesn’t seem to understand principles of inflation, wealth inequality or their historical context.

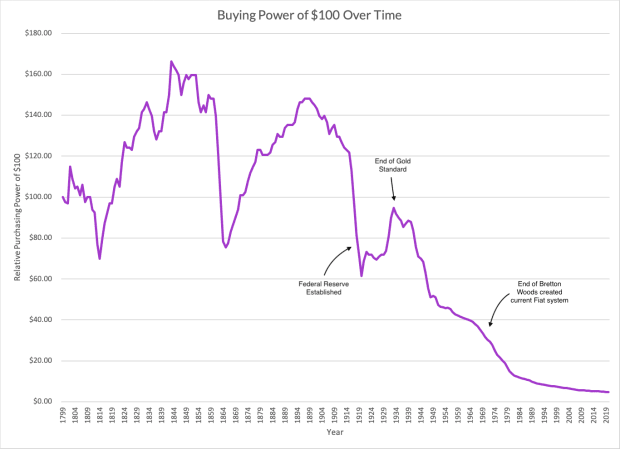

When Lyndon B. Johnson enacted the Great Society programs of the ’60s to alleviate poverty and elevate the general well being of Americans, the world still operated on a gold standard. The government couldn’t print trillions seemingly out of thin air to finance its spending. Today’s world is a stark contrast.

Now, the government can create new money to finance expenditure, bail out corporations, and airdrop USD to people’s bank accounts. Such spending has doubled the USD money supply in the last decade, leading to warranted concerns about inflation. But listen to what Chamath says about inflation on a recent episode of “All In Podcast”:

“Inflation is a phenomenal way to decrease people’s richness… it makes rich people poorer… The one consistent way to redistribute wealth is inflation.”

Chamath is unequivocally wrong. Inflation is one of the biggest drivers of wealth inequality for two reasons: the Cantillon effect, and the debasement of savings for the 45 percent of Americans who don’t own financial assets.

The Cantillon Effect, Inflation And Wealth Inequality

A litany of literature has been written by economists, Bitcoiners and even us on the Cantillon effect and how it pertains to inflation and wealth inequality. In a nutshell: When new money is created, it doesn’t affect all parts of the economic spectrum equally. Increasing the money supply doesn’t benefit the average person in the same way that it benefits wealthy people.

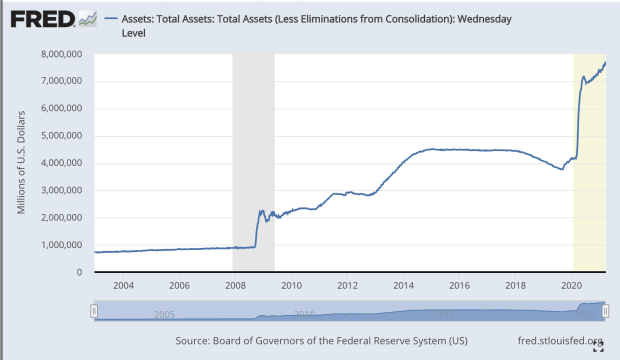

As Richard Cantillon theorized over three centuries ago, newly-created money first floods into the hands of those closest to the government, and eventually a few small droplets trickle down to the everyday layman. Isn’t this what we just saw twice? The Federal Reserve’s balance sheet increased by trillions. Airlines, hedge funds and corporations got hundreds of billions of dollars and we got… three checks over the course of a year totaling to $3,200?

And who pays for these bailouts totaling 20 percent of the country’s GDP? The factory worker living paycheck to paycheck to put food on the table. The nurse putting away a few hundred bucks a month into her son’s college savings account. How? Money printing causes inflation, which debases people’s savings.

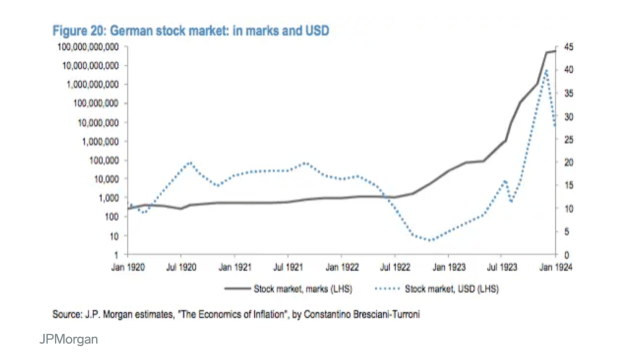

When inflation hits an economy, it first shows up in increased commodity and asset prices. Dave Portnoy isn’t wrong, stonks only go up, but it’s because there is an “infinite amount of cash in the Federal Reserve” that finds its way into financial assets. Weimar Germany’s hyperinflation was prefaced with a massive stock market bubble:

Note the log scale on the left to denominate nominal prices in Deutsche marks.

Through all historical periods of inflation, assets inflate first, then consumer prices inflate and then, eventually (if ever), wages inflate. When assets inflate but wages stay stagnant, investing in markets becomes more inaccessible to everyday people, but the rich get richer as stocks rocket to the moon. When consumer prices go up but wages stay stagnant, the least wealthy suffer the most. The dollars they’ve saved up little by little buy them fewer goods and services.

Inflation isn’t a way to take from the rich and give to the poor, it’s quite the opposite. Inflation makes rich people richer through asset inflation, and makes poor people poorer through consumer price inflation.

So, What Actually Happened In The 1970s?

