What is a Store of Value? A Comprehensive Guide

Store of Value

The concept of a “store of value” refers to goods that are capable of retaining or increasing their worth over time rather than declining in value. This term is used to describe a mechanism that enables individuals to preserve their wealth without experiencing any loss in value over time.

It is one of the three functions of money that Bitcoin Magazine is exploring; the other two are medium of exchange and unit of account.

What is a Store of Value

A store of value is an asset, a currency or a commodity that can be trusted to hold its value over time; ideally, it doesn’t bear much risk. Traditionally, people who are less tolerant to risk will invest in a store of value with an enduring lifespan, a stable demand and low volatility.

Fiat currencies are weak stores of value since they depreciate over time due to inflation. Commodities like bitcoin, gold and a collection of other monetary metals have good store-of-value attributes because they are relatively limited in supply and do not deteriorate over time, thereby maintaining their value.

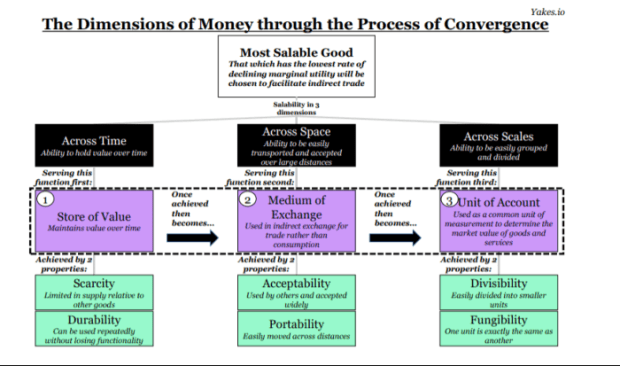

Salability is the critical property that allows something to be freely used as money and defines a physical good or asset that can be quickly sold. To have salability, money must be divisible (scale dimension), transportable (space dimension) and durable (time dimension). When an asset possesses salability across time, we have a good store of value because it can be trusted to maintain its value into the future.

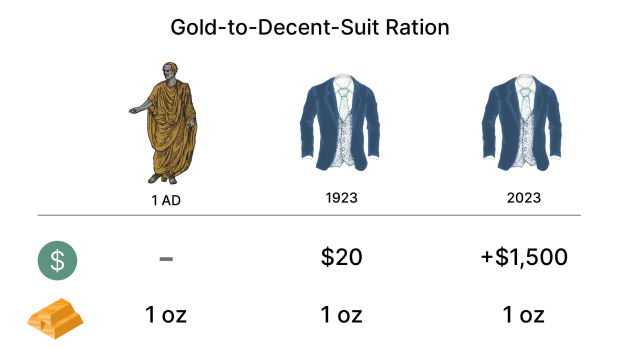

One benchmark often used to understand the store-of-value function is that the value of an ounce of gold happened to match the price of a high-quality men’s suit. This principle is known as the “gold-to-decent-suit ratio,” and its roots can be traced back to Ancient Rome, where the cost of a top-of-the-line toga was said to be equivalent to an ounce of gold. After 2,000 years, the price — defined in gold — of a high-quality suit is still close to the price of an equivalent Ancient Roman toga.

Another example is the price of one barrel of oil in fiat versus gold. In 1913, one barrel of oil cost $0.97, while today it’s about $80. In contrast, one ounce of gold would buy 22 barrels of oil in 1913, while it buys roughly 24 today — showing barely any difference in the gold price (good store of value) versus a big depreciation of the fiat currency (bad store of value).

Why do we need a store of value?

Money is an essential tool for trading goods and services, but it is also important to have a good store of value to save and secure a better future for ourselves and our families. While fiat currencies are suitable as a medium of exchange, they are not reliable stores of value, as they lose value over time due to inflation, historically around 2-3% per year.

In extreme cases, such as in Venezuela, South Sudan and Zimbabwe, hyperinflation has led to astronomical rates of inflation, making these fiat currencies very poor stores of value. While these examples serve as outliers, rising inflation levels are becoming more common in modern times, leading to a natural mechanism to save for the future and to find ways to beat 2-3% inflation rates.

It’s important to have a reliable store of value to secure the value of our hard-earned money over time. As poor stores of value, fiat currencies are thought to discourage people from saving or even earning money in the first place.

Is money a good store of value?

In the modern age, we use “fiat” currencies,, the term derived from the Latin word “fiat” meaning a decree or an arbitrary order; it’s basically a promise of what a value could be. Such a concept was established when governments’ paper or minted money could be redeemed for a set amount of a physical commodity. Since then, the term fiat has remained, even though currencies aren’t backed by commodities or possess any intrinsic value of their own.

