What Happens if the SEC Classifies ETH a Security? (Wrong Answers Only)

It came to light yesterday that the U.S. Securities and Exchange Commission (SEC) is likely looking to reclassify Ethereum’s native token, ether (ETH), as a security. Not everyone believes this to be the case, and so far the SEC has deferred answering definitively on whether there is an ongoing probe — just like how the agency has punted the can on saying definitively that ETH is or isn’t a security.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

A number of digital asset lawyers have said the “voluntary inquiry” the Ethereum Foundation copped to in its Github repository is no cause for alarm. Subpoenaing crypto companies is a normal course of business in this industry. And the Ethereum Foundation’s canary — a reference to “canaries in coal mines,” which indicates whether a government has probed a website — had to come down eventually.

“It is very difficult to know, from what has been publicly disclosed thus far, the nature of the government inquiry that has been sent to the Ethereum Foundation or whether the Foundation is the target of that investigation,” Preston Byrne, managing partner of Byrne & Storm, P.C., told CoinDesk in an email.

Byrne said that it is “unlikely” that the Ethereum Foundation “is the target of the investigation.” However, taking it as a given that there is an ongoing probe, a few questions remain. For instance, it’s not yet clear why exactly the SEC would sue the creators of Ethereum nearly 10 years after its launch and after hundreds of billions of dollars have accrued to the network.

Does the investigation pertain to Ethereum’s initial coin offering and token distribution or its switch to the staking security model? How is it that a U.S. securities regulator has jurisdiction over an organization based in Zug, Switzerland? Will the Commodities Futures Trading Commission (CFTC), which oversees a booming ETH futures market, push back?

As to why crypto companies are being asked about their dealings with the Ethereum Foundation, Byrne offered two plausible causes: either the SEC is trying to classify ETH as a security to force the hand of U.S. spot exchanges to de-list the token or to support its case for denying much-demanded spot ether exchange traded funds (ETFs).

Neither motivation would “necessarily also require the SEC to bring an enforcement action against the foundation,” Byrne added.

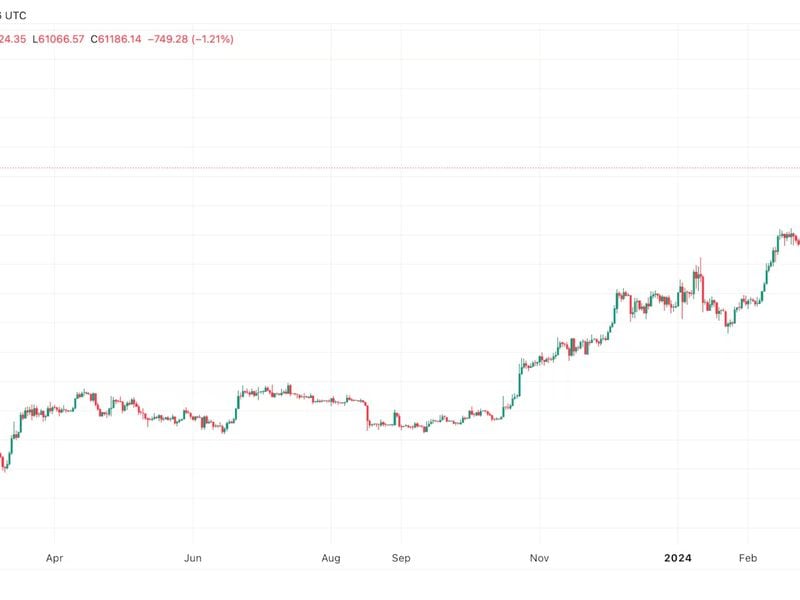

But say there is a lawsuit. Say ETH is a security (despite good reasons saying no). What exactly happens then? Ethereum is the second-largest blockchain by value ($414 billion at today’s prices), and the home of most of the digital asset industry’s most used tools — classifying ETH as a security would likely cause chaos. With a move this big, it is entirely unpredictable where the cards will ultimately fall.

The Demerge …

One of the more unlikely responses is that Ethereum, which switched to a proof-of-stake algorithm that rewards tokens to users who lock up their tokens to secure the network, could revert back to the mining model pioneered by Bitcoin. This in itself is unlikely; it took Ethereum developers at and outside of the Ethereum Foundation years to switch to staking.

Vitalik Buterin came up with the idea for Ethereum in 2013, and, even back then, he figured the blockchain would likely need to switch to staking, a “consensus model” that was at the time in its infancy. It was only in 2020, five years after the network actually launched, that the first tangible step towards Ethereum staking was taken with the launch of the Beacon chain.

