Why Author Brady Dale Is ‘Drowning’ in Sam Bankman-Fried

I am drowning in Sam. He’s everywhere, and unlike any other CEO after a comparably colossal unwinding, he’s not coming at me indirectly, via journalists searching out his history.

No, this deluge is him. He won’t stop. It’s as if he can’t stop, I want to get to get the story of FTX down, but how can anyone discern it through all the noise that is him: that Sam Bankman-Fried? That is SBF: That nasally, excessively informed voice that just won’t stop offering his version of events in his extra-qualified statistically tinted mysticism.

These words are coming to you from somewhere around the halfway point of writing this book. It’s December 1, 2022. Tonight, as my workday at Axios, the internet-native news site, was ending, I was trying to make some time do a little bit of research in companies that one of his companies, Alameda Research, has backed, but then I got a message on our Slack that SBF, the boy wonder who lost several billion dollars in crypto wealth, was doing a Twitter Spaces. For those blessedly adrift from the gravity of Twitter, Spaces are where a few people can go online and talk with each other, no video, just voice, while dozens or hundreds or thousands of others just listen, interacting only with a few emoji. Spaces has become a big way for big accounts to broadcast. And SBF, since late November and here in early December 2022, was all about broadcasting.

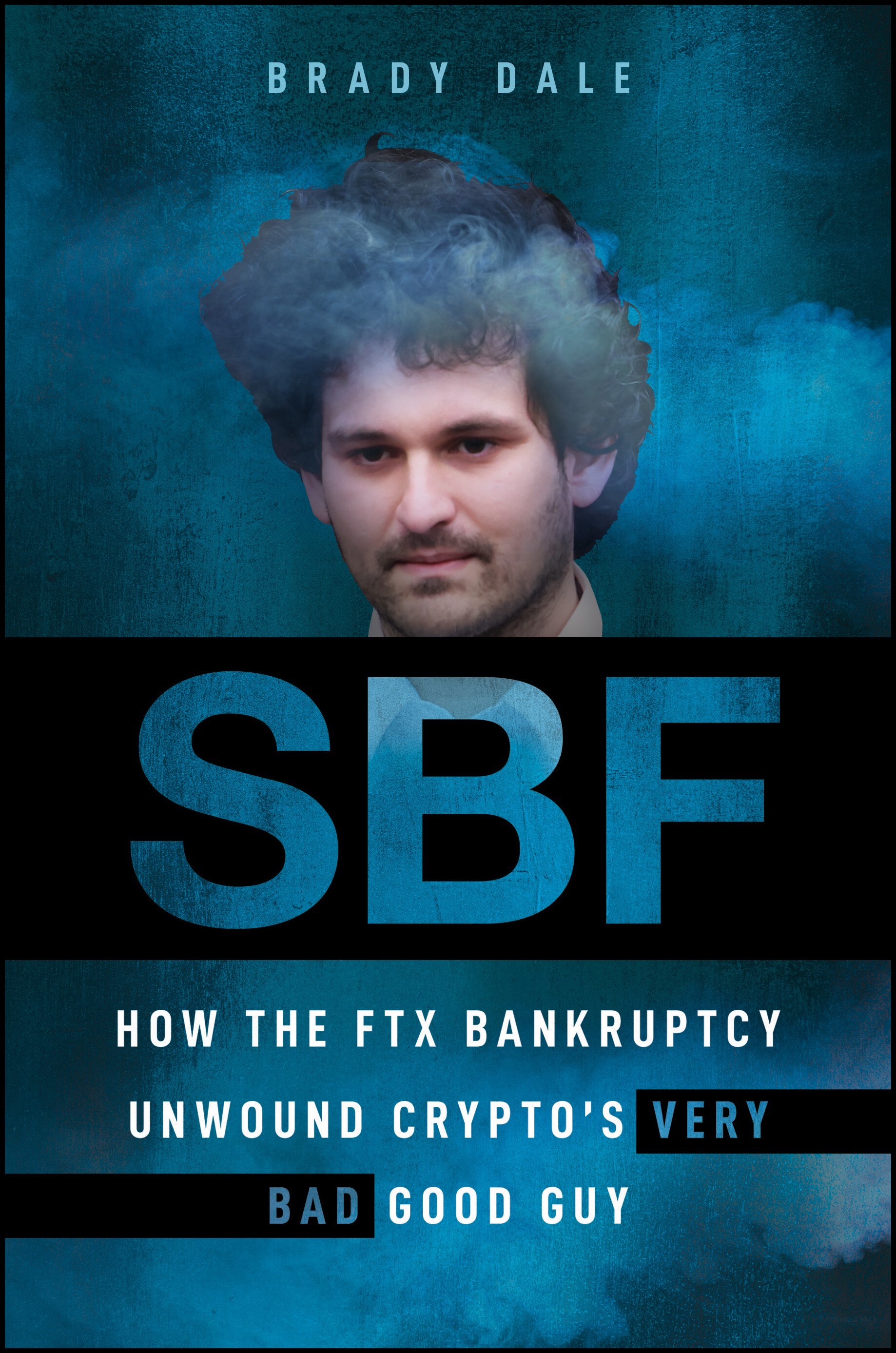

Author Brady Dale said he wrote the majority of his recently published book in the weeks following the FTX collapse. (Wiley)

That was after SBF had made a morning show appearance with George Stephanopoulous, which I haven’t then watched yet. And after a New York Times internet broadcast with Andrew Ross Sorkin, which I also haven’t watched yet. I am the only person I know in the media who hasn’t watched. I am too busy writing this book to watch a thing I knew would be that will there when I am ready. I plan to watch it later. But now he is talking again, to some random faux-investigators on Twitter in a wannabe Barbara Walters grilling I just have the misfortune of hearing.

I listened to a little of the Spaces, but it was more aggravation than information. There was too much of him. I’m drowning.

Sam will not stop coming. People say this deluge is the masterpiece of public relations plotted out by warlock-level flaks inducted into issue control dark arts.

