Why Anthropologists Are More Interested In Bitcoin Than Economists

Mainstream economists are renowned for bashing on Bitcoin. Anthropologists, on the other hand, are becoming more interested in it. Why?

I am an anthropologist and economist who went down the Bitcoin rabbit hole. I wrote this paper to clarify my thoughts about why these two disciplines respond so differently to Bitcoin.

What Is Anthropology?

Anthropology is a social science that is concerned with understanding culture through participatory observation, or ethnography: cultural immersion in the social worlds being studied. This research method is at the heart of the discipline, and it forces practitioners to “get out there,” to expose themselves, and to experience the culture being studied as a local.

This might explain why anthropologists often end up in heated debates with economists, who instead understand the world through numeric aggregates and abstract models. Mainstream economists take a top-down view of the world based on deductive reasoning stemming from their models and assumptions, which are heavily influenced by classical Newtonian physics and its notion of “equilibrium of the heavenly bodies” and lack the “systems perspective” that emerged from thermodynamics and influenced engineering (Alizart, 2020).

In contrast, anthropology, which involves both deductive and inductive logic, is mostly focused on the latter. Observed and experienced real-life evidence leads to the formation (and recalibration) of theoretical frameworks: first comes the evidence, then comes theory, and so forth (more on this in the Limitations section).

Another key element of anthropology is its concern for the “emic” (people’s subjective beliefs and experiences of the world) above the “etic” (objective truth). So, anthropology takes the view that objective measures such as various economic growth parameters can mean very little when abstracted away from people’s experiences and lived realities. Looking at the emic gives anthropology a superpower: the ability and need to be open to alternative belief systems, challenge its own mental models, take in additional insights, and craft a more nuanced and holistic view of the world as a result.

Anthropology’s superpower is its openness to alternative belief systems and ability to craft a more nuanced and holistic view of the world as a result.

Anthropologists are not scared of dealing with people’s belief systems because it relativizes them. That means that each culture must be viewed as “a truth” that must be understood as a rational system on its own terms, which is why judging a culture from an external point of view often leads one to miss the point.

In anthropology, emic truth is multiplicitous and relative rather than universal and absolute.

In anthropology, emic truth is multiplicitous and relative rather than universal and absolute. What does this mean? “Cultural relativism” doesn’t mean that “2 plus 2 does not equal 4” (these claims by self-proclaimed anthropologists are bogus). It just means that a particular belief system may have come to that conclusion, and that in itself may reveal something about that culture. Anthropologists recognize that math and physics have more adequate tools, languages and frameworks to assess the etic (and to establish that 2 plus 2 does equal 4 — for that we need mathematicians).

Anthropologists are not afraid of dealing with the complexity of people’s beliefs — they thrive when doing this thanks to their toolkit of methods and frameworks to make sense of belief systems and behaviors.

Why Are Anthropologists Interested In Bitcoin (And Many Economists Aren’t)?

