What’s in the House Financial Services Committee’s Stablecoin Bill?

Featured SpeakerChristy Goldsmith Romero

CommissionerU.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.

Featured SpeakerChristy Goldsmith Romero

CommissionerU.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

The House Financial Services Committee has finally unveiled its stablecoin legislation, proposing a framework for stablecoin issuers such as Circle and Tether to define how their offerings can be regulated by state and federal entities, while calling for a temporary ban on algorithmic stablecoins.

PS: CoinDesk’s Consensus 2023 conference takes place in Austin, Texas, next week. If you’re interested in attending, here’s a 15% off discount code.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The House Financial Services Committee (finally) published a long-anticipated discussion draft of its stablecoin bill. In short, the bill would create categories of stablecoin issuers, whether they’re banks or nonbank entities; push for a temporary ban on algorithmic stablecoins, and call for a study of the potential impact from a central bank digital currency.

The stablecoin bill has long been rumored as a piece of bipartisan legislation with genuine support from Reps. Maxine Waters (D-Calif.) and Patrick McHenry (R-N.C.), then the chair and ranking member of the House Financial Services Committee (they swapped titles after Republicans secured a majority in the House of Representatives). Especially coming after last year’s terraUSD collapse, the bill seemed to have momentum and interest while focusing on a specific subsector within the broader crypto industry.

The bill creates a definition for “payment stablecoin issuers,” referring to companies behind any stablecoin that’s used specifically for payments or settlements. The issuers themselves must be a state- or federally licensed entity, and could be either insured depository institutions (or a subsidiary of such an entity) or an approved nonbank entity. The issuers would also have to let users redeem their stablecoins within a day of the users seeking a redemption.

Companies hoping to be licensed to issue stablecoins would have to apply with the appropriate regulator, whether at the state or federal level. The regulator would have 45 days to confirm it has everything it needs, and a further 90 days to render a decision. If the regulator doesn’t make a decision, the application would be automatically approved. The regulator would also post the application for public comment.

One of the factors a regulator would have to consider is “The ability of the applicant to maintain reserves backing its payment stablecoins outstanding on an at least one-to-one basis, with reserves comprising of – (i) United States coins and currency (including Federal Reserve notes and circulating notes of Federal Reserve banks and national banks); (ii) Treasury bills with a maturity of 90 days or less; (iii) repurchase agreements with a maturity of 7 days or less that are backed by Treasury bills with a maturity of 90 days or less; or (iv) central bank reserve deposits.”

So, right out of the gate the implications are significant. As Bennett Tomlin points out, the issuer of the world’s largest stablecoin, Tether, would have issues allowing USDT to circulate in the U.S. as the bill is currently drafted.

In a statement, a Tether spokesperson said, “We remain hopeful that stablecoin regulation will provide much-needed clarity for larger corporates, institutions and fintech companies looking to enter the crypto market. As financial regulators address the risks of stablecoins, they should articulate the larger goal of modernizing our payments system and increasing access to the financial system. We believe that greater regulatory clarity will benefit the digital token economy.”

The next few pages of the proposed bill address various requirements to which stablecoin issuers would have to abide. They seem fairly straightforward – customer protection rules, risk management, capital requirement rules, provisions on oversight.

A stablecoin issuer that doesn’t secure a license to operate may face fines as high as $100,000 per day.

Things get really interesting on page 64, section 106, which calls for a two-year moratorium on “endogenously collateralized stablecoins” that aren’t already in existence, referring to stablecoins that are backed by other digital assets or use some other mechanism to maintain their value.

Yeah, remember terraUSD? Pepperidge Farm remembers.

During this moratorium, the Treasury Secretary, Securities and Exchange Commission, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation and Federal Reserve Board are to study these stablecoins, with the report due within a year of the bill’s passage.

Another section calls for a study on “the potential impact” of a central bank digital currency (CBDC), or digital dollar, on the Fed’s monetary policy tools, U.S. financial sector, banking sector and financial stability, as well as to payment services. The Treasury Department, alongside the various regulators, would have to report to the Financial Services Committee, as well as the Senate Banking Committee, the results of this study within 180 days.