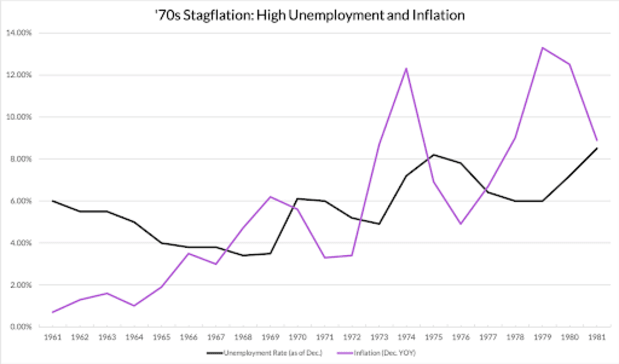

Bringing this back to the example Chamath initially brought up: the 1970s, aka, Stagflation.

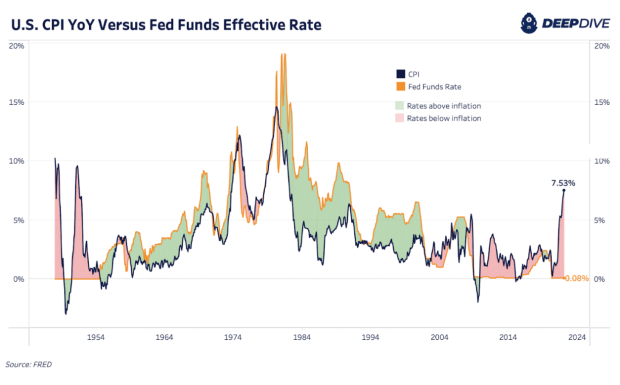

Consumer price inflation spiked up to 20 percent annually in the ’70s for two reasons. First, geopolitical events related to the oil crisis caused a supply shock. Second, we abandoned the gold standard and established the fiat standard, which gave central banks around the world the ability to create unlimited amounts of money, causing inflation.

Inflation was high, and wealth inequality was relatively low, but the former didn’t cause the latter, and even if it did, it certainly wasn’t a good thing. The reason wealth inequality was low was because everybody was having a tough time. The ’70s had one of the highest rates of unemployment in recent history, and prices rose significantly while growth and wages stayed stagnant (stagnation + inflation = stagflation).

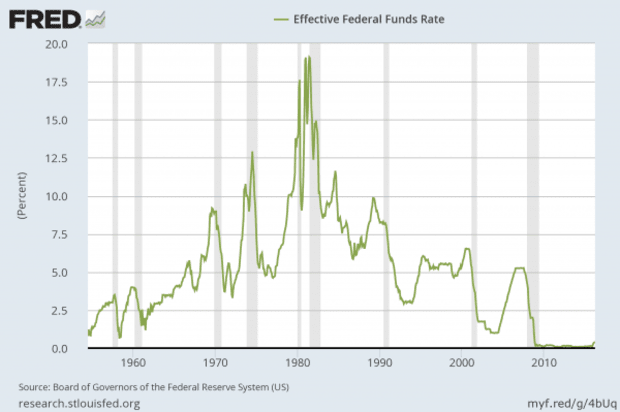

To combat this, former chair of the Federal Reserve Paul Volcker raised interest rates to 20 percent at the end of the decade, sending the country into a recession. Equity prices went down as treasury yields rose, and most people who owned stocks suffered. And everyday folks, out of jobs with little in savings, suffered far more as their money had less value and purchasing power.

Stagflation was a miserable time for most Americans. To imply that both wealthy and poor people suffering is good because they’re somewhat equal is preposterous. Perhaps Chamath knows all of this, and chooses to misinform his 1.4 million followers? Given Chamath’s exposure to both bitcoin and his heavy involvement in U.S. equities, both of which would benefit from inflation, this could make sense. Regardless of his motives, Chamath’s comments on inflation and wealth inequality are wrong. Inflation causes wealth inequality. Well… what now?

Bitcoin: A Fair, Open Monetary Network

Not to beat a dead horse, but Bitcoin fixes this. Bitcoin was purpose-built to solve the problems of central banking and fiat money.

Bitcoin is an open monetary network, and a monetary asset that nobody can control. The rules of the network promote free markets, monetary sovereignty and a financial system that works for everybody. Regardless of if you’re a whale with hundreds of bitcoin, or you’re just getting started with stacking sats, the same rules apply to you:

- 21,000,000 bitcoin fixed supply

- All transactions are broadcasted openly to the network

- All transactions are immutable and irreversible

- Mining difficulty adjusts every 2,016 blocks to ensure an average 10 minute block time

- Block reward is halved every 210,000 blocks to maintain supply schedule

Nobody can change these rules to suit their needs. Nobody can create more bitcoin and distribute it how they see fit. It’s uncensorable and unconfiscatable.

Because of these properties, millions of people are exiting the fiat monetary system that works for the wealthy, and entering a bitcoin-based monetary system. They store their wealth in bitcoin, because finite supply ensures that value only increases over time. They use it for payments because it’s Lightning fast, pseudonymous and permissionless. They use it as a unit of account because they believe it will be the next global reserve currency.

Yes, as Chamath says, bitcoin is a hedge against the current financial system and “schmuck insurance,” but it’s so much more than that. It’s an entirely new form of money, and nobody fully understands how meaningful it is for all of us.

Bitcoin severs the link between governments and the creation of money. Bitcoin can mitigate the impacts of the Cantillon effect.

Bitcoin presents the opportunity to reimagine the way we interact with and store value. Millions of Bitcoiners have started to live their lives on a Bitcoin standard. We’re building Ryze to help them optimize their finances for Bitcoin while helping their friends and family learn about and transition into a Bitcoin-native financial system.

Sources:

- CBPP

- “With A Bang, Not A Whimper”

- Alpha History

- Federal Reserve History

- CBO

- The Week

- Equitable Growth

This is a guest post by Abhay Aluri. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.