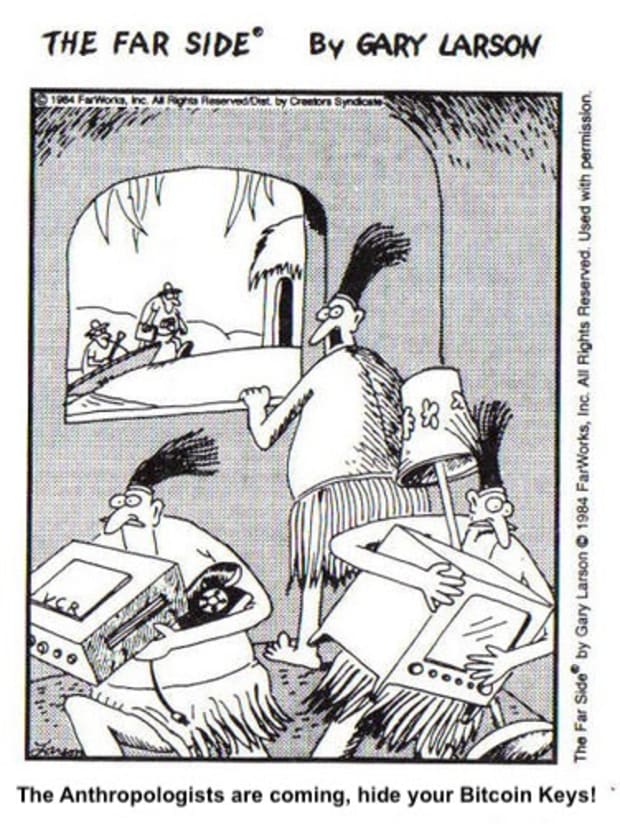

Anthropology has a long tradition of writing about the alien “other,” and bitcoin certainly represents a new type of exotic “other” for the majority of the world’s population. So, anthropologists have approached the culture of Bitcoin as it would approach any other: with no judgment and with openness to challenge its own preconceptions of it.

Anthropologists have ventured to study the world of bitcoin miners, holders, speculators, and local bitcoin merchants, among others. This has allowed them to understand the communities’ beliefs and points of view by going beyond their own perspectives. Many anthropologists have come out of the studies inspired by the ethos and beliefs of these communities, as I will explain in more depth in the next section.

In contrast, mainstream economists continue looking at Bitcoin from the comfort of their ivory towers. Nobel Prize-winning economist Paul Krugman, Nouriel Rubini, Steve Hanke, and many others have systematically dismissed bitcoin as a bubble, tulip, or speculative asset with little regard to how people actually use and view it today.

Economics as a discipline is locking itself in an echo chamber, siloed from other perspectives and receiving little feedback from the outside. It also lacks the methodological tools to make sense of cultures. No wonder it mistakenly reduces Bitcoin’s meme culture to an irrelevant tribal phenomenon.

But the core of economist’s fallacy is epistemological: what is recognized as truth, and where does truth come from? Does it come from the “top” (meaning the state or god), or the “bottom” (the local popular beliefs)? When it comes to money, who decides what is money (the truth of money)? Mainstream economics lives off the assumption that money is money by “fiat,” meaning that its value is determined by the state’s ultimate judgment and formal decree. In contrast, anthropology, being interested in people’s views and beliefs, has no problem accepting bitcoin as money because ultimately, people believe that it is, and that is how they use it.

At the core of economists’ fallacy is the belief that money is money by decree (because the state and its expert economists say so), which means they don’t fully recognise the power held by people’s collective decisions.

Anthropologists are also interested in Bitcoin because it is not a threat to the discipline’s status quo. Anthropology is mostly a descriptive discipline, concerned with making sense of things as they are rather than “messing with things.” In contrast, economics is all about prescribing and “intervening” in the economy: the economy needs to be “stimulated” and then “stabilized,” and employment needs to be “maximized.” As a result, Bitcoin, which cannot be controlled in terms of monetary policy, massively limits the scope of economics to act on the economy. Bitcoin may well be challenging economists’ core beliefs, and perhaps, their relevance (ouch!). Having said that, this is not true of all of economics. For example, there are heterodox approaches that take more of a systems perspective, such as the Austrian school, which flips the episteme around: truth and economic activity come from the economic actions of the individual rather than the state, the latter of which are not seen as fundamental to economic life.

So, What Are Anthropologists Saying About Bitcoin?

After looking at anthropologists’ foundational methods, theories, and epistemologies, it is worth checking what anthropologists are saying about Bitcoin.

1. Bitcoin is money

Anthropologists have no problems admitting that bitcoin is money, first and foremost “because people call it so, [and] many use it as money” (Kavanagh et al.).

2. Bitcoin leverages people’s ethos

Research on Bitcoin miners has revealed the degree of excitement and creative energy that surrounds the Bitcoin space (Calvão), and it is this ethos and ethic of the Bitcoin community that may infect the world.

3. The values and rituals of the Bitcoin community are important for Bitcoin’s success

A study by Kinney demonstrated that Bitcoin adoption by individuals follows a distinct process: first, adopters discover the value of Bitcoin on their own terms. Next, they reflexively overcome challenges to these initial perceptions of its value. Finally, they reaffirm their embeddedness in the system through rituals of commitment (Kinney), such as today’s “Laser rays to $100,000!” phenomena on Crypto Twitter. This reaffirms the importance of group identity to the social construction of Bitcoin as money.