A spokesperson for McHenry said the version published is the same version that was circulating internally among lawmakers last fall. That version does not appear to have been previously made public.

A spokesperson for Senator Sherrod Brown (D-Ohio), the chair of the Senate Banking Committee, said stablecoins today “put people’s money and the financial system at risk” in a statement.

“They’re not being used for payments – they’re being used for speculation. Senator Brown is continuing to look carefully at all the different approaches his colleagues have put forward and talk to the regulators. He is committed to putting consumers and the safety and soundness of our financial system first,” the spokesperson said.

-

Crypto Exchange Bittrex Violated Federal Laws, SEC Charges in Lawsuit: The SEC sued crypto exchange Bittrex, which planned to be done with the U.S. within the next two weeks, alleging it operated a national securities exchange, broker and clearinghouse all at once without registering any of these entities. I think my analysis for the similar Beaxy suit largely holds up so I’ll just link it here. The Bittrex case has more going on – including allegations that more cryptocurrencies are securities, like ALGO and DASH – than Beaxy did, but the main thing is this also does look like it may play a precedent to the pending Coinbase suit.

-

Ryuk Ransomware Gang’s Crypto Broker Gets Light Sentence After a Guilty Plea: Denis Dubnikov pleaded guilty to a charge of conspiracy to commit money laundering a few months ago after being arrested in The Netherlands and extradited to the U.S. on suspicion of being involved in laundering $400,000 in ransomware proceeds. He’s just been sentenced to time served and $2,000 forfeiture.

It’s that time of year again folks. CoinDesk’s Consensus 2023 will be held April 26-28 in Austin, Texas. I’ll be moderating four sessions: one-on-one discussions with Coinbase’s Paul Grewal, NYDFS’ Adrienne Harris and the CFTC’s Christy Goldsmith Romero, and a panel with House Financial Services Committee Chair Rep. Patrick McHenry and Senator Cynthia Lummis. As always, I’m interested in what you are interested in: If you have any questions for one of these speakers, shoot me an email, subject line “Consensus 2023 question,” and I may ask the best ones on stage