But this view comes from witnesses of PR, perhaps its clients. This was not PR. PR is the sandstorm in which I’ve built my home. It’s pointless pellets of banal sameness, a maelstrom in which I have to inhale a few breaths of trustworthy observations. PR has a taste and a smell of risk aversion. What SBF was doing was not that.

This was him. This torrent sprung from his need. This was all Sam.

Chapter 1: I want to believe

Sam Bankman-Fried offered a story that you wanted to believe. The talkative boy billionaire who would turn the wealth creation engine of cryptocurrency into a robber baron’s war chest with which he could fix the world.

He would be like Andrew Carnegie with his libraries, and who doesn’t like those libraries? There was one in my tiny little hometown in Southeast Kansas. It’s beautiful.

But Andrew Carnegie paid for those libraries in part by –– for example –– hiring thugs to bust unionized workers trying to negotiate a better contract. Not great stuff, as it goes. Some of our grandparents paid for those libraries in lost wages.

But SBF wouldn’t spin up a war chest from anything nasty like air pollution–belching factories and life-threatening working conditions. SBF’s war chest would be created off the internet, scratching wealth off like solid gold paint flecks from space money bouncing around something called a blockchain. Far from creating industrial scars in people’s backyards, blockchains don’t even seem real!

So if a good guy could come along and make his wealth off that and help a whole lot of people with that money, where would that harm be?

It was an appealing way to see SBF. A lot of got sucked into it. I got sucked into it ––I believed that he believed the story he was telling. Bonnie Tyler sang it out in 1984, and we all feel today just as he did then: we’re all holding out for a hero.

Let me ask you this question: What if we are all in fact better off for the fact that SBF never got a chance to take a crack at really going to town saving the world?

What if he was the very last hero anyone needed?

What if, in fact, the lesson of SBF is this: the last thing anyone needs is a hero.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/1ebe8652-6a3d-4ba2-aea1-2d439490b248.jpg)

Bradley is the author of SBF: How The FTX Bankruptcy Unwound Crypto’s Very Bad Good Guy

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/1ebe8652-6a3d-4ba2-aea1-2d439490b248.jpg)

Bradley is the author of SBF: How The FTX Bankruptcy Unwound Crypto’s Very Bad Good Guy