Why Bitcoin Can Save Us From Inflation

In a world where capital misallocation is rampant, the sovereign store of value that is Bitcoin offers hope.

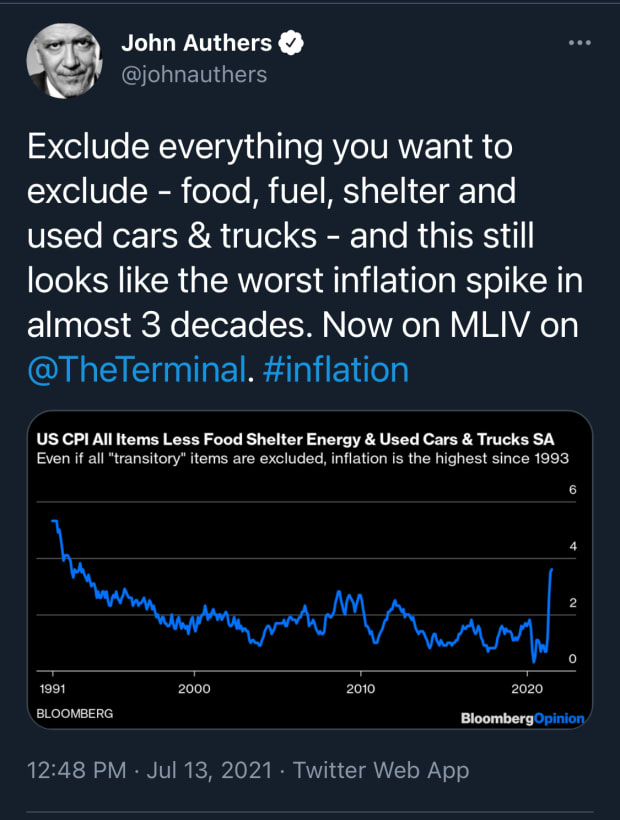

On July 13 at around 8:30 AM EDT, the Consumer Price Index (CPI) report for the month of June dropped. According to the report, consumer prices rose 5.4% this June 2021 from last June 2020. This was the biggest monthly increase in prices since August of 2008. Real wages were or have been negated by these price increases. The cost of things you use and need every day are going up. #Inflation is now trending. Part of the spike in the CPI numbers is due to the massive supply and demand shock the global economy has experienced in the last year. This makes sense considering that the U.S. doesn’t manufacture much anymore.

I feel that I should briefly explain what exactly inflation is because CNBC and Bloomberg will lie to you.

We’ve been taught that inflation is simply the increase of prices. This is a common definition for inflation that you’ll come across. To a certain degree, yes, inflation is the steady rise of prices over time, but this is akin to going to an orthopedist and saying you have a torn hip labrum. Well how did you tear your hip labrum? We gloss over the acute cause of inflation which is … drum roll please …

In all seriousness, the vast majority of US money supply is digitally made through a computer. There is an infinite amount of cash at the Federal Reserve. Let me show you a chart that only goes up because of that.

This is a chart of the Federal Reserve’s balance sheet. What’s going on here?

The Fed controls the money supply in the U.S. and buys assets that go on the balance sheet. In 2006 the balance sheet was at just below $900 billion. In 2008 during the Great Recession, we had the balance sheet shot past $2 trillion. As of June of 2021, there are about $8 trillion dollars worth of assets on the balance sheet. The Federal Reserve has essentially expanded the balance sheet by a multiple of 10! This has boosted asset prices across investment vehicles.

The increase in the supply of money in an economy drives asset prices as well as consumer prices. Assets have, since 2008, appreciated in price. This includes bitcoin as it is currently being monetized (as in being utilized as a money) by retail, institutional investors and even nations such as El Salvador. Stocks, specifically the S&P 500, hit all-time highs almost every other day.

Since the March 2020 sell-off, the S&P 500 has gained approximately 100%. For every dollar you would have put into this index, you got $2 in return. The Fed injected unprecedented amounts of liquidity into financial markets and the consequences have been higher asset prices.

Inflation in government-issued currencies is rampant around the world, and has only shown signs of increasing. 35% of all the U.S. dollars ever printed by the government were printed between March and December of 2020. Dollars are melting ice cubes. There is a startling statistic that approximately 47% of Americans have no assets. They are getting hurt by this money printing, eroding their stored value versus those that are investing.

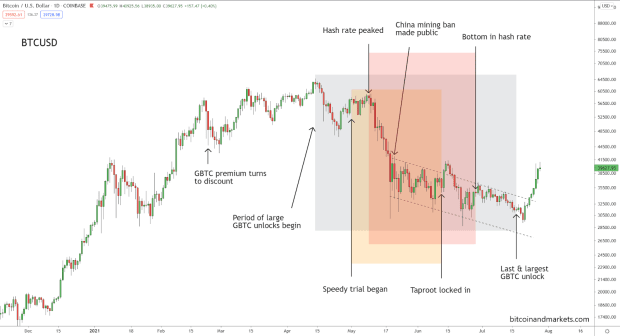

As I stated before, bitcoin is not exempt from the monetary inflation we are witnessing. In fact, it has benefited greatly from it. There are, however, key distinctions between bitcoin and all other assets that I’d like to point out.

It is the most accessible asset ever created since it was designed for a digital world.

The Bitcoin protocol is secured by tens of thousands of nodes distributed all across the globe. Because of this, the network maintains uptime and is resistant to any single point of failure. Anyone and everyone can participate in and secure the bitcoin network.

It is the first asset in existence whose supply is strictly limited. No matter how many people join the network, how much the value rises, or how advanced the equipment is that mines it, there will never be more than 21 million bitcoin in existence. If anyone attempts to raise the supply, they’d have to go through tens of thousands of full nodes. Due to the strict limitation in supply, there is no technical possibility of increasing its supply to match an increase in demand. In this way, bitcoin acts like a whole new asset class and may be one of the most efficient forms of a store of value ever seen. Bitcoin implements a far more superior monetary policy through code than central bankers in suits.

Since the inception of government issued currencies, nations across the globe have been plagued with unlimited printing by irresponsible governments. The current system is not designed to succeed, but rather to delay its ongoing and inevitable destruction.

Let’s do a quick math problem:

What is ∞/21,000,000?

This is a guest post by Paul Opoku. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.