What is Aptos (APT)? The Complete Guide

2022 is a year that saw a lot of chatter on layer-one protocols such as Ethereum, Solana, the BNB Smart Chain, Avalanche, and many others.

The astronomic rise of non-fungible tokens (NFTs) revealed that most of the blockchains were unable to handle the load that comes with some form of mainstream adoption.

Before Ethereum transitioned to Proof-of-Stake (read: The Merge), the network was oftentimes clogged, and transaction fees were unimaginably high. In fact, this prompted the notion that it was only whales that were able to partake in multiple DeFi initiatives on Ethereum.

Solana, on the other hand, also had its issues. Although advertised as a high-throughput chain capable of handling thousands of transactions per second (TPS), the network experienced multiple outages where it was downright unusable.

Now, there’s a new kid on the block – the Aptos Blockchain. Called by many “the Solana Killer,” Aptos is presented as a “scalable, safe, reliable, and upgradable” network that’s been under development for over three years and has just launched its mainnet.

Quick Facts:

- Aptos is a layer-one blockchain developed by Aptos Labs

- Aptos Labs was founded by core contributors of Diem (developed by Meta)

- It uses Proof-of-Stake (PoS) for its consensus algorithm

The Aptos Core

Full details and the complete technical stack of the Aptos Blockchain can be found in the Aptos Whitepaper.

According to the official website, the Aptos Blockchain is “designed with scalability, safety, reliability, and upgradeability as key principles” and has been worked on by a team of over 350 developers.

There are a few key components that this guide will break down, namely:

- The Move language

- The Aptos data model

- The Move module

The Move Language

To represent the state of the ledger, Aptos uses Move’s object model. Move is a new smart contract programming language, and its main focus is on both safety and flexibility. It uses Move modules to encode the rules of state transactions.

Users submit transactions that can publish new modules, upgrade ones that already exist, execute certain entry functions that are defined within this module or contain scripts that are able to interact with the public interfaces of various modules.

The ecosystem also has a compiler, a virtual machine (VM), as well as other tools that developers can use.

Here’s a breakdown of how developers can begin interacting with the Aptos ecosystem.

The programing language is designed to put a strong emphasis on resource scarcity, as well as preservation and access control. It leverages a bytecode verified that guarantees type and memory safety, even when there’s code that’s untrusted. On the other hand, to help write code that’s more trusted, developers have access to the Mover Prover – it’s a formal verifier that’s capable of authenticating the functional correctness of a program against a pre-set specification.

According to the whitepaper, the team behind Aptos has further enhanced the programming language to support a broader range of Web3 use cases.

Data Model

The Aptos blockchain has defined its ledger state as the state of all accounts. It is versioned with an unsigned 64-bit integer that corresponds to the number of transactions that the network has executed.

Anyone is free to submit a transaction and, hence, modify the ledger state. Upon execution, the transaction output gets generated, and it contains zero (or more) operations to manipulate the ledger state. These are called write sets and represent a vector of resulting events, the amount of gas consumed, as well as the executed transaction status.

The transactions themselves provide the following information:

- Transaction authenticator

- Sender address

- Payload

- Gas price

- Maximum gas amount

- Sequence number

- Expiration time

- Chain ID

It’s also worth noting that Move’s data model supports global addressing of both modules and data natively. Those transactions which don’t contain overlapping conflicts in their data and accounts can also be executed in parallel.

For a closer look at the definitions for both Events and Accounts, please refer to the official whitepaper.

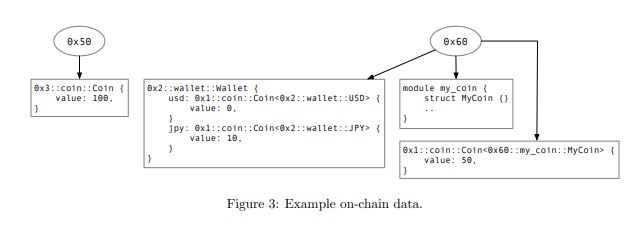

Move Module

A Move module has the Move bytecode which declares the structs and procedures. The structs are merely the data types.

It is identified by the address of the account where the module is declared, and it comes with a module name. The module has to be named uniquely within a certain account, and each account can declare no more than one module with any given name.

All modules are grouped into packages that are located at the same address. The owner of this address then publishes the package as a whole on the blockchain, and it includes the bytecode and the metadata of the package. Said metadata can define whether or not the package can be upgraded or if it’s immutable. For those packages that are upgradeable, there are additional compatibility checks performed before permitting the upgrade.

It’s important to note that while new functions and resources can be added, the entry point functions can’t be changed, and the resources can’t be stored in memory.

Defined as a regular upgradeable package of modules, the Aptos framework is represented in the following graphic:

How Will Aptos Scale?

Based on its Whitepaper, the protocol was initially launched with a single ledger state, but over time, Aptos intends to take a somewhat unique horizontal approach to scale.

To achieve this, the protocol will implement multiple sharded ledger states where every one of them will offer a homogeneous API and sharding as a concept.

Data may be transferred between shards using a homogeneous bridge, and both users and developers should be able to choose their own sharding schemes, depending on their own needs.