-

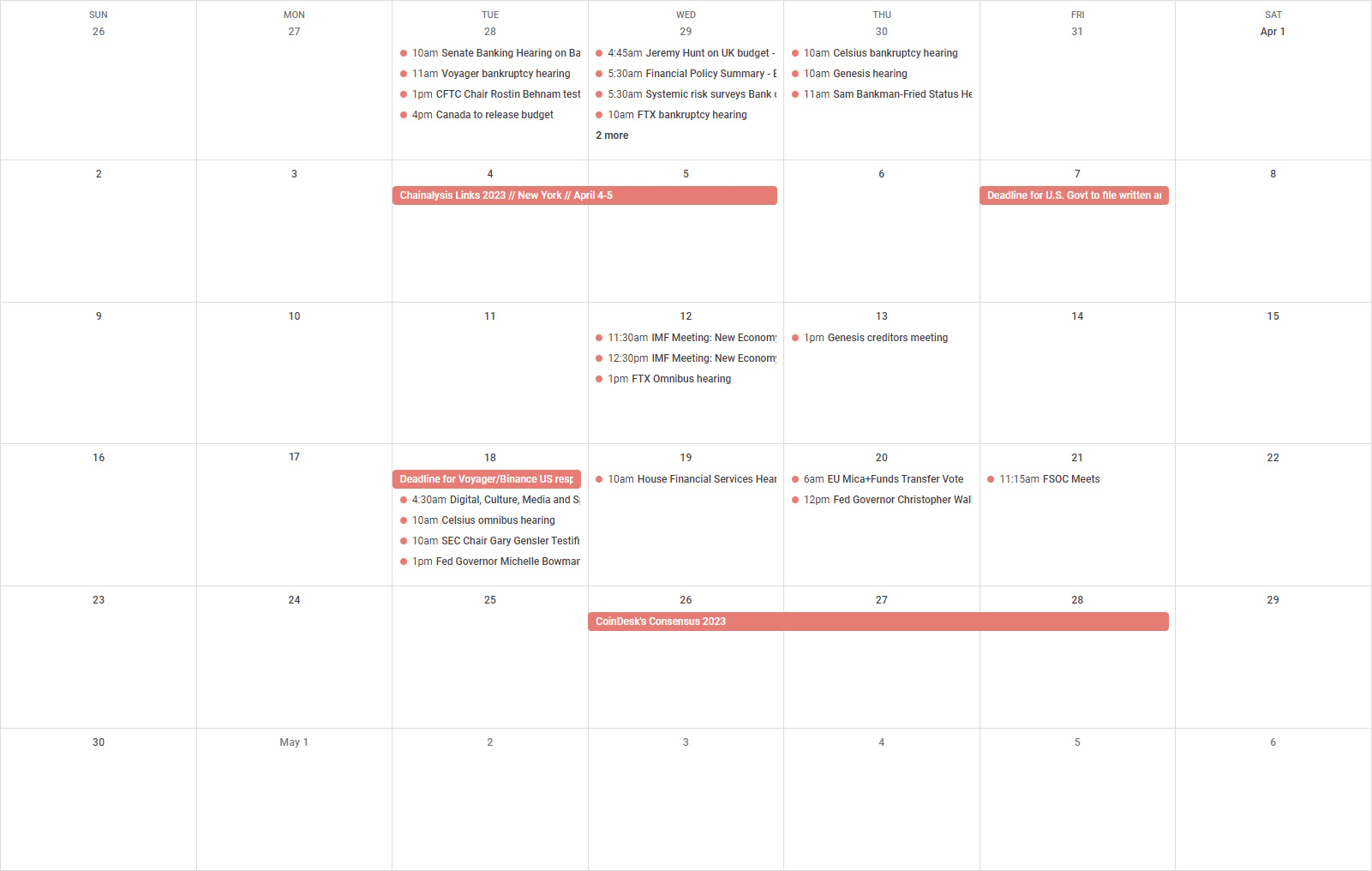

08:30 UTC (9:30 a.m. BST) The U.K. Parliament’s Digital, Culture, Media and Sport Committee will host a hearing on non-fungible tokens. Note: A private session will start at 9:30 a.m. local, but the public portion won’t begin until 30 minutes later. The event will be livestreamed.

-

14:00 UTC (10:00 a.m. ET) The House Financial Services Committee will hold a hearing on the Securities and Exchange Commission, with Chair Gary Gensler testifying. The event will be livestreamed.

-

14:00 UTC (10:00 a.m. ET) There will be an omnibus hearing for bankrupt crypto lender Celsius Network.

-

17:00 UTC (1:00 p.m. ET) Federal Reserve Board Governor Michelle Bowman will speak on central bank digital currencies. The event will be livestreamed.

-

14:00 UTC (10:00 a.m. ET) The House Financial Services Committee’s Subcommittee on Digital Assets, Financial Technology and Inclusion will hold a hearing on stablecoins. The witnesses will be NYDFS Superintendent Adrienne Harris, Circle Chief Strategy Officer Dante Disparte, Columbia Business School Adjunct Assistant Professor Austin Campbell, Blockchain Association Chief Policy Officer Jake Chervinsky and Consumer Reports Director for Financial Fairness Delicia Hand. The event will be livestreamed.

-

16:00 UTC (12:00 p.m. ET) Federal Reserve Board Governor Christopher Waller will talk about cryptocurrencies. The event will be livestreamed.

-

15:15 UTC (11:15 a.m. ET) The Financial Stability Oversight Council will meet. The event will be livestreamed.

-

(PC Gamer) Riot Platforms, a major bitcoin mining center operator, pushed back against last week’s New York Times article on mining concerns with a written list of issues the company said it had about the article. It then completely undermined its position by revealing the people behind the company either don’t understand or want to pretend they don’t understand the carbon emissions issue (which, in fairness, was also in the written response). More broadly, the crypto industry seems to have taken an opportunity to push back against some questionable editorial choices as an excuse to completely lose its mind. So good job, I guess.

-

(The New York Times) The Times published a fascinating look at how investigators were able to identify the alleged leaker of national security documents on Discord, a chat app I primarily use to joke about the Ace Combat video game series.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.