Why Bitcoin’s ‘Monetary Maximalists’ Oppose ‘JPEG Enjoyers’ (and Why They’re Wrong)

In the nether realms of crypto-Twitter/X, there is a brewing civil war between the “monetary maximalists” and “JPEG enjoyers.” While the Bitcoin network is limited in its storage capacity, the threshold for confirming transactions of any kind whether monetary or any arbitrary data from things like Ordinals inscriptions and meme coins is actually quite limited within each block.

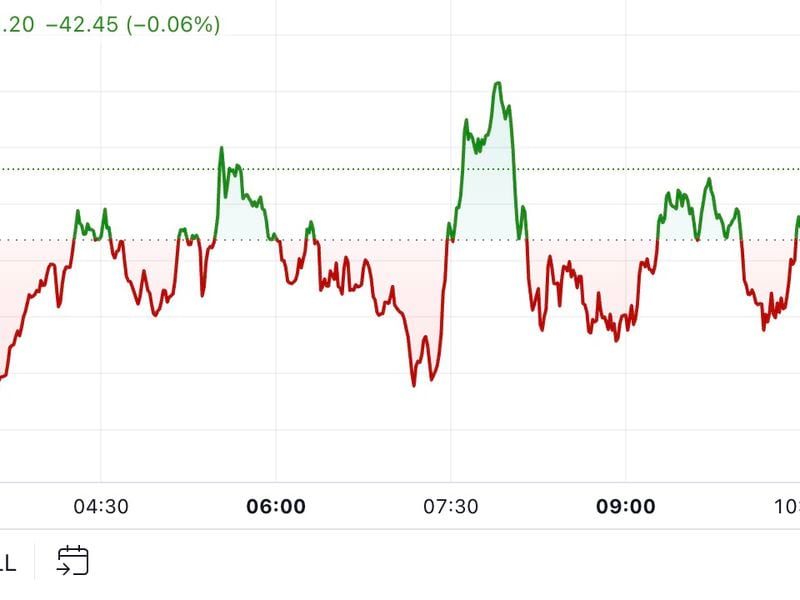

The mempool can become congested relatively quickly and drive up fees for all users.

This op-ed is part of CoinDesk’s “Future of Bitcoin” package published to coincide with the fourth Bitcoin “halving” in April 2024.

Taras Kulyk is the founder and CEO of SunnySide Digital, Inc.

Herein lies the conflict: is Bitcoin open to anyone for any purpose? Or did Satoshi Nakamoto have an intended purpose for his creation, which should be accounted for when deciding who can use Bitcoin and how?

It turns out there are heavy consequences and tradeoffs for both paths. As the saying goes, “Bitcoin is for enemies,” and we are finding out just how true that is. Here is why the Battle over Block Space is worth fighting, and why the question remains who will ultimately obtain the spoils of war.

The monetary maximalist perspective

To begin, the title of the white paper is “Bitcoin: A Peer-to-Peer Electronic Cash system,” allowing for “online payments” to be sent directly from one party to another without going through a financial institution. It makes no mention of file storage. On the surface, this might feel like enough precedent to legitimate monetary transactions only (some treat it as scripture). However, Satoshi himself made an inscription on the Genesis block with the famous headline from The Times in 2009 that read “Chancellor on brink of second bailout for banks.”

The takeaway here is that invoking WWSD (What Would Satoshi Do?) or reapplying what he has done or said in the past via email is a losing battle. Putting aside some of the apparent contradictions between what Satoshi himself sometimes did and said, the core argument for Monetary Maximalism is that Ordinals inscriptions and BRC20 tokens spam the blockchain and abuse the current rule set. They could be considered a kind of DDOS attack. Or worse, a grift.

In short, why focus on meaningless, fun-for-some pet JPEGS (often with VC ties) on Bitcoin when the real aim is revolutionizing global money, value storage and peer-to-peer payments. Using Bitcoin as file storage, which is predominately done in wealthy nations, is pricing those out in developing countries that rely on bitcoin for day-to-day transactions. It might even push out new entrants that notice how high fees are, forcing them to explore cheaper options as new users typically won’t understand L2s like the Lightning Network — this might be their one shot at giving bitcoin a try.

What’s more, given the block size limitations on the Bitcoin blockchain, data / file storage doesn’t scale on the protocol. The only way to scale file storage is to make the system more centralized (which is arguably why Ethereum switched to proof-of-stake) and that is obviously a fast track to obsoletion.

I fundamentally believe what’s good for miners is good for Bitcoin.

And yet, there are very real benefits in the near term for storing more data on-chain, like higher fees for miners, taking market share from other chains and encouraging expressivity and development, among other things.

Ordinals: magically growing fees, usage and fun

Inscriptions, whether you hate them or love them, have helped jumpstart a fee war, comprising 21% of all fees last year. While it’s true that inscriptions have helped ignite a competitive transaction fee environment (the peak of the inscription craze in May was $18 million), regular daily transaction fees have amounted to $13 million. Miners even saw fees double the block reward multiple times last year thanks to inscriptions. Ordinals are also responsible for the largest block and largest transaction in Bitcoin’s history. That’s no small feat, and as someone who’s deeply involved in the digital mining ecosystem, I fundamentally believe what’s good for miners is good for Bitcoin.

A healthy and lucrative fee war, whether they are monetary transactions or ordinals, is unarguably positive for miner revenues in what is proving to be a cut-throat capitalistic industry.

What’s more, the top two noncustodial bitcoin wallets (Unisat and xverse) by active users are both Ordinal/BRC20 wallets, with each growing over 30% month over month. What got us here might not be the same thing that is going to get us to where we need to go. In order to reach that level of adoption, the ideology in its current form will have to evolve. The goal is to be the predominant blockchain for everything that, at this point in time, is currently siloed on different protocols.

The gravitational force of Bitcoin, by way of engaging fun, cultural and technological movements as found in ordinals, NFTs, etc., will also benefit everyone who owns and is passionate about Bitcoin.

When it comes down to it, Bitcoin is about economic incentives only, not altruism. While it’s true the high fees will prevent others from transacting on-chain, it could be argued that this is exactly what it’s all about: free market forces.

Hate it or ignore it

The fact of the matter is, if you’re a monetary maximalist you could probably get away with ignoring ordinals and be just fine. They’re accelerating Bitcoin adoption and a healthy fee market for blockspace in the near term, and long term are likely to be priced out entirely and pushed to other layer 2 or sidechain solutions.

Naturally, Bitcoin, as the monetary network we all believe it will be, will eventually price out all uneconomic transactions regardless.

The network was built from a security model standpoint to bake in higher fees, so the argument that a spike in fees now is bad for Bitcoin later is nonsensical. My take: ignore the noise, let this trend play out, and of course — stay humble and stack sats.

Edited by Daniel Kuhn.