What if You Mined Bitcoin For a Day in 2010? How Much Would it Be Worth Now?

We’ve all heard plenty of stories of people who bought or mined BTC back in the days, but it’s always nostalgic to reminisce. “What if” could be a depressing recollection, but it can also be a powerful motivator.

In this story, we take a look at the question – what if you mined BTC back in 2010? How much would it be worth right now?

A disclosure should be in place – the following writeup doesn’t take into account technical specifications that may vary widely but rather the commentary of someone who was an active miner during the Satoshi era, using a Pentium processor and revealing their proceedings in a conversation with Satoshi Nakamoto.

A Conversation With Satoshi

Satoshi Nakamoto – the pseudonymous creator of Bitcoin – may now be inactive for years, but this wasn’t the case back in 2010. Bitcoiners like to come back to some of the conversations he had with early adopters back in the early days of the protocol, and that’s what we’re going to do now.

Bitcointalk used to be the preliminary source of information back then and also the conversational platform of choice. In this particular thread, Satoshi talked about the very first automatic difficulty adjustment of the proof-of-work network that took place on December 30th, 2009.

We had our first automatic adjustment of the proof-of-work difficulty on 30 Dec 2009.

The minimum difficulty is 32 zero bits, so even if only one person was running a node, the difficulty doesn’t get any easier than that. For most of the last year, we were hovering below the minimum. On 30 Dec we broke above it and the algorithm adjusted to more difficulty. It’s been getting more difficult at each adjustment since then.

To those of you who might not be aware, Bitcoin’s network adjusts proportionally to the total effort spent across the entire network. Hence, if the number of nodes increases, the difficulty will also increase.

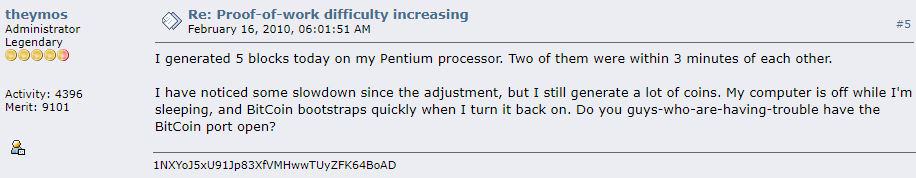

One user remarked that he generated five Bitcoin blocks in one day using a Pentium processor:

This was written in 2010 in response to the thread on the difficulty adjustment. For context – miners back then used to receive 50 BTC for successfully adding a block to the network because the latter hadn’t yet undergone the subsequent halving events.

Every four years or so, the BTC network goes through a halving where the block reward is slashed in half. At the time of this writing, miners get 6.25 BTC per block.

250 BTC Mined in a Day – Currently Worth $11 Million

Quick math shows us that the user received 250 BTC in one day, mining BTC on their Pentium processor.

It’s hard to determine the exact price of the coins back then, but chances are that each BTC was worth cents of the dollar had it been tradable at all. Fast forward to February 2022, 250 BTC are worth slightly less than $11 million.

That’s a lot of money, but it’s also incredibly hard to make the assumption that someone would hold this amount of BTC throughout all that time.

And this brings us to our next point, which is the “what if” narrative and how it can be a powerful motivator.

It Might Not Be Too Late

Many newcomers tend to believe that they are way too late to the Bitcoin scene. While the barriers to entry, especially when it comes to efficient BTC mining, are much higher now, I’d like to direct your attention to a paragraph from the same conversation with Satoshi.

Commenting on the thread was a user who said:

Satoshi, I figured it will take my modern core 2 duo about 20 hours of nonstop work to create 50 BTC! With older PCs it will take forever. People like to feel that they “own” something as soon as possible…

This goes to show that even at the nascency of the Bitcoin protocol, people still felt as if they weren’t getting coins too quickly.

And yet, about 12 years later, a day of computational effort is now worth millions. In other words – patience is the name of the game. BTC’s supply is only going to decrease with time – it won’t increase. Securing a piece of the network by purchasing BTC makes the user a verifiable owner of the first digitally scarce object – this should surely mean something beyond the standard “BTC is already too expensive” narrative.

None of the above should be construed as financial advice – the article is for informational and entertainment purposes only. Always do your own research and never risk more than what you can afford to lose with any investment, be it in BTC.