What to Make of the SEC’s Latest Bitcoin ETF Rejection

The Takeaway:

- The SEC rejected the latest bitcoin ETF proposal last week, though it wasn’t entirely unexpected.

- The decision clarified the SEC’s concerns, which mainly revolve around market manipulation.

- Legal experts say a bitcoin ETF could be years away – because, in the eyes of regulators, the bitcoin market is too small and immature to support a fund right now.

- The SEC suggested that a surveillance-sharing agreement between a regulated exchange and a bitcoin market of “significant” size might help allay its unease.

- Bitwise and others see this as an opening. Some experts remain unconvinced.

The bitcoin market isn’t yet mature enough to support an exchange-traded fund (ETF).

So said the U.S. Securities and Exchange Commission (SEC) last week when it rejected Bitwise’s bitcoin ETF proposal in a mammoth 112-page order that included more than 500 footnotes.

Legal experts said the decision suggests that a bitcoin ETF may still be years away. But Matt Hougan, Bitwise’s global head of research, sees positives in the decision. The SEC has at least shown it’s willing to raise addressable concerns, rather than rejecting a product out-of-hand with little explanation.

“A bad outcome would have been a cursory [filing],” Hougan told CoinDesk, adding:

“After digesting it a little bit, we’re pleased with the detail the staff provided and the clarity of what we have to do.”

Zachary Fallon, a principal at Blakemore Fallon, said that while Bitwise’s effort may not have been successful, the process was revealing – and will almost certainly help when launching a bitcoin ETF at some point in the future.

Market manipulation

The SEC worries about the bitcoin market because of the potential for manipulation, said Lindsay Danas-Cohen, general counsel and chief operating officer at crypto exchange and brokerage Velocity Markets.

Bitwise pointed to its research showing that 95 percent of crypto trading is fake as proof that it understands the market. Perhaps understandably, this didn’t help the company’s case.

“Bitwise tried to get out in front of these arguments by asserting they’re very aware that only 5 percent of the bitcoin spot markets are ‘real’ and I commend that effort,” Danas-Cohen told CoinDesk.

But Fallon, a former SEC senior counsel, said Bitwise did not explain how the exchanges with “real” volume were insulated from the prices found on other platforms.

He added:

“Bitwise did not address the concern that the price quoted on legitimate digital asset trading platforms is itself influenced by the weight of the other 95 percent and the prices quoted there. So it’s like the tail wagging the dog, or the dog wagging the tail, and the SEC said, ‘You need to address that risk.’”

Surveillance sharing

The solution to this issue, according to the SEC, may be surveillance-sharing agreements between national exchanges sponsoring ETFs (such as NYSE Arca, which filed the actual ETF proposal for Bitwise) and regulated markets.

“Until an ETF sponsor can satisfy the SEC’s demand for surveillance-sharing agreements – or until the SEC changes its view on the Exchange Act (which almost certainly means waiting for a new Chairman) – there will be no bitcoin ETF,” Jake Chervinsky, general counsel at Compound Finance, told CoinDesk in a Twitter DM.

Chervinsky does not see this happening anytime soon:

“The SEC once again strongly rejected the idea that a bitcoin ETF sponsor can satisfy Exchange Act Section 6(b)(5) without entering surveillance-sharing agreements with regulated markets of significant size, and given bitcoin’s current market structure, it’s very unlikely that any sponsor will be able to enter such agreements within the next couple years.”

(The SEC previously defined a “significant market” as one that where an individual trying to manipulate an exchange-traded product would have to trade on the same market, meaning a surveillance-sharing agreement would help in identifying any would-be manipulators.)

Notably, Danas-Cohen said the fresh emphasis on a surveillance-sharing agreement differs from previous disapprovals.

She speculated that, should the SEC greenlight an ETF in the future, it would want to point to such an agreement as evidence that it did everything in its power to protect against market manipulation.

“It’s just something tangible that the SEC can point to and review explicitly and say, ‘Hey, broader world, this is exactly what we’re relying on and this is why we think that fraud and manipulation are rightfully off the table as significant concerns in the space,’” she said.

Philip Liu, chief legal officer and co-founder of investment firm Arca, noted that the SEC’s new order scarcely raised concerns about digital asset custody – a break from previous rejections that have focused on this issue.

“I assume that the custody issues are pretty much moot at this point,” he said.

There are a number of reputable “custodians” in the space now, including Coinbase Custody and Paxos Trust Company, and increased transparency between these entities and the regulators could help the SEC become more comfortable with the issue, Danas-Cohen said.