Thus, the Bitcoin community’s value systems and rituals make bitcoin mature and have helped to establish it as money. As the Bitcoin community has also clarified, Bitcoin is backed not only by technology and numbers, but also by memes.

As the Bitcoin community has also clarified, Bitcoin is backed not only by technology and numbers, but also by memes.

4. Bitcoin is not just speculation

Anthropologists reject the notion that Bitcoin is just about speculation. Bitcoin is an asset for owners to hold for the long term.

Bitcoin is sustained not only by greed, but also by community, beliefs, and a sense of belonging (Morucci).

“Balinese Cockfights & Bitcoins”

5. Bitcoin is a mirror

The meaning of Bitcoin is “loose enough to mean many things to the members of the community, but specific enough to bind that community together.” The facts that this community is a new type of organism (Quittem) and that bitcoin’s valuation is difficult to establish mean that each person can project the meanings and desires of their choice on them. Bitcoin tells us all what we want to believe, and that is true of both lovers and critics (Kavanagh et al.).

6. Bitcoin is highly political

So, Bitcoin has the ability to create political bodies. It has the ability to project our primitive human passions, even in ways that are destructive to the current political, economic, and social systems (Caldararo).

For example, to the Bitcoin community in cyberspace and offline, hodling is a way of countering state-controlled debasement of the value of money (Morucci). Furthermore, a study of a Bitcoin coffee shop in Slovakia showed how the staff supported the initiation of Bitcoin “newbies.” Bitcoin provided a great degree of power and freedom from the state’s “Big Brother techniques” of control to the coffee shop (Tremcinsky).

Interestingly, others have come to the conclusion that Bitcoin can help us to overcome corporate power entrenchment caused by the centralisation of new technologies, which is currently in the hands of a few tech corporations (Caldararo).

7. Bitcoin is not just dependent on the math and is not entirely “trustless”—its social layer is essential to maintaining it and giving it value

Anthropologists have criticized the Bitcoin community’s belief that Bitcoin is totally trustless and entirely “run by numbers.” According to anthropologists, this would be impossible because we are social creatures, which means that Bitcoin’s sociocultural layer plays an important role in determining whether it has value, and what that value is. The formation of democratic communities in the digital economy remains embedded in social relations. So, the idea that Bitcoin is not mediated by any institution is seen as an illusion (Tylor and Bill Maurer).

A similar stance has been echoed by Giacomo Zucco, who proclaimed the importance of maintaining a puritan Bitcoin-only stance whereby all cryptocurrencies besides Bitcoin are declared “shitcoins” and not worthy of holding.

“You need dogma, you need taboo, you need social protocols to force people to be better.” (WBD Podcast).

This further highlights that the “social layer” of the Bitcoin protocol is just as important as the technical one.

8. The nature of money is changing, and Bitcoin will play a critical role in the future

Anthropologists have noticed that, thanks to Bitcoin, serious questions are being raised about the nature of money, which has important implications about society and humanity at large. Even if it fails, Bitcoin is a fascinating “‘breaching experiment’ that helps to reveal how money is implicated in the social order and how particular values and practices come to emerge” (Kavanagh et al.).

In his book “The Social Life of Money,” Dodd wrote that what is considered money has changed through time, and that we are on track to see it change again. Money is becoming increasingly fragmented, and Bitcoin is likely to play a role in the future of money.

“The era in which money was defined by the state is coming to an end. Money can and likely will be organized differently.” (Dodd, “The Social Life of Money”).

Anthropology’s Limitations In Understanding Bitcoin

Anthropology is far from perfect, and it has some challenges as a framework for understanding Bitcoin:

- Anthropology lacks the quantitative toolkits needed to be able to understand and research on-chain activity, from which one can gain many behavioral insights. We need to push anthropology to be able to understand the technological backbones of our digital world so that it can remain relevant and engage in broader discussions with other disciplines.

- Anthropology has always been a highly diverse discipline, welcoming perspectives, theories, and approaches from very different viewpoints and other disciplines. However, in the last few decades, it has been undergoing increasing homogenization towards hyper-reflexive, highly theoretical, and overly philosophical schools of thought, which often lose touch with people’s everyday lives.

