Who Says Bitcoin Mining Needs To Be Profitable?

In addition to profits, bitcoin mining can also offer consistent electricity demand and can clean up the air by utilizing electricity made from wasted methane.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

I’ve heard some recycled fear, uncertainty and doubt recently about transaction fees on the Bitcoin network not being able to sustain the miners, and thus maintain security once the block subsidy gets too low and or disappears. This got me thinking about how incentives might play out.

Besides the obvious observation that they’re assuming no network usage growth and perpetually low fees on the base chain, I believe there are two key underlying assumptions that need to be addressed:

- Mining hardware will continue to exist in its current form as standalone, single-use computers.

- Mining companies will continue to exist in their current form as large, stand-alone companies that must constantly strive for profitability or go out of business.

Mining Hardware: One Man’s Trash Is Another Man’s Treasure

The name of the game here is utilizing waste. In its current form, electric heating elements create heat through the use of resistors. Resistors resist, changing the “flow” of electricity and dissipating the electrical power in the form of heat. You’re essentially utilizing poor electrical conductors in order to create heat. Seems pretty wasteful to me.

In terms of miners, their main waste product is heat. Imagine the applications you could build utilizing Bitcoin-specific ASIC chips. I see a future when every furnace and water heater produced utilizes ASIC chips as the heating element rather than the traditional electrical resistor types that exist today.

MintGreen in Canada is already doing this at a pretty large scale. They utilize their waste heat from the miners to heat local businesses like breweries, sea salt distilleries and even greenhouses.

This changes the home mining-profitability math completely. When utilizing dual purpose applications and harnessing the heat originally characterized as waste, the applications don’t need to be profitable in the traditional sense anymore.

The use of the newest generation of ASIC chips for heating purposes is not necessarily needed, nor desirable. Bitcoin mining heating applications, especially at the retail level, simply need to use the same amount of electricity or less than their non-mining competitors. The little bitcoin that is mined is simply an added benefit for upgrading your system or an incentive for builders to put into new homes.

Why would you want to buy a home that wastes electricity by simply heating it? That’s old school. I want a home that heats up and pays me when I heat it. I want a Bitcoin smart home.

Electric System Explained

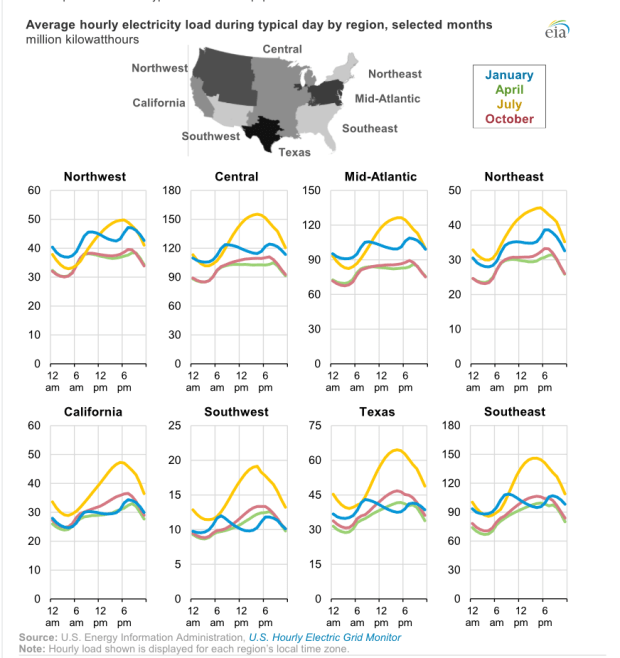

To understand the second assumption, you first need to understand how electricity is generated. Electricity generation capacity consists of three main generating sources: base, peak and intermediate load generation. Base load power generates the minimum amount of electricity in order to satisfy the minimum level of demand in the system. Peak load generation is used to meet peak demand periods when demand spikes. It is ramped up and down, making it less efficient and more expensive. Intermediate load is also a variable source which responds to changes in demand, bridging the gap between base and peak load.

If we have variable capacity on hand, that means that at least some of the time we have unused capacity — valuable capital — that’s not being utilized. What this means is that your electricity costs not only have to cover the cost of production, but also must subsidize the cost of all the unused, but necessary capacity electricity producers have to maintain.