Ethereum developers deployed and refigured a number of testnets to experiment with switching to staking over several years, and a “de-merge” would likely take as long.

Part of the issue, apart from the scaling and cost benefits of staking is that mining is a purposefully energy-intensive process, and one that developers were happy to say goodbye to. After “the Merge,” it is theorized that Etheruem’s energy consumption declined 99% — shutting down critics of crypto’s environmental footprint.

“It’s impossible for me to see any outcome as you point out that would result in something like a merge,” Paul Brody, head of blockchain at EY, told CoinDesk.

ETH PoW Powered Up

Ethereum is Ethereum and Ethereum Classic is Ethereum Classic, even if Ethereum Classic (ETC) actually maintains the “original, unaltered” history of the blockchain. But what if Ethereum Classic, from which Ethereum was forked, becomes the conical chain? This would certainly be an easier solution than the “Demerge,” considering the network is already running.

Sure, Ethereum Classic has experienced a number of faith-busting re-orgs, but readopting Ethereum’s lovelorn sibling could answer SEC Chairman Gary Gensler’s apparent concerns over staking. So would the alternative to the alternative Ethereum: EthereumPoW (ETHW), the fork that launched during the Merge to retain proof-of-work.

Neither ETC nor ETHW has rallied much on news of the SEC’s potential investigation, indicating their rapid adoption is unlikely. But it’s not impossible. Afterall, Buterin did admit that ETC was “a totally fine chain.”

One notable downside of this, among many, is that Etheruem’s founders would likely maintain massive stakes of ETC or ETHW tokens, mirroring the state of their ETH holdings at the time of the two forks. It’s not clear whether or not the SEC is concerned about Ethereum’s token issuance, which distributed valuable tokens to the founding team and the Ethereum Foundation. But the agency has said in the past such disbursements resemble investment contracts.

XRP wins?

The XRP Army has been waiting for a moment like this for years. Although not as visible a conflict as Ethereum versus Solana or Bitcoin versus Everyone, many XRP stans absolutely despise Ethereum. The history here likely stems from Bill Hinman, the former head of the agency’s division of corporation finance, declaring that ETH was not a security because it was “sufficiently decentralized.”The XRP Army, backing its own project, has seen that intervention as unfairly picking winners in the crypto market, privileging one project for special consideration while downing others that look quite similar.

Over the years, XRP champions, including Ripple Labs CEO Brad Garlinghouse, have argued that Ethereum is “Chinese controlled”; that Vitalik Buterin could be co-opted by the Chinese Communist Party; and that the network itself was “cherry-picked” to win by U.S. authorities. Of course, Buterin didn’t win himself any favors when responding to these accusations by calling XRP a “sh*tcoin.”

One thing XRP has going for it is that, unlike most cryptocurrencies, there is actually a little legal clarity surrounding that asset after Ripple Labs fought back in court against the SEC, and won a few concessions from the presiding judge. XRP itself is not a token, and exchange trades with it are not securities transactions, though Ripple’s programmatic sales to qualified buyers were investment contracts.

“It is the characteristics of the sale or offer for sale that make something an investment contract, not necessarily which cryptocurrency it is. ETH is sold on public exchanges without advertising,” Christa Laser, a law professor at Cleveland State University, told CoinDesk. “The SEC is likely targeting only staking rewards, but it will need to show that there is a central promoter.

Gensler’s reputation, tarnished again

In fact, one possible outcome of the SEC going after ETH is another major loss for the agency in court. As former CFTC Commissioner Brian Quintenz said yesterday, the SEC already implicitly said ETH was a commodity after it allowed the launch of ETH futures and ETH futures ETFs in the U.S. Further, countless U.S. investors, businesses and individuals have acted on the SEC’s signals over the years that ETH is not a security.

Add to this that there is a growing acknowledgment that Gensler’s SEC has been unfair in its legal fight with the crypto industry. Instead of devising comprehensive regulations that actually account for the differences between decentralized protocols and traditional ways of doing business, he has launched lawsuit after lawsuit against companies that add — rather than detract value — from the U.S. economy.

This “lawfare” hasn’t always worked out for Gensler. Just recently, a U.S. federal judge called out the SEC’s “gross abuse of the power” for “deliberately perpetuating falsehoods” in its dispute with crypto firm DEBT Box. This is on top of the unprecedented shutdown by a three-judge appeals panel that called out the agency’s yearslong denial of spot bitcoin ETFs “arbitrary and capricious.”

In short: If it’s true the SEC is trying to build a case for denying spot ETH ETFs by going after the underlying asset, it better have a good justification.