While fiat currency has many properties that identify it as money, it’s a poor store of value since it isn’t linked to physical reserves, such as gold or silver. The result is that fiat currencies gradually lose value due to inflation or suddenly in the event of hyperinflation.

Fiat currencies are considered soft money because they are too dependent on a government’s price stability targets — generally focused on price stability, with general prices increasing at 2% per year — instead of allowing the market to naturally decide prices. This approach leads governments to gradually siphon off the value of the money while increasing the price of everything else in the process.

Essential Elements of a Store of Value

During its evolution as money, an item will develop through three different phases, starting with a store of value before becoming a medium of exchange and eventually a unit of account. The three dimensions of the most salable goods are across time, space and through scales.

A store of value is the most salable good, one that has the ability to preserve its value over time.

To possess the function of a store of value, a salable good should be scarce; it must have a limited supply compared to other goods. It should also be durable so that it can be used repeatedly without losing its functionality.

- Scarcity: a good that’s limited in supply relative to other goods and to the demand for it. Computer scientist Nick Szabo defined scarcity as “unforgeable costliness,” meaning the cost of creating something cannot be faked. If money is too plentiful, it loses value over time as more units can and will be created, and more will be required to purchase a good or service.

- Durability: this property refers to the ability of a good to maintain its physical and functional properties over time. This means that the currency should be able to withstand wear and tear and remain in circulation for a long period without deteriorating or losing its value.

- Immutability: Immutability is a desirable and new property of money because it ensures that once a transaction is confirmed and recorded, it cannot be altered or reversed.

What’s a good store of value?

Many different assets can serve as a store of value, but defining the best is constantly debated among investors and largely depends on market dynamics and investors’ preferences. It is worth noting that certain assets may lose their store-of-value status over time. A prime example of this is silver, which experienced a decrease in its store-of-value functionality as its supply increased due to its growing use in industrial applications rather than its traditional use as a monetary metal.

Bitcoin

Initially regarded as a speculative asset due to its notable price fluctuations, bitcoin increasingly became a store of value as investors and more people realized its potential worth as a new monetary asset. Bitcoin represents the discovery of digital, sound money and is a scientific revolution that is proving so far to not only be a store of value but also a means to increase value.

Bitcoin is becoming a significant force in the economy because it meets the requirements of a store of value better than any other form of money.

- Scarcity: Bitcoin has a finite supply of 21 million coins, which makes it resistant to the arbitrary inflation that ails traditional currencies. This limited supply gives it a scarcity value, making it a valuable asset to hold and store wealth.

- Durability: Bitcoin is a purely data-based, immutable form of money. Its digital ledger system uses proof of work and economic incentives to resist any attempts to alter it, ensuring that it remains a reliable store of value over time.

- Immutability: once a transaction is confirmed and recorded on the blockchain, it cannot be altered or reversed. This immutability is a critical feature of Bitcoin because it ensures that the integrity of the ledger is maintained, and transactions cannot be tampered with or falsified. This is especially important in an increasingly digital world, where trust and security are paramount concerns.

Precious Metals

Precious metals like gold, palladium and platinum have long been good stores of value due to their perpetual shelf life and industrial use cases. They are relatively limited in supply which makes their value appreciate relative to fiat money. Bitcoin is even more limited in supply than gold and precious metals and has appreciated in value against gold since its inception.

Physically storing large quantities of gold is expensive and challenging. For this reason, investors often choose to invest in digital gold or gold stocks, which are subject to counterparty risks. Gemstones like diamonds and sapphires are useful too as they are easier to store and transport.

Real Estate

Real estate is one of the most common stores of value due to its tangibility and utility. Over time, its value tends to increase, at least this has been the case since the 1970s. Before then, real estate and land kept pace with prices, having real returns around ~0% over longer periods (subject to wars and crashes, etc). Despite temporary downfalls along the way, it remains stable, offering physical land or construction owners a sense of safety when investing in it.

Real estate can be any physical property like land or a home that can be used as a primary residence, a vacation home, or a commercial property to rent or sell. The downside of real estate is that it’s not liquid or censorship resistant. This lack of liquidity can be problematic for property owners who require access to cash quickly and can be subject to government intervention or legal action.

Stock Market

Buying stocks on the NYSE, the LSE and the JPX markets has proved to be a good investment over time because they have increased their worth over the years: Stocks have been decent stores of value. However, they may experience high volatility and depend highly on market forces and economic movements, which makes them similar to fiat currencies.

