What Ripple’s Partial XRP Win Means for Other Crypto Firms Fighting SEC

A U.S. court ruling partly in Ripple’s favor may augur well for other cryptocurrency firms fighting litigation from the Securities and Exchange Commission – if the decision survives potential appeal.

This year, the SEC has come after exchange platforms such as Coinbase (COIN), Binance and Bittrex for operating what it says are unregistered trading platforms that list what the agency deems unregistered securities including Cardano (ADA), Solana (SOL) Polygon (MATIC) and Filecoin (FIL). Following Thursday’s ruling by the U.S. District Court for the Southern District of New York that certain sales and distributions of XRP tokens by Ripple and its executives were not investment contracts, those other defendants may have a new arrow in their quiver.

“This is a significant opinion that has the potential to change the landscape of the SEC’s enforcement efforts, or the success of those efforts,” said Teresa Goody Guillén, a former attorney with the SEC office of the general counsel, and now a partner with law firm BakerHostetler. “This is also helpful precedent for Coinbase and Binance to defend against allegations that they are operating as unregistered securities exchanges, brokers and clearing agencies.”

Several legal experts were quick to pour cold water on the excitement, arguing that the summary judgment may rest on shaky ground, and may not translate to the crypto industry’s hoped-for change in the way it’s treated by the SEC.

“The SEC will look to the parts of the court decision that are in its favor to justify its continued views on the regulatory status of coins and tokens – i.e., that they are all securities — and its continued approach to enforcing those views on the industry,” Joe Castelluccio, leader of law firm Mayer Brown’s fintech and digital assets, blockchain and crypto groups, wrote in an email.

According to Castelluccio, the portions of the decision that are in Ripple’s favor are “fairly fact-specific, and while there may be some that are similarly situated in the market, others in the market may find it challenging to rely on those portions of the decision if their circumstances do not directly align.”

Castelluccio added that the case “does not provide regulatory or legal clarity for the numerous other regulatory issues that the digital assets sector is navigating.”

Thursday’s summary judgment by the U.S. Southern District Court of New York ruled that certain sales and distributions of XRP tokens by Ripple and its executives were not investment contracts – and therefore don’t break securities laws – as the SEC alleged in a 2020 civil lawsuit.

The industry latched on to the news that a federal judge had essentially declared token sales on exchanges weren’t investment contracts even though institutional sales of XRP to hedge funds and the like were deemed securities in the same ruling.

“The court rejects the view that cryptocurrency tokens are securities, which has previously led to widespread confusion,” said Jeffrey Alberts of Pryor Cashman LLP, adding that the judge had clarified in her ruling that crypto tokens are not themselves securities.

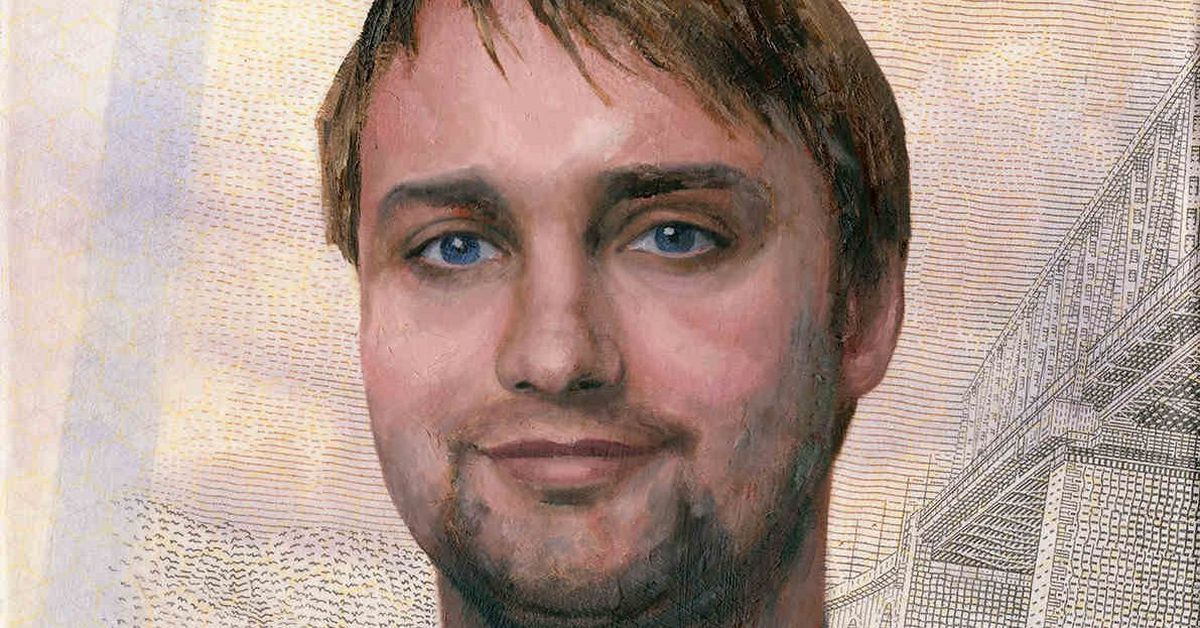

Congratulations and cries of “LFG” – internet slang for “onward and upward,” at least in the G-rated translation – poured in as CEO Brad Garlinghouse tweeted Ripple was “on the right side of the law, and will be on the right side of history.”

The price of the XRP token surged as high as 96% on Thursday following the news.

“There’s no way to look at the Ripple decision as anything but a win for the crypto industry. XRP is not a security and the company’s and executives’ transactions in XRP on the secondary market do not violate the securities laws,” Christian Schultz, a former official at the SEC division of enforcement said in an email to CoinDesk.

The good, bad and the complicated

Arthur Jakoby, partner at Herrick, Feinstein LLP, echoed Goody Guillén, saying the ruling undercuts the SEC’s position that secondary sales of digital assets on exchanges such as Coinbase constitute the sale of unregistered securities.

“If upheld on appeal, this decision significantly narrows the SEC’s jurisdiction over the crypto market,” Jakoby said.

While no other district court judges are obligated to follow the reasoning in this ruling, it could “spell problems for the SEC in other pending litigation, particularly those that are focused primarily if not exclusively on secondary market activity,” according to Schultz.

In addition to sales of XRP on exchanges, other distributions including to employees, and sales of the token by executives Garlinghouse and co-founder Christian Larsen were also ruled not securities.

On the other hand, the fact that institutional sales of XRP were deemed investment contracts supports SEC Chair Gary Gensler’s views that virtually all initial coin offerings (ICO) are securities, Schultz said. ICOs, once a popular fundraising method for crypto startups, offer tokens to the public or privately to investors to raise capital for various projects. Although Ripple has denied conducting a single offering of XRP, the SEC alleges in its suit that Ripple sold approximately $728.9 million of XRP in institutional sales.

“I would expect the crypto industry to look for creative ways to make an initial distribution of digital assets that avoid the facts and circumstances that led to this judge finding there is an investment contract security relating to the digital asset,” Schultz said.

Preston Byrne, corporate partner at law firm Brown Rudnick’s digital commerce group, wrote in a CoinDesk op-ed that the ruling – which concluded institutional sales of XRP do constitute investment contracts but other distributions do not, essentially assigning two regulatory states to one token – may be flawed and vulnerable to overturn if the SEC decided to appeal the decision.

Although Thursday’s ruling was in response to motions for summary judgment by the SEC and Ripple to stop the case from proceeding to trial, parts of the requests that were denied – which include the institutional sales of XRP – will proceed to trial.

Edited by Marc Hochstein.