Why so much complexity? Because demand is not constant. The above graphic shows the average demand for electricity and just how volatile it is, not only by region, but also by season. If power plants produce too much electricity, it can actually damage the grid, leading to a blackout.

There are a few techniques to store excess energy such as pumped storage hydropower, but they all have limitations such as access to water, space and battery technology. Simply put, once your battery is full, there’s nowhere else for the energy to go which ultimately leads to power curtailment. It’s also why intermittent sources like wind and solar will likely never be a sole source of power for the grid. There’s simply not enough storage capacity to keep the system running when the sun isn’t shining or the wind isn’t blowing.

Bitcoin, of course, fixes this.

Miners Don’t Need To Be Profitable

Right now, we see miners as standalone companies, buying electricity on the markets from electric companies. If the bitcoin price goes down and/or costs go up, miners get squeezed and go out of business. It’s a viciously competitive industry, but what if it wasn’t? What if mining became a service rather than a standalone business?

Service One: Elimination Of Variable Load Energy Sources

In my humble opinion, the only way forward for a truly sustainable energy system is one that is based on nuclear power. Nuclear power, however, is a base load energy generator; you can’t really ramp it up and down. The electricity produced must be consumed or literally wasted by sending it into the ground. So what do we use for variable demand?

My answer is bitcoin.

Instead of building capacity in variable forms — using up a bunch of capital for assets that are only used some of the time — why not build a massive base load of nuclear energy and use bitcoin mining as the variable demand to smooth the electricity demand curve. It flips the paradigm on its head. Not only do we get a massive source of clean and sustainable energy, we also utilize all of our capacity all of the time. The only variable being how much hash rate the power plant produces throughout the day.

In the meantime, bitcoin can be used to utilize all of the grid’s energy producing capacity. It will increase power company revenues, providing them with more capital to invest and build out infrastructure. Through the integration of bitcoin mining and energy production, bitcoin mining no longer has to be profitable in the traditional sense; it simply needs to outweigh the opportunity cost of not producing electricity at all.

Furthermore, the increased utilization means that consumers are no longer subsidizing unused capacity in their monthly bills. Imagine electricity rate-freezes or even cuts. At the very least, power rates wouldn’t need to rise nearly as fast. What’s good for the goose is good for the gander.

If a clean, sustainable, resilient, reliable and affordable electric grid is your goal, bitcoin is the way.

Service Two: Cleaning Up The Air

Waste products like natural gas and methane have been nothing more than an expensive cost of business for some time. All of that is beginning to change at a rapid pace.

Whether the gasses are produced through the breakdown of buried trash at a landfill, the drilling for oil, or the excrement of livestock and people, those gasses can now be harnessed and monetized through the use of generators to mine bitcoin.

It’s already happening.

ExxonMobil is just one of the companies starting to do this. Natural gas is a byproduct of oil drilling and extraction. In many cases, it was simply not economical to bring the gas to market, forcing producers to flare, or even worse, vent the gas directly into the atmosphere. Now the waste gas can be routed into a generator and used for mining bitcoin. It incentivizes companies to be more careful with that waste gas because it has been transformed into an income-producing asset rather than a pesky cost of business.

Landfills are also facing the same incentives. As garbage breaks down under the surface, it produces methane gasses. Those gasses, much like oil producers, were often flared or vented. With bitcoin mining, the methane is now an asset to those companies, incentivizing them to become better stewards, reducing air pollution.

Even human waste can be monetized with bitcoin mining. Wastewater treatment plants typically use anaerobic digesters to break down the solids after separating them from the bulk of the water they process. This process produces, you guessed it, methane.

Much like the power plant examples, bitcoin waste mining creates a situation in which miners no longer need to be profitable. Mining simply needs to outweigh the opportunity cost of not mining. In the situations where the gas cannot be brought to market, anything is better than nothing. I think I see a world where gas flaring and venting is a thing of the past.

No Profits? No Problem

Satoshi Nakamoto had to think differently to bring about the creation of an entirely different network of money and value. We now need to think differently to not only ensure the network survives, but to ensure human flourishing continues into the foreseeable future.

Energy is not scarce, nor should it be. Bitcoin is the incentive that the world needs to become truly innovative to ensure cheap, clean energy is available for all. Bitcoin is human flourishing.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.