The Aptos Governance

The Aptos network operates on a proof-of-stake (PoS) consensus algorithm where validators need to have a minimum required amount of staked Aptos tokens to participate in transaction validation. AptosBFT, on the other hand, is the protocol’s BFT consensus algorithm, and it is based on HotStuff.

BFT stands for Byzantine Fault Tolerance, and it’s a reference to the well-known Byzantine general’s problem, where components may fail, and there’s imperfect information on whether a certain component has failed.

Validators are able to decide on the split of rewards between them and their stakers respectively. Stakers, on the other hand, can select any number of validators where to stake their tokens and arrange a pre-agreed reward split. Rewards are received at the end of every epoch via the relevant on-chain Move module.

The token that powers the Aptos ecosystem is called APT.

The APT Cryptocurrency Tokenomics

APT’s tokenomics created somewhat of a considerable controversy within the cryptocurrency community because the token was initially about to launch without any public information on its total supply, distribution, and overall plan.

The team has since issued a formal blog post explaining most of the details.

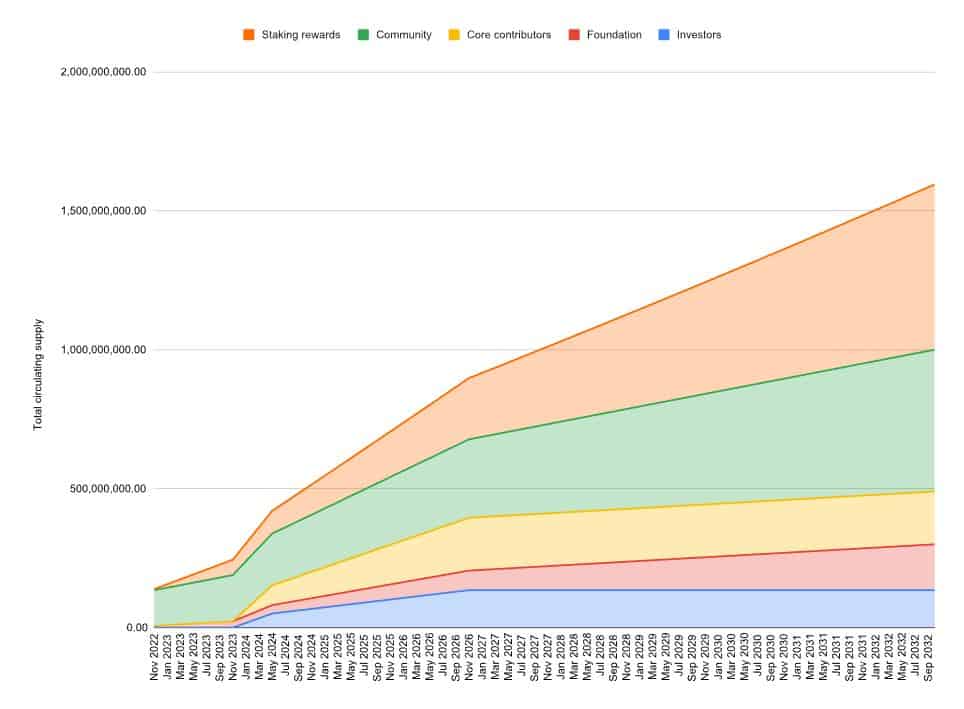

APT’s initial supply at the time the mainnet was launched was set at 1 billion tokens, where the minimal unit is called an Octa.

From that initial supply, 51% was designated under a “community” category, 19% for “core contributors,” 16.5% for the “foundation,” and 13.48% for the investors. Detailing the first category, the blog post reads:

This pool of tokens is designated for ecosystem-related items, such as grants, incentives, and other community growth initiatives. Some of these tokens have already been allocated to projects building on the Aptos protocol and will b granted upon the completion of certain milestoins. A majority of these tokens are held by the Aptos Foundation and a smaller portion are held by Aptos Labs. These tokens are anticipated to be distributed over a ten-year period…

Investors and core contributors, on the other hand, have a 4-year lockup on their tokens, excluding token rewards. Meanwhile, this is what the estimated token supply schedule looks like:

APT Airdrop

To kick off its mainnet launch with a bang, the project airdropped a total of 20,076,150 APT tokens to a total of 110,235 eligible addresses, representing 2% of the total initial supply.

At the time, the team stated:

This is our first airdrop based on our existing community data. The aptos Foundation will continue to evaluate future opportunities to support the Aptos community.

Users can check eligibility here.

The Aptos Labs Leadership and Funding

Aptos Labs is the organization that developed the Aptos blockchain and is led by Mo Shaikh and Avery Ching in 2021. Both of them previously worked on Meta’s (formerly: Facebook) blockchain project Libra, which was later completely rebranded to Diem.

Back in February 2022, Shaikh said:

Since departing Meta, we have been able to put our ideas into motion, ditch bureaucratic red tape, and build an entirely new network from the ground up that brings them to fruition.

Aptos is also one of the best-funded blockchain projects. In March 2022, the team raised $200 million in a funding round led by Andreessen Horowitz (a16z), FTX Ventures, Coinbase Ventures, and other crypto heavyweights.

In July of that year, Aptos raised another $150, and the funding round was led by FTX Ventures.

The post What is Aptos (APT)? The Complete Guide appeared first on CryptoPotato.