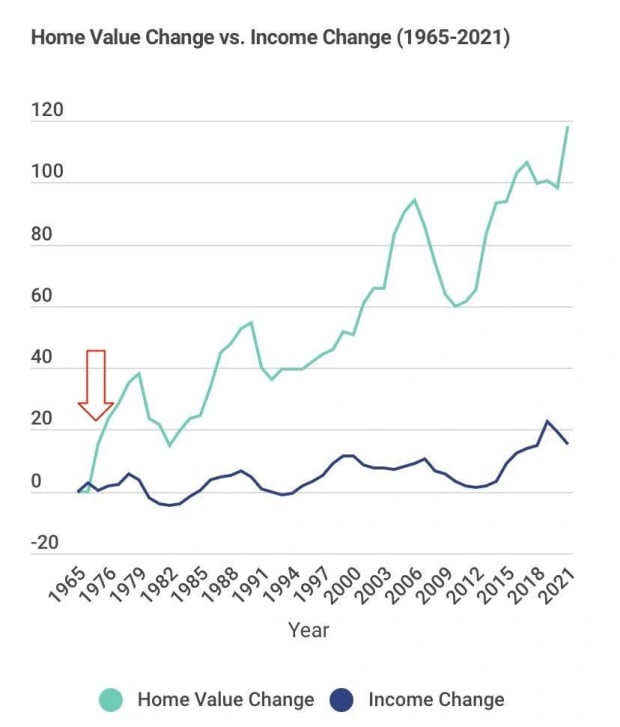

- Anthropology lacks a systems view of macroeconomics and does not do enough to understand the basics of the current monetary paradigm. This leads many anthropologists today to view the market as simply dysfunctional and the system as simplistically capitalistic or neoliberal with little awareness of the extensive role that central banks play in economies.

Like the rest of academia, anthropology has no (or little) skin in the game, so not only can it afford to be wrong, but it can continue being wrong and pretending that it is right. Anthropology does not need to be scared to become more applied in praxis, and by doing so, it can grow its methods and frameworks. This is what the hybrid discipline of design anthropology is doing today.

Conclusion

The key takeaway here is that anthropologists have many interesting things to say about Bitcoin. In contrast, economists’ commentaries are often very stale and uninformed.

Anthropologists recognize the important role that Bitcoin is playing in leading us to rethink what money is, which in turn has many consequences for social life. At the same time, anthropologists also recognize that the social dynamics and community surrounding Bitcoin, its memes and the socio-cultural elements of the Bitcoin phenomenon are critical to its success.

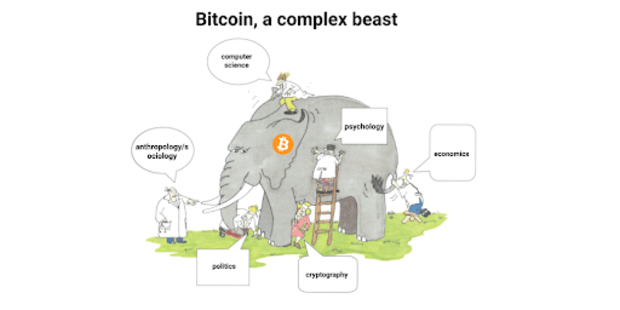

Anthropology may not be the best discipline to understand Bitcoin as a whole, but the same can be said about every other discipline on its own. Bitcoin is complex, and to fully understand it would require an understanding of engineering, cryptography, incentives, culture, social psychology, network systems and much more. In other words, it is not a one-discipline job.

The cultural and social aspects of the Bitcoin phenomenon cannot be understated and overlooked, as therein lie answers to many questions (such as the why). Why do people care about Bitcoin? Why should we care about Bitcoin? Well, for many anthropologists, this technology may well be brings money back in the hands of the people.

Notes:

- I am aware that the disciplines of anthropology and economics are highly varied and complex, more so than I am picturing here. I am therefore guilty of making generalizations. I do not purport to speak for all economists or anthropologists out there.

- That said, this article does not aim to be a criticism of economics as a whole, but of its current state: it has lost touch with reality because of its command-and-control approach, top-down methods, models, assumptions, and the lack of a systems perspective.

Acknowledgements:

Thanks to the following thinkers and writers for the invaluable feedback: Martin Tremcinsky, Emil Sandstedt and Paula Magal.

This is a guest post by Michele Morucci. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.