What Had Caused Bitcoin To Gain 230% In 2019? Year In Review – Weekly Market Update

If so far we wondered about the direction of the market, now it is official: 2019 has awakened the market and changed its course upwards.

As time passes, the HODL and the DCA strategies continue to prove themselves as the best investment methods because of the great difficulty in trying to schedule the market or design short-term trading plan.

Bitcoin is the most dominant currency on the crypto markets, and it’s again stealing the spotlight from the altcoins. However, there are still some opportunities to invest in trading against the dollar as well as in the IEOs that are still being launched successfully on exchanges.

After a relatively quiet period on behalf of the mainstream media, Bitcoin is coming back to the headlines as people are looking for reasons for the current bullish wave. Still, as we already know, it’s difficult to predict or to explain the behavior of the market rationally for a long time.

2019 So Far In Crypto

2019 has been so far full of events and news which seemingly catalyzed Bitcoin’s price surge. In February, Litecoin’s price went up significantly alongside the launch of two new MimbleWimble-based privacy coins called Grin and Beam. They attracted interest in what used to be a sleepy market.

Additionally, we can see talks about the bottoming prices, as well as such for new highs around the upcoming Bitcoin halving which contributed to changing the bearish trend. And if that wasn’t enough, Binance Launchpad – a platform for launching new projects backed by the leading crypto exchange, gave birth to the IEO phenomenon which set fire to the whispering embers and woke the put the bear market to rest.

What started as moderate lesions, continued to gain further momentum thanks to large corporations which expressed their renewed interest in the quickly growing cryptocurrency ecosystem. Among them, we saw big industry names such as Nike, Disney, Facebook, Samsung, Fidelity, and other companies who want a share of the pie of a market that’s shaping up right in front of their eyes.

Moreover, the VanEck/SolidX Bitcoin ETF, which has been postponed on multiple occasions still elicits interest, as well as anticipation. It’s also important to mention the Lightning Network which continues to gain momentum and appears to be a very reliable solution to the problem of payments in Bitcoin, without making any substantial changes to its core code.

The last few weeks can be concluded as vibrant, with quite a lot of news and updates. We saw the market respond accordingly as the trading volume soared and miners woke up in anticipation to pile up as much Bitcoin as they can for the next wave and the upcoming advance.

Market Data

Crypto News

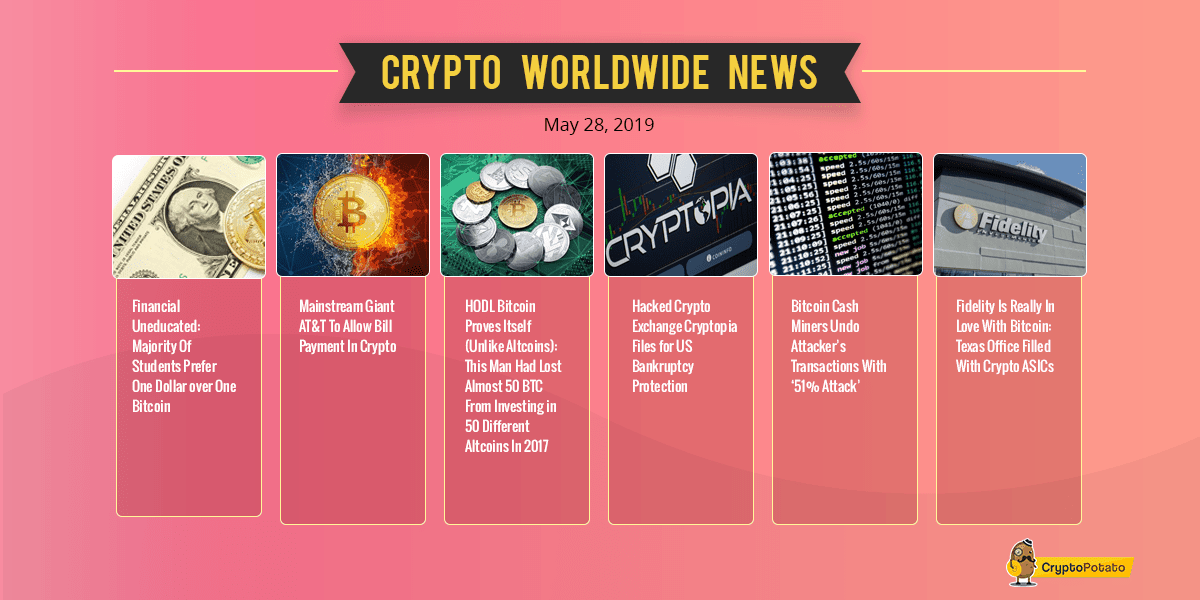

Financial Uneducated: Majority Of Students Prefer One Dollar over One Bitcoin. In an interesting interview among CU Boulder students, a Youtuber established that the majority of participants would prefer $1 instead of 1 Bitcoin on the spot. Of course, they quickly changed their mind after finding out how much 1 BTC is worth.

Mainstream Giant AT&T To Allow Bill Payment In Crypto. According to a recent statement, mainstream telecom provider AT&T now accepts Bitcoin for paying bills. The company will be using BTC payment processor BitPay.

HODL Bitcoin Proves Itself (Unlike Altcoins): This Man Had Lost Almost 50 BTC From Investing in 50 Different Altcoins In 2017. A member of the cryptocurrency community recently revealed that he had invested 1 BTC in 50 different altcoins (each) back in mid/late 2017. By now, most of his investment is gone as he has seen losses in the range of 70 percent to more than 90 percent.

Hacked Crypto Exchange Cryptopia Files for US Bankruptcy Protection. New Zealand-based cryptocurrency exchange Cryptopia which was hacked earlier this year, has filed for bankruptcy protection in the US. An emergency motion for temporary relief is expected until June 7th.

Bitcoin Cash Miners Undo Attacker’s Transactions With ‘51% Attack’. Two bitcoin cash (BCH) mining pools, namely BTC.com and BTC.top, have carried out a 51% attack on the network to reverse another miner’s transactions. Supposedly, the latter took coins that he wasn’t supposed to have access to.

Fidelity Is Really In Love With Bitcoin: Texas Office Filled With Crypto ASICs. Fidelity, one of the most significant asset management funds in the world, has a room full of Bitcoin miners located at their office in Texas. The fund is said to be in the final testing stage of its cryptocurrency platform.

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, and EOS – click here for the full price analysis.

The post What Had Caused Bitcoin To Gain 230% In 2019? Year In Review – Weekly Market Update appeared first on CryptoPotato.