Moonshot

It seems unlikely that the SEC will approve an ETF for launch in the near future. Arca’s Liu told CoinDesk that the SEC took a thorough look at the question and “pretty much put the kibosh” on the concept.

For his part, Chervinsky does not expect an ETF before the latter half of 2020.

“It’s reasonable to assume that Jay Clayton’s SEC will never approve a bitcoin ETF,” he added on Twitter.

Clayton’s term is set to end in June 2021, but under SEC rules he could remain in office until 2023 if not replaced. The SEC chairman has long been an outspoken skeptic of the bitcoin market, saying as recently as last month that sponsors and companies applying for an ETF have work to do addressing issues such as market manipulation.

Danas-Cohen said she would be surprised if an ETF was approved over the next year:

“Under the current regime, I think it’s going to be difficult for an applicant to get all its ducks in a row in a manner that would give the SEC comfort. I think it would take a bit longer for the SEC to wrap their arms around the space.”

Chervinsky says the SEC’s current perspective on the Exchange Act comes directly from Chairman Clayton.

“It was the crux of the Commissioners’ denial of the Winklevoss ETF appeal in July 2017,” he said.

The SEC did not write the latest rejection. Instead, it delegated the task to the Division of Trading and Markets, Fallon noted. He said this could be because the commissioners do not have much to add on top of what they wrote in the Winklevoss rejection.

Next steps

The rejection won’t stop Bitwise. Hougan said the SEC has provided enough detail for his company to file again at a future date, though Bitwise has not yet decided when it will re-file.

“I don’t think anything [the SEC] said [that was] fundamental to the bitcoin market was impossible to meet,” he said, adding:

“It’s just a matter of answering their questions and providing them with yet more extensive data.”

Bitwise intends to explore surveillance-sharing agreements and it isn’t alone. VanEck and SolidX, which withdrew their ETF proposal with Cboe BZX in September, are also likely to re-file their rule change proposal at some future date.

Asked if he expects an ETF to one day be approved, Hougan said:

“I think if we can satisfy their requests, yeah, absolutely. I don’t think the commissioners or the Commission is inherently anti-bitcoin or crypto, I just think they’re appropriately cautious.”

Others remain less certain.

Bitwise did “move the baton further down the line,” but that’s no guarantee the company will get an ETF approved, Fallon said.

He likened the approval process for the ETF to convincing his parents to let him drive a car. There was an initial struggle, but, after a certain point, his parents gave in.

Assuming Bitwise – or another company – can answer the market manipulation issues, there is no reason why an ETF won’t be approved eventually, he said.

Danas-Cohen said identifying what a “significant market” consists of is another step that Bitwise needs to take if it wants to establish a surveillance-sharing agreement.

But for other observers, doubts remain.

Said Arca’s Liu:

“The takeaway is, I just don’t see how it can be approved at this stage – for anybody that comes in.”

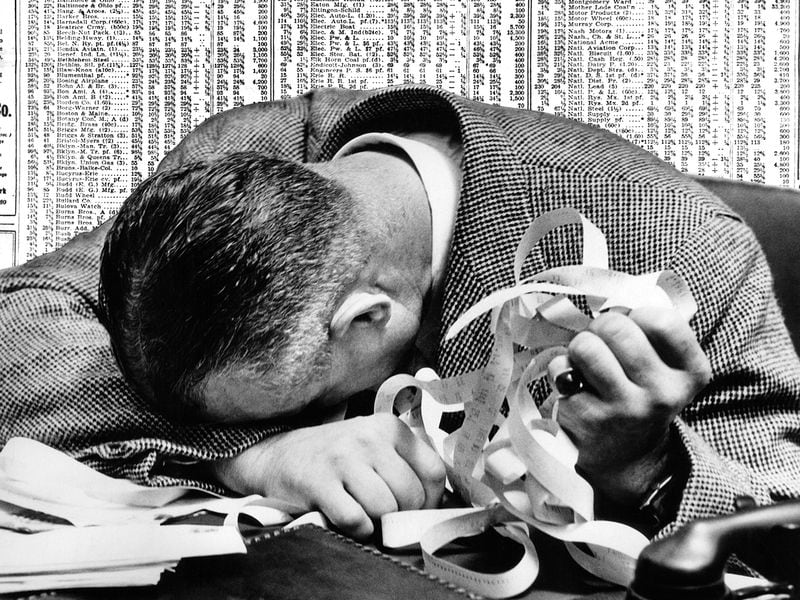

SEC Chairman Jay Clayton image via CoinDesk archives