Index Funds/ETFs

Index funds and exchange-traded funds (ETFs) are another way to get exposure to the stock and equity markets and provide an easy way for investors to diversify their portfolios.

Over a long time, such markets have also proved to increase in value, making them good stores of value. ETFs are also more cost- and tax-efficient than similar mutual funds.

Other stores of value

People can get creative with their favorite stores of value that sometimes match their passions or interests. For example, fine wines, classic cars, watches or art can be good stores of value as their worth typically appreciates over time.

What’s a bad store of value

Perishable items

Perishable items are goods that expire and lose value over time, gradually becoming worthless.

Food makes for a poor store of value, as it has an expiry date. A ticket to a concert or for transport becomes worthless after the expiry date, and are also considered perishable.

Therefore, they are not considered a good store of value.

Fiat money

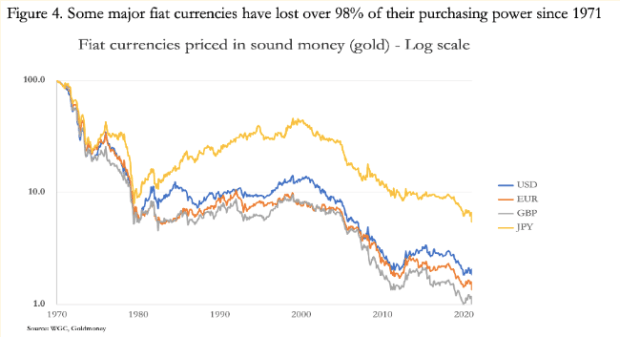

We mentioned that fiat currencies do not retain their value over time, as the chart below shows.

It is mainly due to inflation that they lose value because every year, the price of goods and services tends to rise compared to the dollar and other fiat currencies. As a result, currencies consistently lose purchasing power.

Cryptocurrency

Cryptocurrency alternatives to bitcoin are very similar to speculative stocks, with even higher risks since most have short lifespans and almost all lose value versus bitcoin over the long term.

Cryptocurrencies with longer lifespans prioritize functionality over security, scarcity and censorship resistance, making them poor stores of value, considering their poor economic propositions and weak use cases.

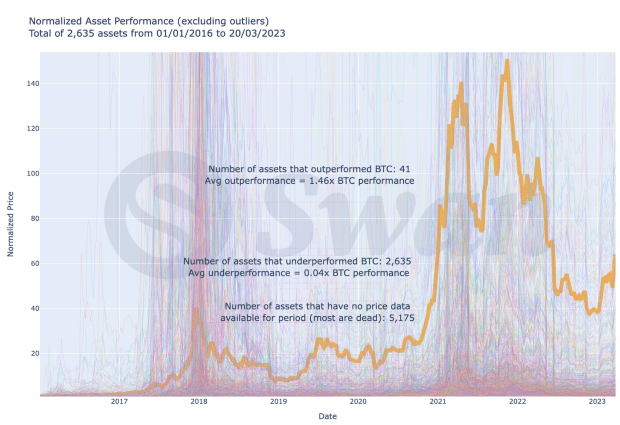

According to research conducted by Swan Bitcoin, altcoins have proven to be a bad investment. The study analyzed 8,000 cryptocurrencies since 2016 and found that 2,635 of them had underperformed versus Bitcoin and a staggering 5,175 of the cryptocurrencies no longer exist.

Speculative Stocks

Speculative stocks are small-cap assets, also called penny stocks, that trade at less than $5 per share. They are not considered good stores of value because they are highly speculative.

Due to their high volatility and low market caps, they can quickly and suddenly increase a lot or lose all of their value. They are considered risky investments and certainly do not make good stores of value.

Government bonds?

For a long time, government bonds like U.S. treasuries were considered great stores of value simply because governments backed them. However, negative interest rates applied for years have highly affected the economies of big countries like Japan, Germany and other European countries, making government bonds unattractive for the average investor. Some bonds are meant to protect beneficiaries from inflation such as I-bonds and TIPS. However, they are still government-led and rely on the Bureau of Labor Statistics to accurately calculate the inflation rate (which it may choose, or be influenced, not to do).

The bottom line

To sum up, a store of value tends to maintain or increase its purchasing power over time, depending on the law of supply and demand, which can also be used to determine whether or not something might be a good store of value.

Many still regard bitcoin as an experiment. However, its relatively short life has proved that it offers all those properties typical of money and is a good store of value. The next challenge will be to prove that it can also be a unit of account.